By achforbusiness September 11, 2025

Automated Clearing House (ACH) payments are a backbone of modern finance, enabling direct bank-to-bank transfers for everything from payroll deposits to bill payments. But what happens when an ACH transaction doesn’t go through? That’s where ACH returns come into play.

An ACH return occurs when an ACH transaction cannot be processed and is sent back to the originating bank – in other words, the payment is rejected (similar to a bounced check).

This comprehensive guide will explain what ACH returns are, why they happen, and how to manage them effectively. We’ll also cover compliance rules, practical tips to minimize returns, and answers to frequently asked questions. Short, clear sections and tables are provided for easy understanding.

What is an ACH Return?

An ACH return is a notification that an ACH payment failed and the funds are being returned to the sender. In the ACH network (the U.S. electronic payment system), if a direct deposit or bill payment can’t be completed, the receiving bank generates a return code and sends the transaction back through the network.

Each return comes with a standardized three-digit ACH return code explaining the reason (e.g. insufficient funds, invalid account, etc.). Essentially, an ACH return indicates the transfer was not successful and the money did not settle as intended.

Why ACH returns happen: ACH payments can fail for many reasons, each identified by a specific return code. Common causes include:

- Insufficient funds (R01): The payer’s account didn’t have enough money to cover the debit.

- Closed account (R02): The destination account has been closed.

- Invalid account details (R03, R04): The account number or routing number is incorrect or does not correspond to an existing account.

- Unauthorized transaction (R10, R07): The account holder did not authorize the payment or revoked a prior authorization.

- Stop payment (R08): The account holder placed a stop payment order on the transaction.

- Account holder deceased (R15): The account owner is deceased, so the transaction is refused.

- Other reasons: There are numerous other codes for issues like frozen accounts, duplicate entries, incorrect payment type, etc. (for example, R05 for wrong payment code usage, R06 for returns at the ODFI’s request, etc.).

Whenever an ACH payment is returned, the originator (the party who initiated the payment) and their bank receive a return code that tells them why it failed. This helps in quickly identifying the problem so that it can be corrected (similar to how a declined card gives a decline code).

ACH Return Codes and Their Meanings

NACHA (National Automated Clearing House Association) – the organization that governs the ACH network – has defined over 80 different ACH return codes covering every possible return reason. These codes consist of “R” followed by a two-digit number (for example, R01, R02, up to R85). Each code corresponds to a specific reason for return.

For practical purposes, most businesses and consumers will encounter only a subset of these codes regularly. The table below highlights some of the most common ACH return codes, their meaning, and the typical resolution timeframe for each:

| Return Reason | Code | Description | Typical Time Frame |

|---|---|---|---|

| Insufficient Funds | R01 | Not enough funds in payer’s account to cover the transaction | 2 banking days |

| Account Closed | R02 | The account has been closed and cannot receive the payment | 2 banking days |

| No Account / Unable to Locate | R03 | The account number is invalid or no such account exists | 2 banking days |

| Invalid Account Number | R04 | The account number is improperly formatted or contains errors | 2 banking days |

| Unauthorized Debit | R05 | A consumer account was debited using a corporate entry code (not authorized for that account type) | 60 calendar days |

| ODFI Request (Fraud suspected) | R06 | Returned at Originating Bank’s request (e.g. fraudulent or erroneous transaction) | No set limit |

| Authorization Revoked | R07 | The customer revoked their authorization for this payment | 60 calendar days |

| Payment Stopped | R08 | The account holder placed a stop payment on this transaction | 2 banking days |

| Uncollected Funds | R09 | Insufficient available funds (pending deposits that aren’t cleared) | 2 banking days |

| Unauthorized/Improper (Generic) | R10 | Customer advises the debit was not authorized or is improper (catch-all for unauthorized) | 60 calendar days |

Table: Common ACH return codes, their meaning, and standard resolution time frames under NACHA rules. Codes R01–R10 cover the majority of typical return reasons.

Most ACH return codes beyond those listed are for more specialized situations (e.g. R12 for branches sold to another bank, R16 for accounts frozen, R29 for corporate customers not authorized, etc.).

Return time frames are usually within 2 banking days for routine issues, but returns for unauthorized debits to consumer accounts (codes like R05, R07, R10) have an extended window of 60 days in which the receiver (customer) can dispute and return the payment. A code like R06 (ODFI-requested return) is a special case with no predefined time limit in the rules.

How the ACH Return Process Works

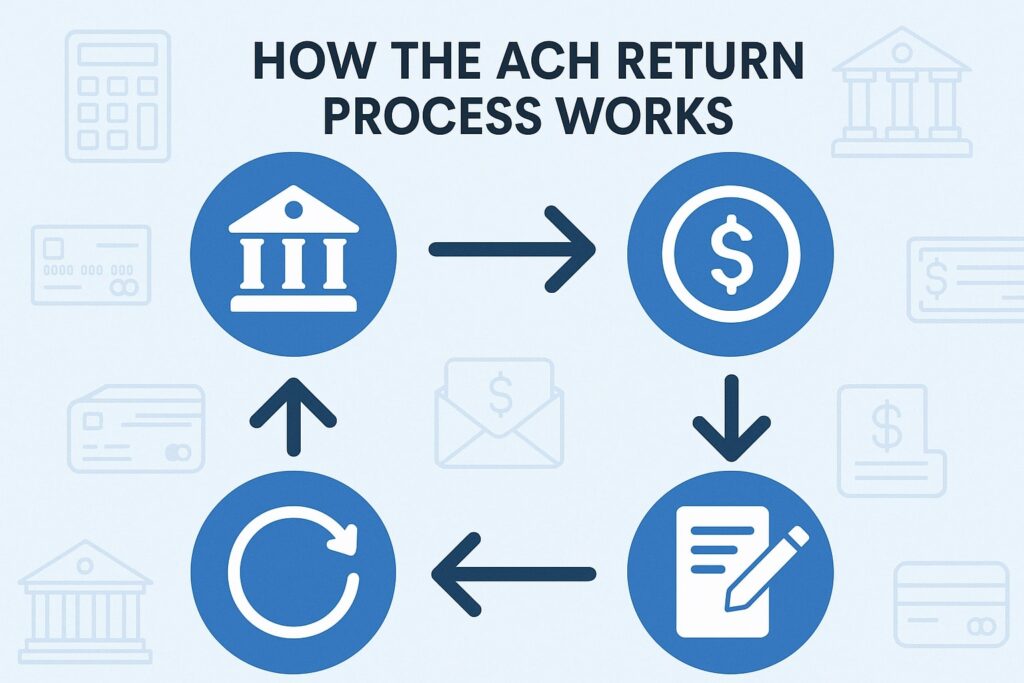

Simplified illustration of the ACH return process: the Originator’s bank (ODFI) sends a payment through the ACH Operator (e.g., Federal Reserve) to the Receiver’s bank (RDFI). If an issue occurs (e.g., invalid account), the RDFI initiates a return back through the ACH network to the ODFI, notifying the originator of the failure.

Five parties are involved in a standard ACH transaction: the Originator (person or business sending the payment), the Originating Depository Financial Institution (ODFI) (the originator’s bank), the ACH Operator, the Receiving Depository Financial Institution (RDFI) (the receiver’s bank), and the Receiver. When a payment is initiated, it flows from the originator’s bank, through the ACH Operator, to the recipient’s bank.

If something goes wrong – say the account is closed or the number is wrong – the RDFI (receiving bank) will send an ACH return entry back through the network to the ODFI, indicating the failure.

The ODFI then passes that information (the return code) to the originator. This return process typically happens quickly: most ACH returns are generated and sent within two business days of the initial transaction’s settlement date. The originator effectively sees the debit or credit reversed and receives notice of the return reason.

Extended return periods: In cases of unauthorized transactions on consumer accounts, the ACH rules allow returns to be initiated much later – up to 60 calendar days after settlement – to protect consumers.

For example, if a consumer finds an unauthorized ACH withdrawal on their bank statement, they can dispute it and the bank (RDFI) can return it within that 60-day window. These extended-timeframe returns carry codes like R07 or R10 as noted earlier.

Businesses should be aware that an ACH payment isn’t fully “safe” from return until those windows lapse for consumer payments.

ACH Returns vs. ACH Reversals

An ACH return occurs when an ACH transaction cannot be processed and the receiving bank sends the transaction back to the originating bank. Returns adhere to Nacha rules and must be initiated within a specified time frame from the transaction’s settlement date, typically within two banking days.

An ACH reversal is initiated by the originator of an ACH transaction if it finds that an error was made (e.g., wrong amount, duplicate transaction). The originator can send a reversing entry to undo the incorrect transaction.

Reversals must also adhere to Nacha guidelines, which state that they must be initiated within five banking days of the original transaction date and must be for the full amount of the original transaction.

In short, returns are reactive (a failure notice from the receiver’s bank), whereas reversals are proactive (a request from the sender to correct or undo an error). Both processes are governed by NACHA rules, but they serve different purposes.

Impact of ACH Returns on Businesses and Consumers

When an ACH payment bounces back as a return, it can have several consequences for all parties involved. Here are some key impacts:

- Delayed or lost revenue: For businesses, a returned ACH debit means the expected funds are not received on time. This can delay revenue and disrupt cash flow until the issue is resolved. Small businesses operating on tight margins may struggle to cover expenses when payments bounce.

- Increased administrative workload: Each return demands follow-up. Businesses must investigate the reason code, communicate with the customer if necessary, and possibly initiate a new transaction or get an alternate payment. This increases the administrative workload and costs time and effort.

- Additional fees: Returns often come with extra costs. Banks and payment processors may charge an ACH return fee for the failed transaction, and if the return was due to insufficient funds, the payer’s bank may also levy an NSF fee (non-sufficient funds fee).

Frequent returns can therefore become expensive for both businesses and consumers. (We cover fee details in the next section.) - Impact on customer relationships: Payment failures can strain customer relationships. From a payer’s perspective, a returned payment might result in late fees or service interruptions (for example, if a bill payment is returned).

From the business’s perspective, having to ask a customer for a different payment because the first attempt failed can be delicate. If not handled tactfully and quickly, it may erode trust. - Reputational and compliance risks: Excessive payment issues, including ACH returns, can harm a business’s reputation. If customers see a company as unreliable at handling transactions, it could lose credibility.

Moreover, high rates of ACH returns might draw regulatory scrutiny, potentially leading to audits or penalties if improper practices are uncovered. (NACHA sets specific return rate limits – discussed in the compliance section below.)

In summary, ACH returns are more than just an inconvenience – they carry financial costs and relationship implications. Whether you’re a business or an individual, it’s in your interest to minimize returned payments.

ACH Return Fees and Charges

One of the first questions people ask when dealing with ACH returns is: will I be charged a fee? In many cases, yes. There are a few types of fees and charges associated with ACH returns:

- ACH return fee (processor/bank fee): Often, the payment processor or ODFI will charge the originator a fee for each returned item. This ACH return charge is typically relatively small – on the order of $2 to $5 per return – but it can add up for businesses with many returns. Think of it as a small penalty similar to how banks charge a fee when a check bounces.

- NSF fee (Non-sufficient funds fee): If the return reason is insufficient funds (R01 or R09), the payer’s bank may hit the payer’s account with an NSF fee. These fees are usually much higher than the return fee to the originator.

NSF fees often range from $15 up to $35 for each occurrence. So, for instance, if a customer’s ACH payment to a business bounces due to lack of funds, the customer might pay an NSF fee to their bank, and the business might still want to recover a returned payment fee from the customer as well. - Returned payment fee (for credit cards or loans): If you were paying a credit card bill or loan via ACH and that payment is returned, the creditor (e.g., credit card issuer) will likely charge a returned payment fee.

Credit card returned payment fees typically range $25 to $40 per instance. This is separate from any bank NSF fee. Essentially, the card issuer treats it similarly to a bounced check payment – you’ll see a fee on your credit card account for the failed payment. - Stop payment fee: In cases where the payer actively stops an ACH payment (return reason R08), the payer’s bank may charge a stop payment fee for that service. Stop payment fees vary but often fall in the $15–$35 range, similar to NSF fees. This fee would be charged to the account holder who initiated the stop payment.

- Re-initiation or resubmission fees: If a business reattempts a returned ACH (when permitted by the rules) or uses a representation service, there might be additional small fees for each retry. These are generally a few dollars or less, depending on the bank or processor. While small individually, multiple retries can incur multiple fees.

- Unauthorized entry fee (NACHA rule): Behind the scenes, NACHA has implemented an Unauthorized Entry Fee that the originating bank (ODFI) must pay to the receiving bank for every ACH debit returned due to lack of authorization.

As of the current rules, this fee is $4.50 per unauthorized return (covering return codes R05, R07, R10, R29, R51). This fee is meant to incentivize originators to reduce unauthorized transactions. While the ODFI pays it, in practice those costs can be passed down to the originator (and potentially the originator’s customer).

Important: All these fees underscore why it’s important to manage ACH returns. For a business, frequent returns not only mean chasing payments but also incurring many small charges that cut into margins.

For a consumer, a single bounced payment could result in multiple fees (one from the bank, one from the biller). Wherever possible, it’s best to avoid returns or address them promptly to mitigate fees.

Compliance and Regulations (NACHA Rules for Returns)

ACH transactions in the United States are governed by the NACHA Operating Rules, which include specific provisions about returns. Beyond the practical need to get your payments through, businesses must also stay compliant with these rules to avoid penalties. Key compliance points include:

- Return rate thresholds: NACHA monitors the percentage of an originator’s transactions that get returned. There are three critical thresholds:

- Unauthorized return rate: Must be 0.5% or less. This covers returns for reason codes indicating unauthorized debits (R05, R07, R10, R29, R51).

- Administrative return rate: Must be 3.0% or less. This includes returns for administrative errors like bad account numbers or closed accounts (R02, R03, R04).

- Overall return rate: Must be 15.0% or less of all debit entries originated (excluding a few special cases like re-presented check entries).

- Unauthorized return rate: Must be 0.5% or less. This covers returns for reason codes indicating unauthorized debits (R05, R07, R10, R29, R51).

- These percentages are calculated on a rolling 60-day basis. If an originator exceeds any of these levels, it triggers a review and inquiry from NACHA.

The originator’s bank (ODFI) is required to work with them on a corrective plan to reduce return rates. Continued non-compliance can lead to fines or even suspension of the originator’s ACH privileges. - Obligation for authorizations: NACHA rules require that ACH debits (especially from consumer accounts) have proper authorization. Businesses must obtain and retain proof of authorization (such as signed ACH authorization forms or recorded consents for phone/web entries).

If customers dispute an ACH as unauthorized, the business should be able to produce this proof. Lack of proper authorization can lead to customer disputes (unauthorized returns) and put the business in violation of the rules. - Timely processing of returns: Banks (RDFIs) are obligated to process returns within the allowed time frames (generally 2 business days for most returns, or up to 60 days for consumer unauthorized returns).

For businesses, this means you should also monitor your ACH activity daily. If a return comes in, you’ll want to know promptly – both to resolve the payment issue with your customer and to stay within any response windows for disputing errors. - Reinitiation rules: NACHA rules limit how many times and under what conditions you can re-initiate a returned ACH debit. Generally, an ACH that was returned for insufficient funds (R01 or R09) may be reattempted up to two more times within 30 days, and only after notifying the customer.

Payments returned for other reasons (like account closed or invalid number) should not be retried until the underlying issue is corrected. Any payment returned as unauthorized must not be reinitiated unless new authorization is obtained. Ignoring these rules can lead to compliance violations. - Potential fines and penalties: If an originator consistently flouts NACHA rules – for example, by having excessive returns or causing many unauthorized debits – NACHA can levy fines.

These fines can range from a few thousand dollars up to tens of thousands in severe cases. In extreme situations, an originator could even lose access to the ACH network.

Essentially, maintaining low return rates and following procedures is not just best practice, it’s required. It signals to banks and regulators that your company is managing payments responsibly.

How to Manage and Reduce ACH Returns (Best Practices)

ACH returns may never be completely avoidable, but there are many steps you can take to minimize their frequency and handle them smoothly when they occur. Here are some best practices and practical tips for businesses (and even individuals):

- Verify bank details upfront: One of the simplest ways to prevent returns is to ensure the account and routing numbers are correct before you initiate an ACH.

Use verification methods like micro-deposits (small test deposits) or third-party bank account validation services to confirm the account is valid and active. Catching a typo or closed account in advance saves you from a return later. - Obtain proper authorization: Always have explicit authorization from the account holder for ACH debits.

For recurring payments, get a signed ACH authorization form or equivalent electronic consent and provide a copy to the customer. This is required by NACHA rules and also protects you if a customer later claims a payment was unauthorized. - Communicate with your customers: Keep customers informed about upcoming ACH debits, especially for large or first-time payments. A simple reminder (email or text) that “We will debit your account on [Date] for $X” can prompt customers to ensure sufficient funds are available.

Open communication also encourages customers to notify you in advance if there’s an issue (like a changed bank account) before the payment date. If a payment does bounce, notify the customer immediately and work with them on a quick resolution (such as arranging an alternate payment method or a new debit date). - Monitor ACH transactions daily: Don’t wait for monthly statements to discover returns. Use online banking or your payment processor’s dashboard to check for returned items every business day.

Promptly address any return that appears: if it’s something you can fix (e.g. a typo in account info), correct it and possibly reinitiate; if it’s insufficient funds, contact the customer about trying again on a better date or collecting via a different method.

Quick action can sometimes turn a return into a successful payment before too much time passes. - Use technology and automation: Leverage tools that help manage returns. Many ACH payment systems can send automatic alerts when a transaction is returned. Use validation APIs or software to spot invalid account details instantly at the point of entry – this reduces human errors that lead to returns.

Automating parts of your payment process (for instance, integrating your payment platform with accounting software) can also help catch mistakes and streamline handling of exceptions. - Analyze patterns and improve: Keep an eye on your return rate and the reasons behind returns. If you notice a pattern – for example, a particular batch of customers frequently has R01 insufficient funds returns – consider adjusting your processes.

This might mean changing billing dates to align with customers’ paydays, or requiring a credit card backup for those who often have NSF issues.

If you frequently get R03/R04 (bad account numbers), improve your data collection or validation steps at customer onboarding. Analyze return data regularly to spot recurring issues and address the underlying causes. - Educate and train staff: Ensure your finance or accounts team understands ACH return codes and procedures.

When they see a return code, they should know what it means and what action to take (for example, a code for account closed means reaching out to update the account info, a code for stop payment means not to retry and to contact the customer, etc.).

Proper training prevents mishandling of returns and avoids making issues worse (like accidentally resubmitting a payment that was unauthorized or stopped). - Consider alternative payment options: If a customer repeatedly has ACH payments returned, it may be wise to move them to a different payment method. Offering options such as credit/debit card payments or digital wallets can ensure you get paid.

This is especially relevant if a particular client has chronic ACH issues – using a different payment channel might save everyone time and trouble.

Frequently Asked Questions

Q.1: How long does an ACH return take to process?

Answer: Most ACH returns are processed within two business days of the transaction’s settlement date. That means if a payment fails, you’ll typically know within a couple of days.

However, certain return reasons (particularly unauthorized debits on consumer accounts) allow the return to be initiated up to 60 days later. In those cases, a disputed transaction might be reversed weeks after it is settled.

Q.2: How much is an ACH return fee?

Answer: It depends on your bank or payment processor. Generally, ACH return fees (the charge to the originator for a returned item) range from $2 to $5 per return.

Keep in mind, if the return was due to insufficient funds in the payer’s account, the payer might also incur a separate NSF fee from their bank, which can be around $25 or more.

Q.3: Can ACH returns be disputed or reversed?

Answer: In some cases, yes. If you believe an ACH return was made in error, the RDFI (receiving bank) can dishonor the return under specific conditions.

For example, reasons to contest a return include if it was a duplicate or misrouted return, contained incorrect information, was not done within the allowed time frame, or if it resulted from an error in a reversal process. These are special scenarios – in general, you cannot “reverse” a legitimate ACH return code (instead, you’d correct the issue and initiate a new transaction).

Q.4: What does “Returned Mobile ACH Payment” mean?

Answer: “Returned Mobile ACH Payment” (sometimes shown as “Return Mobile ACH Payment” on statements) refers to an ACH transaction initiated via a mobile banking app or platform that failed and was returned. In other words, a payment you sent from your mobile device didn’t go through and the funds were sent back.

The reasons are the same as any ACH return – often insufficient funds or invalid account details. You would need to check the return code or talk to your bank to find out the specific reason, then resolve the issue (for example, by funding your account and paying again if it was an NSF problem).

Q.5: What is a “Returned ACH Card Payment”?

Answer: A “Returned ACH Card Payment” usually means that a payment toward a credit card (or similar account) made via ACH was returned. For instance, if you paid your credit card bill by entering your bank details (ACH payment) and that transaction bounced, your credit card issuer might label it as a returned ACH card payment on your statement.

When this happens, the payment amount is not applied to your card, and the card issuer will likely charge you a returned payment fee (about $25–$40) for the failed payment. If you see this on your account, you should promptly make another payment (and ensure your bank info is correct and funded) to avoid late fees or other issues.

Q.6: Is there a limit to how many ACH returns I can have?

Answer: There’s no strict numeric limit on the count of returns, but there are return rate thresholds you’re expected to stay under. NACHA rules require that the rate of unauthorized returns stays below 0.5%, administrative returns below 3%, and overall returns below 15% of your total ACH debit volume.

Exceeding those rates can trigger warnings or compliance action. In practice, a few occasional returns are normal (customers might bounce a payment here or there), but consistently high return rates are a red flag and can lead to penalties or loss of ACH privileges.

Conclusion

ACH returns are an inevitable part of using the convenient ACH payment system – but with knowledge and preparation, they don’t have to be a major headache. In summary, an ACH return means a payment didn’t go through, and it comes with a code telling you why.

Understanding these return codes and reasons allows businesses and consumers to quickly fix issues, whether it’s as simple as asking a customer to update their bank info or as serious as investigating a possible unauthorized debit.

By staying on top of return notifications, following NACHA’s compliance rules, and adopting best practices to prevent common errors, you can keep your ACH return rates low and your finances running smoothly.

The costs and hassle of returns – lost time, fees, strained customer relations – make it well worth the effort to manage them proactively. Remember, the goal isn’t just to avoid fees or fines, but to provide a seamless payment experience for both you and your customers.

With the guidelines and tips provided in this article, you should be well-equipped to handle ACH returns like a pro. Whether you’re a small business owner making sure your invoices get paid or a consumer managing your bill payments, knowing how ACH returns work is key to avoiding surprises in your bank account.

ACH payments are here to stay, and by focusing on accuracy, communication, and compliance, you can ensure they remain a reliable and efficient part of your financial toolkit.

Leave a Reply