ACH Payments for Business That Save You Money

Fast Transfers, Low Fees – Accept ACH Payments Now!

Welcome to ach for business

ACH Payment Solutions for Business: Your All-in-One Payment Platform

Looking for a simple way to manage ACH payments for business growth? ACH for Business delivers easy, reliable, and affordable electronic payment solutions that help you get paid faster—no matter the size of your company. In 2025, businesses and customers are moving away from paper checks and high-fee card transactions, embracing the convenience of direct bank payments.

Our platform is built for busy entrepreneurs and finance teams, streamlining your collections, boosting efficiency, and giving you all the tools you need to delight customers while improving your bottom line. Whether you need to handle one-time invoices, set up recurring billing, or process bulk payouts, ACH for Business keeps your cash flow running smoothly.

With ACH for Business, you can tap into this modern payment network to accept ACH payments from customers securely and reliably, all while keeping more of each dollar you earn.

- Low-Cost Transactions

- Recurring Billing Tools

- Bank-Grade Security

Start Saving with Low-Cost ACH Payments

Sign up Today and Keep More of Every Transaction

Service We Provide

ACH Payment Solutions Tailored for Small Business Success

Empower your company with the flexibility and freedom of our ACH payments platform – the perfect solution for businesses that need to get paid anywhere, anytime. Our advanced system is built to move with you, making it effortless to accept payments on the go, whether you’re in the office, on a job site, or working remotely with clients. With true flexibility, your payment process goes wherever your business goes. ACH processing for small business or large enterprise is equally seamless with our platform, so you can scale up without worry.

Every ACH payment solution we provide is designed for speed, security, and simplicity. Seamlessly handle electronic bank payments, manage recurring billing, and generate real-time reports right from your online dashboard or mobile device. Say goodbye to complicated setups, paper checks, and high fees – and hello to a fast, paperless, and dependable payment solution that helps you get paid faster. Ready to streamline your billing? Get started now with ACH for Business and experience hassle-free payments.

ACH Payment Processing

Easily accept one-time bank-to-bank payments directly from customers’ checking accounts at a fraction of the cost of credit cards. We facilitate secure Automated Clearing House transfers so you can accept ACH payments with minimal fees and effort.

Electronic Check Payments

Give customers a convenient, paperless way to pay by check electronically. Our system converts traditional check information into a digital ACH transaction, eliminating manual checks and speeding up payments.

Recurring Billing & Subscriptions

Automate your ongoing billing cycles for memberships, subscriptions, or installment plans. Schedule electronic check payments to recur at set intervals, so you collect revenue on time without customers having to re-enter information.

Bulk & B2B Payments

Send or receive high-value business payments with ease. From vendor invoices to employee payroll, our platform handles large ACH transfers and batch payments quickly and securely – ideal for B2B transactions that would be costly on cards.

Why Choose

ACH for Business?

Choosing ACH for Business means equipping your organization with the tools to thrive in today’s fast-paced, cashless world. Our ACH payment systems are specifically designed around the unique needs of modern businesses, ensuring every transaction is smooth, secure, and lightning-fast. By leveraging the Automated Clearing House network, we enable you to move money reliably without the hefty costs or hassles of other payment methods.

For example, a $50,000 client payment could rack up around $1,500 in credit card fees, but only about $0–$3 in ACH fees. And if you process hundreds of recurring payments each month, ACH can save you tens of thousands of dollars per year in fees compared to credit cards. That’s real money back in your business’s pocket – and a big reason why so many companies are making the switch to ACH.

What sets us apart is that we deliver more than just an ACH payment service – we provide flexibility, reliability, and modern payment options that help your business flourish. Experience the difference with these powerful features:

- Low Payment Processing Fees

- Recurring & Subscription Billing

- Secure ACH Transfers

- Seamless Integration

- High Transaction Limits

- Dedicated Customer Support

ACH vs. Credit Card vs. Wire Transfer – Cost Comparison

Curious how ACH stacks up against other payment methods? When it comes to fees, ACH is the clear winner for cost-conscious businesses. Typically, ACH transfers charge a low flat fee (often just a few cents), whereas credit cards take a percentage cut of every transaction, and bank wires charge hefty per-transfer fees. Below is a quick comparison of payment costs:

| Payment Method | Fee Structure | Example Cost (for $1,000) | Processing Speed |

|---|---|---|---|

| ACH Transfer | Flat fee (around $0.20–$1.50 per transfer) | ~$0.75–$3 in fees | 1–3 business days |

| Credit Card | Percentage (≈2.5%–3.5% + $0.30) | ~$25–$35 in fees | Instant / Same-day approval |

| Wire Transfer | Flat fee (domestic $25–$50) | $25–$50 in fees | Same-day (near-instant) |

As shown above, ACH payments for business carry minimal cost compared to credit card or wire payments. A typical ACH transfer might only cost you around $0.20–$1.50 in bank fees, regardless of amount. In contrast, credit card processing usually eats up 2.5%–3.5% of each transaction (that’s $25–$35 on a $1,000 payment). And while wire transfers are fast, they often charge $25–$50 per transfer, which is impractical for routine or high-volume payments. ACH gives you the best of both worlds – a low-cost, electronic payment method that’s ideal for large transactions and recurring billing alike. It’s no surprise that businesses handling lots of payments are saving thousands by shifting from cards and wires to ACH.

ACH for Business helped us start accepting electronic check payments for memberships and B2B billing. I was surprised how smooth the process is—no more waiting on mailed checks or chasing down late payments. It’s efficient, affordable, and much more scalable for our growth.

We’ve reduced our payment processing costs significantly by encouraging ACH over credit card payments. ACH for Business gave us the education and tools we needed to make the switch easy for both us and our clients. The fee savings alone have made a real difference.

Our firm started accepting ACH and e-check payments to simplify billing for retainer clients. ACH for Business made the onboarding painless and their tools helped us track payments efficiently. Clients appreciate the convenience, and we appreciate fewer credit card disputes.

As a small business, keeping costs low is always a priority. Accepting ACH payments through ACH for Business has allowed me to offer clients an easy way to pay without the hefty transaction fees of cards. It also feels more professional than checks and helps with cash flow predictability.

Switching to ACH payments for our vendor payouts was one of the smartest moves we’ve made. The cost savings compared to credit card fees are noticeable, especially on high-ticket invoices. ACH for Business helped us implement a streamlined solution that fits perfectly into our workflow.

Frequently Asked Questions

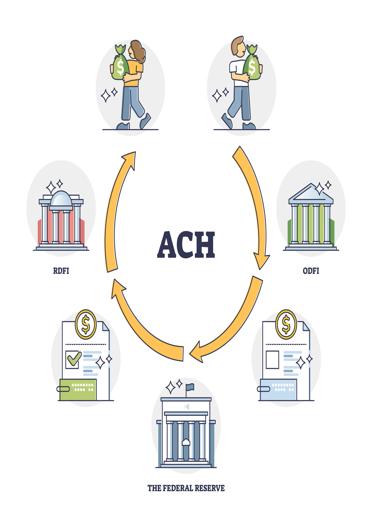

ACH (Automated Clearing House) payments allow businesses to transfer funds electronically between banks. ACH payments for business are a secure, low-cost alternative to paper checks or credit cards—ideal for payroll, vendor payments, and recurring billing.

ACH transactions typically have lower fees than credit card processing. When comparing ACH vs credit card fees, businesses can save up to 90% on transaction costs, especially for high-ticket or recurring payments.

Small businesses can begin ACH processing by partnering with a provider or bank offering electronic check services. Setting up a merchant account enables you to accept ACH payments securely and efficiently.

Yes. ACH payments are governed by NACHA regulations and use secure encryption. Businesses that accept ACH payments enjoy enhanced fraud protection and reduced chargebacks compared to card transactions.

ACH is the network through which electronic check payments are processed. Electronic checks are one method of ACH payments where a customer authorizes a debit directly from their bank account.

ACH processing for small business is ideal for recurring invoices, B2B transfers, rent collections, and utility billing. It offers a cost-effective solution with lower transaction fees and reliable timing.

Merchant Services And

Credit Card Processing Blog