By Rinki Pandey September 11, 2025

In today’s digital banking world, you often hear terms like ACH and EFT when moving money. Both refer to electronic ways of transferring funds, but they aren’t identical.

Many people ask, “Is EFT the same as ACH?” or wonder about the difference between EFT and ACH transactions. The short answer is that ACH (Automated Clearing House) is one specific type of electronic funds transfer, while EFT (Electronic Funds Transfer) is a broad category that includes ACH along with other digital payment methods.

In other words, all ACH transfers are EFTs, but not all EFTs are ACH transfers.

This article will explain ACH vs. EFT in detail, focusing on how each works in the U.S. financial system. We’ll compare their speed, fees, uses, and security so that whether you’re a general consumer, a business owner handling payments, or a finance professional, you can clearly understand these payment methods.

What is an Electronic Funds Transfer (EFT)?

Electronic Funds Transfer (EFT) is an umbrella term for any transfer of money that happens electronically from one bank account to another. Essentially, EFT means moving funds without any physical paper – no cash or checks are involved.

There are many forms of EFT, including everyday bank transactions and online payments. Common examples include:

- Wire transfers: Money sent in real-time through networks like FedWire or SWIFT (often used for urgent or large transfers).

- ACH transfers: Bank-to-bank transfers that go through the automated clearing house network (more on ACH below).

- Direct deposit and direct debit: For example, your paycheck deposited into your account, or a bill payment automatically pulled from your account (these typically use ACH in the U.S.).

- Debit card or credit card payments: When you swipe your card or use it online, funds move electronically from your account to the merchant.

- ATM transfers: Transferring money between accounts at an ATM or withdrawing cash (the account debit is an electronic transfer).

- Electronic checks (eChecks): Digital versions of paper checks, where the payment is processed electronically (often via ACH).

- Peer-to-peer (P2P) payments: Payments through apps like PayPal, Venmo, or Zelle that transfer funds digitally between individuals’ accounts.

In simple terms, if money is moving through computers and banking networks (rather than exchanging physical cash or checks), it’s likely an EFT transaction.

Strictly speaking, the term EFT also refers to the U.S. Electronic Fund Transfer Act (Regulation E), which defines consumer rights and protections for electronic transfers. This law ensures that consumers have recourse if an unauthorized electronic withdrawal occurs.

EFT transactions have become very popular because they save time and hassle. With electronic payments, there’s no need to mail checks or handle cash, and transactions often complete faster. Plus, each payment creates a digital record, making it easy to track and document.

Using EFT can also save money. You cut down on costs like postage, paper, and manual processing, since everything is handled digitally. These transfers are generally secure as well – banks use encryption and other safeguards to protect EFT transactions.

What is Automated Clearing House (ACH)?

Automated Clearing House (ACH) is a specific electronic payment network in the United States used for bank-to-bank money transfers. The ACH network is governed by the nonprofit National Automated Clearing House Association (Nacha) and overseen by the federal government to ensure transfers are safe and reliable.

ACH is central to everyday payments – in 2024 the network processed about 33.5 billion transactions totaling around $86 trillion. This massive volume shows how critical ACH is in the U.S. economy.

ACH transactions come in two main forms:

- ACH Direct Deposits: Transfers that go into an account (for example, an employer depositing payroll or the government sending a benefit payment).

- ACH Direct Payments: Transfers that pull money out of an account (for example, when you pay a bill or authorize a purchase and the amount is withdrawn from your bank).

Direct Deposit via ACH is extremely common – about 93% of U.S. workers receive their paychecks through ACH.

ACH transfers are processed in batches rather than individually. Banks collect customers’ ACH transfer requests and send them to be sorted and cleared at scheduled intervals (a few times each business day).

Because of this batch system, a typical ACH payment takes 1–3 business days to complete. However, modern improvements like Same-Day ACH have enabled many ACH transfers to clear within the same day when needed.

Uses of ACH: The ACH network is used for a wide range of transactions in the U.S.:

- Payroll and employee payments: Most employers pay wages via ACH direct deposit.

- Bill payments and subscriptions: Consumers pay many bills (utilities, loans, subscriptions) by authorizing ACH deductions from their bank accounts.

- Business-to-business (B2B) payments: Companies send payments to vendors or suppliers electronically through ACH instead of writing checks.

- Person-to-person transfers: Individuals can transfer money to each other using ACH (for example, using a bank’s online transfer service to send money to a friend).

- Government payments: The government uses ACH to disburse things like tax refunds and Social Security benefits.

Overall, ACH has become a backbone of U.S. banking for domestic transfers. It’s ideal for high-volume or recurring transactions that are not urgent, providing a low-cost, reliable way to move money electronically.

ACH vs. EFT: Key Differences

Given that ACH is actually one type of EFT, why compare them? The reason is that people often use “EFT” to mean an ACH bank transfer, which can cause confusion.

Here, we clarify the differences between ACH transfers and other forms of EFT.

At a high level, they differ in processing methods, speed, cost, and typical use cases.

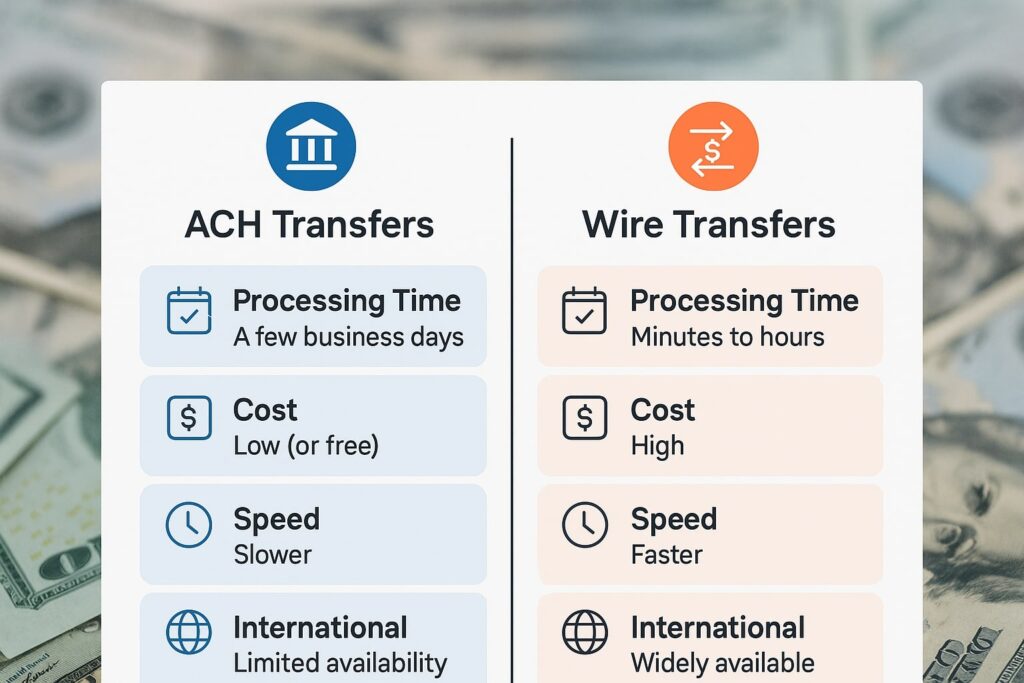

Comparison of ACH Transfers vs. Wire Transfers (a Common EFT Method)

| Aspect | ACH Transfer (ACH Network) | Wire Transfer (Bank EFT) |

|---|---|---|

| Processing Method | Batch processing at scheduled intervals. Transactions are grouped and processed together by the clearing house. | Processed individually in real time. Each wire is sent directly from the sending bank to the receiving bank, often via networks like Fedwire or SWIFT. |

| Speed | Typically 1–3 business days for standard ACH. Same-day ACH available for faster clearing in many cases. | Usually same-day (domestic wires can arrive within hours). International wires may take 1–2 days. Immediate confirmation of sending. |

| Cost | Low cost or free for most users. Banks may charge a small fee (often just a few dollars) for ACH transfers. | High fees are common. Domestic wires often cost ~$15–$30; international wires $30–$50. The sender (and sometimes receiver) pays for the speed and service. |

| Transaction Limits | Often has daily or per-transaction limits (e.g., a bank might cap personal ACH payments at a few thousand dollars per day). Suitable for moderate amounts. | Typically high or no fixed limits (aside from available funds). Wires are used for very large transfers since banks can handle big transactions with proper verification. |

| Security & Reversibility | Secure and governed by NACHA rules and U.S. law. Consumers have protections under Reg E for unauthorized ACH transfers. ACH payments can be canceled or returned in case of errors or insufficient funds (within a limited window). | Secure network, but once sent, wires are generally irreversible. Banks verify details before sending, but a completed wire is very hard to recall. Fewer consumer protections (especially for business wires under UCC 4A) compared to ACH. |

| Use Cases | Routine transactions: payroll, bill payments, account transfers, subscriptions, B2B payments that are not urgent. Ideal when low cost is a priority. | Urgent or high-value transactions: e.g. real estate closings, large same-day payments, or international transfers. Chosen when speed or immediate settlement is critical despite higher fees. |

| Geographical Scope | Domestic U.S. only (ACH network is U.S.-based). International ACH equivalents exist but are separate systems. | Both domestic and international. Wires can send money overseas through global banking networks (e.g. SWIFT). They are the go-to for cross-border bank transfers. |

As the table shows, ACH and other EFT options each have their advantages. Next, let’s explore some of these differences in detail:

Processing: Batch vs. Real-Time

ACH transfers are processed in batches (grouped) at scheduled intervals.

This makes ACH efficient for high volumes, but it also means an ACH transfer isn’t instantaneous.

By contrast, many other EFT types (like wire transfers) are processed one by one in real time. A wire sends money directly from the sender’s bank to the recipient’s bank, often within minutes, with no batching.

Transfer Speed

- Wire transfers: Typically same-day (often within hours) for domestic wires; international wires may take a day or two.

- Debit card or ATM transactions: Usually immediate for authorization (funds are deducted almost instantly when you use your card or an ATM).

- Digital payment apps: Services like Zelle or PayPal can transfer funds within seconds (though moving money from the app to a bank account might still take a day or more).

In short, if speed is critical, a different EFT method (like a wire or card payment) will deliver funds faster than ACH.

Fees and Costs

ACH transfers usually cost very little (often free for consumers, or just a few cents for businesses).

By contrast, wire transfers are expensive – domestic wires often cost around $15–$30, and international wires $30–$50.

Other EFT methods fall in between. For example, paying by credit card incurs merchant fees of ~2–3%, while many bank-based P2P transfers are free.

Overall, ACH is among the cheapest electronic payment options.

Transaction Limits

Different payment methods have different limits. ACH transfers often have lower limits per transaction or per day – for example, a bank might cap personal ACH payments at a few thousand dollars per day. (Businesses can arrange higher limits if needed.)

Wire transfers, on the other hand, can handle much larger amounts. Banks usually don’t set strict caps on wire amounts (aside from available funds and security checks). Some consumer payment apps do impose limits – for instance, PayPal may allow around $60,000 per transfer.

Security and Regulations

Both ACH and other EFT methods use encryption and safeguards, making them secure channels to transfer money.

However, ACH transfers offer more consumer protections. If an unauthorized ACH debit hits a consumer’s account, the Electronic Fund Transfer Act (Reg E) generally entitles the customer to dispute it and get a refund. Also, ACH payments can be canceled or reversed by the bank in certain cases (such as error or insufficient funds).

By comparison, wire transfers are usually final once sent. If you wire money to the wrong account or are tricked into a fraudulent wire, it is very difficult to recover those funds. Business wire transactions aren’t covered by Reg E’s consumer protections and fall under different rules, so there’s less automatic recourse.

Use Cases: When to Use ACH vs. Other EFTs

- Recurring or bulk payments: Use ACH. It’s perfect for payroll, subscriptions, and regular bills where low cost matters more than speed.

- Everyday consumer purchases: ACH isn’t typically used at the point of sale. For one-time retail purchases, people use other EFT methods (like cards or digital wallets).

- Large or time-sensitive payments: If a payment is very large or needs to arrive quickly, a wire transfer (or another instant method) is a better choice despite the higher fee.

- International transfers: ACH is generally for domestic U.S. payments. To send money overseas, you would use a wire transfer or other international payment network.

In practice, many businesses use a mix of both ACH and wires depending on the situation – for example, ACH for routine domestic payments and wire transfers for urgent or cross-border payments.

Benefits of Using EFT and ACH Payments

Both EFT in general and ACH in particular offer significant advantages over old-fashioned paper-based payments.

Advantages of Electronic Funds Transfers (EFT)

Digital payments have largely replaced checks for good reason. Some benefits of using EFT include:

- Convenience and Speed: You can transfer money with a few clicks, without writing checks or handling cash. Electronic transfers typically move funds faster than mailing a check, especially when you set up recurring transactions.

- Cost Savings: Electronic transfers save on costs of paper, postage, and manual processing. In general, sending money digitally is very affordable.

- Security: EFT payments are encrypted and generally safer than carrying cash or mailing checks, which can be lost or stolen. There’s also a reduced risk of check fraud.

- Accuracy and Record-Keeping: Automated electronic payments reduce human error, and each transaction leaves a digital trail. This makes it easy to track payments and keep clear records for accounting.

- Environmental Benefits: Going paperless with EFT means less paper waste (no checks or envelopes), which is more eco-friendly.

Advantages of ACH Transfers for Businesses and Consumers

As a specific type of EFT, ACH transfers have some standout benefits, especially for domestic payments in the U.S.:

- Low Transaction Fees: ACH transfers usually cost only a few cents (often no fee at all), making them far cheaper than checks or wires.

- Faster than Paper: ACH payments typically clear in 1–2 business days, much quicker than mailing a check. (Same-Day ACH can speed this up even more.)

- Secure: ACH transfers are encrypted and regulated by strict rules. The network’s security measures help protect against fraud and errors.

- Traceable: Every ACH transaction leaves a digital record, so it’s easy to track payments and confirm they reached the right account.

Choosing Between ACH and Other EFT Options

- Speed vs. Cost: If you need funds to arrive the same day (or you’re sending money internationally), a wire or other fast method is the better choice. If keeping fees low is the priority and a 1–2 day delivery is acceptable, ACH is optimal.

- One-time vs. Recurring: For one-off payments (like a single purchase or an emergency transfer), using a wire or card may be more convenient. For repeating payments such as payroll or monthly bills, ACH is ideal due to its automation and low cost.

- Amount and Frequency: Large, infrequent transfers tend to favor wires, whereas moderate, frequent transfers favor ACH. For example, you might wire a one-time $100,000 payment, but use ACH to pay $5,000 to multiple vendors regularly.

- Recipient’s needs: Consider the preference of the other party. A vendor might request a wire for a same-day or international payment, but accept ACH for routine domestic payments.

Frequently Asked Questions (FAQs)

Q1: Is EFT the same as ACH?

A: No – ACH is a type of EFT, but EFT is a broad term for any electronic funds transfer. All ACH payments are EFTs, but not all EFT payments are ACH. Many people use “EFT” to mean an ACH bank transfer, but technically EFT also includes other kinds of transfers.

Q2: How long do ACH transfers take compared to other EFT methods?

A: A typical ACH transfer takes 1–3 business days to clear (with same-day ACH available for some payments). Other EFT methods can be faster – for example, domestic wire transfers often arrive the same day, and debit card transactions are nearly instant at purchase. If speed is crucial, ACH might not be the fastest option.

Q3: How much do ACH transfers cost vs. other methods like wires?

A: ACH transfers are usually very low-cost or free for the sender. In contrast, wire transfers often cost around $15–$30 for a domestic wire and $30–$50 for an international wire. That makes ACH one of the cheapest ways to send money electronically.

Q4: Are ACH payments safe and secure?

A: Yes – ACH payments are very safe. They use encryption and secure banking networks, and the ACH system has strict rules to protect against fraud.

Moreover, if an unauthorized ACH withdrawal occurs, the Electronic Fund Transfer Act (Reg E) gives consumers the right to dispute it and be reimbursed. Still, you should only authorize ACH withdrawals with trusted parties.

Q5: Can I use ACH transfers for international payments?

A: Generally, no. ACH is used for domestic U.S. payments – the network only connects U.S. banks. To send money internationally, you would use a wire transfer or another global payment system. (Some banks offer “international ACH” by routing through foreign networks, but that isn’t a standard ACH transfer.)

Q6: When should I use ACH vs. a wire transfer?

A: Use ACH for everyday domestic payments where low cost is a priority and a short processing time (1–2 days) is acceptable – for example, payroll deposits, bill payments, or transferring funds between your own accounts.

Use a wire or another instant transfer when speed is critical or the amount is very large or international – for example, a same-day large payment or an overseas transfer. In summary, ACH is great for routine transactions, while wires are suited for urgent or cross-border needs.

Conclusion

ACH and EFT both refer to electronic payments, but it’s important to understand their relationship and differences. Remember that ACH is a specific type of EFT – one that excels for domestic transfers that aren’t time-pressing.

For most routine payments, ACH provides a reliable, low-cost method to move money electronically. On the other hand, other EFT options (like wire transfers) are available when you need speed or international reach. By choosing the right method for each situation, you can make your payments in a way that is both convenient and cost-effective.

Leave a Reply