By Rinki Pandey January 13, 2026

An ACH Authorization Form is a written or electronic agreement that gives a business permission to debit or credit a customer’s bank account through the ACH Network.

In plain terms, the ACH Authorization Form is the customer’s “yes”—and it’s the foundation for compliant bank-to-bank payments like recurring subscriptions, installment plans, payroll direct deposit, and one-time eCheck-style debits.

A properly executed ACH Authorization Form typically confirms (1) who is authorizing the transfer, (2) which account will be used, (3) what amount and timing are allowed, and (4) how the customer can cancel.

For consumer accounts, ACH authorizations intersect with both ACH Network rules and consumer electronic transfer protections that regulate preauthorized transfers and stop-payment rights.

Because bank payments can be reversed through returns and disputes, the ACH Authorization Form also functions as Proof of Authorization—the documentation your bank or payment provider may require if a debit is questioned.

Industry guidance emphasizes that authorization is the customer’s agreement to allow debits to their account, and that businesses should understand the responsibilities tied to that permission.

In this guide, you’ll learn what an ACH Authorization Form includes, how to collect it (paper, online, or phone), what rules shape it, how long to keep it, and how to design an authorization process that reduces returns and improves approval rates—plus practical future-facing trends shaping ACH authorization over the next few years.

Why an ACH Authorization Form matters for businesses and customers

The ACH Authorization Form matters because it turns a bank transfer into a documented, enforceable permission. For businesses, that permission lowers payment friction and cost compared with many card transactions, but it also increases responsibility: you must debit only within the boundaries the customer agreed to.

When a customer disputes an ACH debit, the question usually becomes simple: Did you have a valid authorization, and can you prove it? That’s why a clean ACH Authorization Form is one of the most valuable documents in your payment system.

For customers, the ACH Authorization Form creates transparency and control. It clarifies when money will move, whether payments repeat, how amounts can change, and how cancellation works.

Consumer protections around preauthorized transfers include the ability to stop payment of a scheduled preauthorized transfer by notifying the financial institution within required timelines, and rules for notices when amounts vary under certain conditions. These protections only work smoothly when the authorization is clear about schedules, variability, and cancellation.

Operationally, the ACH Authorization Form also reduces avoidable errors. Many ACH returns stem from preventable issues: wrong routing/account numbers, unclear billing cadence, weak identity checks for online signups, or collecting “permission” in a way that doesn’t match the transaction type.

When your authorization language matches the actual ACH entry type and timing, you get fewer returns, fewer angry customers, and fewer compliance escalations.

Finally, the ACH Authorization Form supports scalability. As you grow from one-time ACH payments to recurring billing, installment plans, or variable-amount billing, the form becomes your standardized framework—so customer service, accounting, risk, and operations all work from the same “source of truth.”

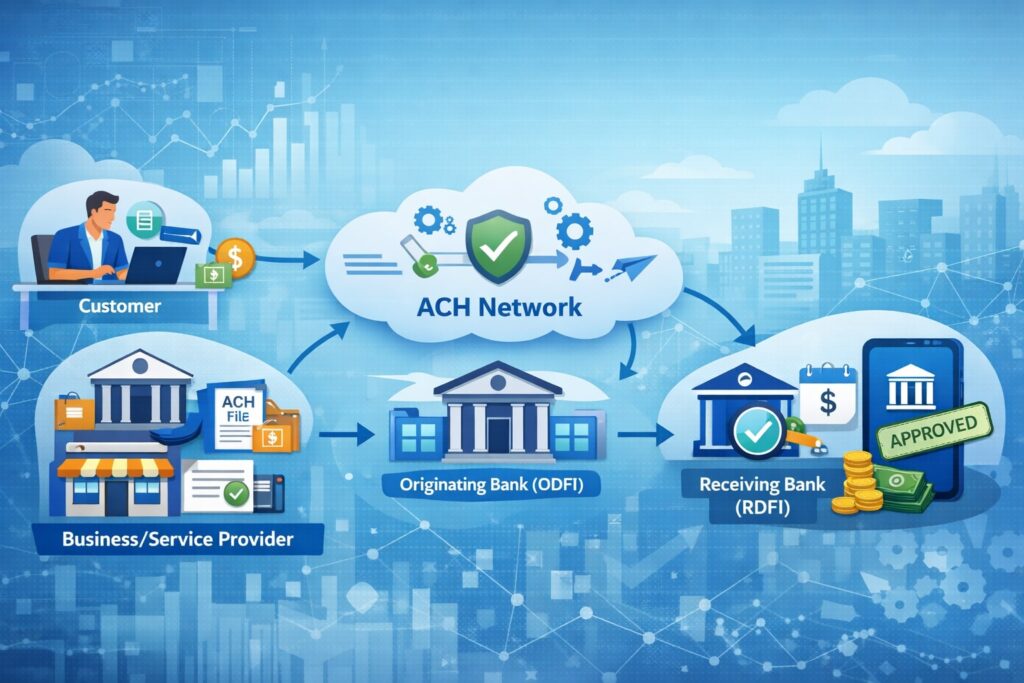

How ACH authorization works inside the ACH Network

To understand the ACH Authorization Form, it helps to know the basic workflow. A business (the “Originator”) sends ACH entries through its bank or payment provider. The customer’s bank receives the entry and posts it to the customer’s account.

Rules define what the business must do before sending entries—especially for debits, where the customer’s money is pulled rather than pushed.

Authorization is the step that must happen before the business originates the debit (or sometimes before initiating certain credits, depending on context). Industry guidance describes authorization as the agreement between the business and the consumer that permits debits to the consumer’s account, and notes that both ACH Network rules and consumer transfer rules can apply for online consumer debits.

The practical meaning is this: your ACH Authorization Form should line up with the specific way the transaction is created. If you collected authorization online, your controls and documentation should support online authorization.

If you collected it by phone, your procedures should support phone-based authorization. If you’re billing monthly, your authorization should clearly state monthly cadence, cancellation rules, and what happens if the amount changes.

When authorization and transaction type don’t match, that mismatch is where disputes, higher returns, and compliance headaches often begin. So the “best” ACH Authorization Form is not just a template—it’s a document integrated with your payment flow, customer experience, and recordkeeping.

ACH Authorization Form vs. “Proof of Authorization”

An ACH Authorization Form is the customer-facing agreement. Proof of Authorization is what you retain to demonstrate that agreement if the debit is questioned later.

In many real-world cases, they’re the same document—but Proof of Authorization can also include supporting artifacts such as timestamped logs, IP/device details, call recordings (where permitted), or a copy of the checkout page terms the customer accepted.

For online consumer debits, industry materials commonly emphasize the dual need for authorization and authentication—meaning you not only capture “permission,” but you also implement reasonable methods to confirm the person granting permission is the account holder or is otherwise authorized.

Retention is a major part of Proof of Authorization. Some merchant education guidance states that businesses should retain Proof of Authorization records for two years following the date of the last transaction, which aligns with common expectations across ACH operations when documentation may be requested later.

(Your bank or provider may require longer retention based on risk, underwriting, or sector norms, so storing longer is often wise.)

If you want a simple rule of thumb: treat the ACH Authorization Form as a “living contract” and treat Proof of Authorization as an “audit-ready file” that includes everything needed to defend the authorization.

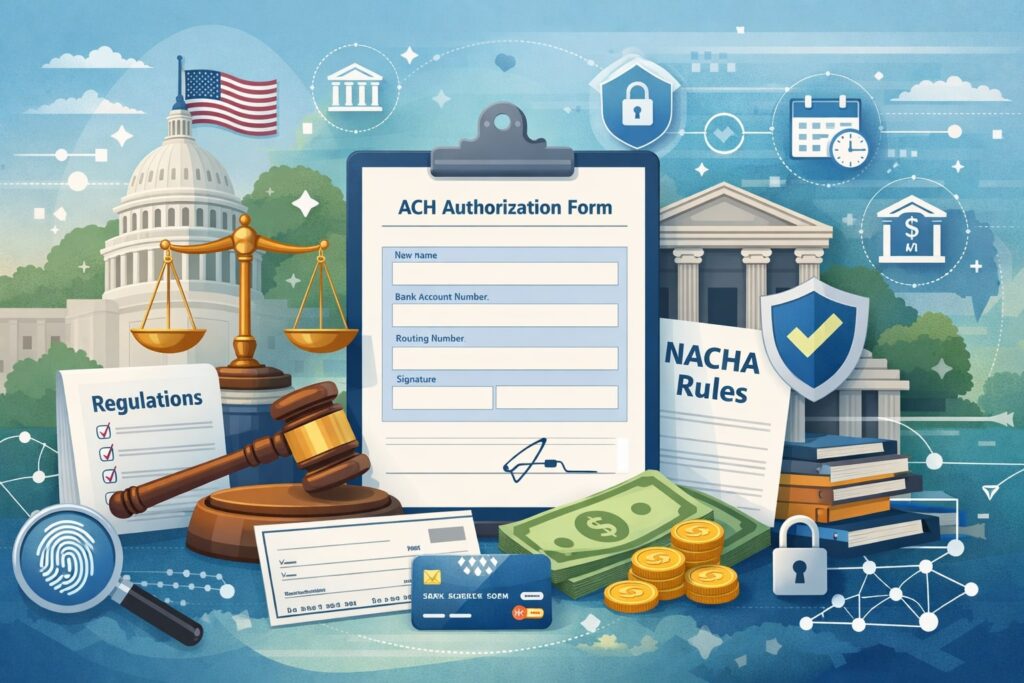

The legal and rules framework that shapes an ACH Authorization Form

A strong ACH Authorization Form is written with the rules in mind—not in legalese, but in clear language that covers what the rules expect. Two big rule layers often come into play:

1) ACH Network operating rules (entry-type specific)

ACH Network rules define responsibilities for participants and set requirements tied to how entries are initiated. Nacha publishes updates over time and lists rule changes by effective date, which is important because authorization practices can evolve (for example, updates around e-commerce purchase definitions and standardized descriptions).

2) Consumer electronic transfer protections for preauthorized transfers

Consumer protections for preauthorized transfers cover issues like variable amounts and stop-payment rights. Regulation text addressing preauthorized transfers discusses notice requirements when a preauthorized transfer varies in amount and the consumer’s right to stop payment by notifying their financial institution within required timing.

Official commentary also explains what counts as a preauthorized transfer—authorized in advance, recurring at substantially regular intervals, and requiring no further action by the consumer to initiate.

Put simply: the ACH Authorization Form should clearly define whether payments are one-time, recurring, or variable; how notice works for changes; and how cancellation works. If your authorization is vague, your risk rises—especially for recurring consumer debits.

Types of ACH authorization: one-time, recurring, and standing authorization

Not every ACH Authorization Form is the same, because not every payment relationship is the same. A helpful way to design an ACH Authorization Form is to start with authorization type:

One-time authorization

A one-time ACH Authorization Form permits a single debit (or credit) for a specified amount on or around a specified date. This is common for invoices, deposits, and immediate payments.

Recurring authorization

A recurring ACH Authorization Form permits repeated debits on a schedule (weekly, biweekly, monthly). Subscriptions and membership billing live here. Because recurring billing drives more customer service questions, your recurring ACH Authorization Form should be very explicit about the cadence, amount, and cancellation method.

Variable and “standing” style authorization

Some payment relationships aren’t perfectly recurring in the same amount. Think utilities, usage-based billing, or invoices that change but are paid automatically.

Modern guidance and industry discussion highlight that consumer authorization concepts can differ slightly between consumer transfer rules and ACH operating rules, and that authorization frameworks have evolved to address real-world use cases more cleanly.

For variable payments, the ACH Authorization Form must do extra work: it should define how the customer will be notified before a debit when the amount changes, what counts as “authorized,” and how cancellation works in a way a customer can actually use.

ACH Authorization Form requirements by payment channel and entry type

A surprisingly common reason for ACH problems is that businesses collect authorization in one channel but process transactions under another channel’s assumptions. Your ACH Authorization Form should align with how the customer authorized the debit.

Online authorization (WEB)

If the customer authorizes via an online checkout, portal, or e-sign flow, that authorization is generally treated as online. Nacha guidance for WEB entries stresses the importance of authorization and understanding applicable obligations for online-initiated debits.

Phone authorization (TEL)

If authorization is obtained by phone, procedures often include recording the call (where permitted), capturing key terms verbally, and storing a record that can be retrieved later.

Written authorization (paper or e-sign)

If the customer signs a paper form or an electronic signature form, you retain the signed document and any e-sign metadata (date/time, identity steps, signature certificate).

Business vs. consumer context

Some materials used by banks and payment companies highlight the importance of using the correct classification for consumer vs. business accounts and matching the right codes and naming conventions.

Practically, your ACH Authorization Form should include a checkbox or statement that clarifies whether the account is consumer or business and that the signer has authority to authorize payments from that account.

What information an ACH Authorization Form should include

An ACH Authorization Form should be simple to read but complete enough to stand up during a dispute. Most high-performing forms include the elements below (written in plain language):

1) Customer identity

- Full name (and business name if applicable)

- Email and phone

- Billing address (often helpful for verification and record matching)

2) Bank account details

- Routing number

- Account number

- Account type (checking/savings)

3) Authorization terms

- Debit or credit permission (or both)

- One-time vs recurring vs variable

- Amount (fixed amount, max amount, or variable with notice rules)

- Frequency (monthly, weekly, on invoice issue, etc.)

- Start date and (if relevant) end date or cancellation trigger

4) Cancellation and revocation instructions

- How to cancel (email, portal, written request, phone with verification)

- Cutoff timing (for example, “at least X business days before next debit”)

5) Disclosures for changes

For preauthorized transfers that vary in amount, rules can require advance notice in certain scenarios, and your ACH Authorization Form should explain how you’ll deliver that notice (email, SMS, or mailed notice depending on your process).

6) Signature and timestamp

- Signature (wet signature or e-sign)

- Date/time captured

- For e-sign: IP address, device fingerprint (optional but useful), and consent to electronic records

7) Authorization statement

A clear statement that the customer authorizes you to initiate ACH entries to the specified account under the listed terms, and that the customer can revoke authorization per the stated method.

If you want your ACH Authorization Form to rank and convert, keep it readable: short paragraphs, clear bullets, and human language. A “perfect” ACH Authorization Form is not one that sounds like a contract—it’s one customers understand and fewer customers dispute.

How to design an ACH Authorization Form for e-sign and online checkout

Modern businesses often collect an ACH Authorization Form through an online checkout or e-sign flow. That’s convenient, but it raises the bar for record quality and fraud controls. A good online ACH Authorization Form flow typically includes:

Clear consent and affirmative action

Use an unchecked checkbox like: “I agree to the ACH Authorization Form terms.” Then require a button click to submit. This creates a clean “affirmative assent” record.

Authentication that matches risk

Nacha’s WEB-focused industry practices discuss authorization and authentication concepts for online debits and encourage businesses to understand the requirements and responsibilities. In practice, that often means adding at least one strong step beyond “enter bank info,” such as:

- Email/SMS one-time passcode

- Customer login

- Device reputation checks

- Knowledge-based verification (used carefully)

Confirmation and receipt

Immediately provide a receipt page and email confirmation that restates the key ACH Authorization Form terms: amount, schedule, cancellation instructions, and the bank account nickname (“Checking ending 1234”).

Audit-friendly storage

Store the exact authorization text shown at the time of acceptance, plus metadata: timestamp, IP, user ID, and version number of the terms. This turns your ACH Authorization Form into strong Proof of Authorization.

Online flows that skip these steps can still “work,” but they tend to generate higher return rates and more unauthorized claims—especially if your product is high-ticket or your customer acquisition channels include promotions that attract fraud.

Account validation, micro-entries, and why they affect ACH authorization quality

A strong ACH Authorization Form isn’t only about wording—it’s also about whether the bank account information is valid and controlled by the payer. Account validation reduces returns like “invalid account” and helps prevent unauthorized debits.

One common method is micro-entries, where small credits (typically less than $1) and sometimes offsetting debits are used to verify account access.

Nacha’s micro-entry rule materials describe standardization for micro-entries, including a standard description (for example, “ACCTVERIFY”) and risk-management expectations, with phased effective dates already in place.

How this connects to your ACH Authorization Form:

- Your ACH Authorization Form should mention that you may use account validation steps before the first debit.

- Your payment flow should delay debits until validation is completed (unless using an approved alternative validation method).

- Your customer messaging should explain what micro-deposits are and how to confirm them, reducing confusion and support tickets.

Looking forward, account validation is becoming less optional. More businesses are pairing the ACH Authorization Form with real-time validation methods (where available) or enhanced fraud detection for online authorizations. The better your validation, the more confidently you can offer ACH as a “primary” payment method.

Handling changes: variable amounts, schedule shifts, and reauthorization

Businesses often evolve pricing: upgrades, proration, usage charges, late fees, or changes in billing date. These changes are where ACH problems happen if your ACH Authorization Form doesn’t anticipate them.

For preauthorized transfers that vary in amount, rules can require providing advance notice of the amount and date of the transfer under certain conditions. Your ACH Authorization Form should spell out your change-notice policy in plain language:

- What counts as a “change”

- How you notify (email/SMS/letter)

- How many days in advance (align to your compliance obligations and provider requirements)

- What the customer can do if they disagree (cancel, pause, or contact support)

When do you need reauthorization?

- If you expand beyond the original scope (example: adding a new recurring fee not described)

- If you change the payer identity (example: new account holder)

- If the customer revokes and later reinstates payments

- If you switch the authorization channel in a way that changes documentation expectations

A practical best practice is versioning your ACH Authorization Form. When terms materially change, capture a new acceptance with the new version number. This improves customer clarity and reduces the “I never agreed to that” problem.

Cancellation, revocation, and stop payments: what your form should explain

A high-quality ACH Authorization Form makes cancellation easy to understand. When customers can cancel smoothly, they are less likely to go to their bank first, which can produce returns and fees.

Your ACH Authorization Form should state:

- How to revoke authorization (email address, portal path, mailing address)

- Verification steps (to prevent malicious cancellations)

- Cutoff timing before the next scheduled debit

Consumer rules recognize that a consumer may stop payment of a preauthorized electronic fund transfer by notifying the financial institution within required timing (often at least three business days before the scheduled date, depending on the scenario).

You shouldn’t rely on that bank-side process as your main cancellation method. Instead, your ACH Authorization Form should encourage customers to contact you first and explain that bank stop payments can block future legitimate debits until authorization is re-established.

From an operations standpoint, build a “revocation pipeline”:

- Receive cancellation request

- Confirm identity

- Stop future debits in your billing system

- Confirm cancellation in writing (email receipt)

- Store the cancellation record alongside the original ACH Authorization Form

That full paper trail—authorization plus revocation—reduces confusion and protects both parties.

Recordkeeping and retention: how long to keep an ACH Authorization Form

Retention is where many businesses slip. They collect the ACH Authorization Form, but can’t retrieve it quickly when a dispute happens. For online debits, that’s especially risky because disputes can arise long after onboarding.

Merchant guidance commonly states that businesses should retain Proof of Authorization for two years after the last transaction under that authorization. Many banks, processors, or underwriting programs may ask for longer retention or faster retrieval SLAs, particularly for higher-risk categories.

Best-practice retention approach:

- Store the signed ACH Authorization Form (PDF or rendered HTML)

- Store the “terms text” exactly as displayed

- Store acceptance metadata (timestamp, user ID, IP, device info where collected)

- Store follow-on records: notices of change, failed payment notices, cancellation confirmations

- Make it searchable by customer name, last 4 digits of account, and authorization ID

Think like this: if you got an urgent call tomorrow—“Provide the ACH Authorization Form for these three disputed debits”—could you produce it in minutes, not days? That’s the operational standard that separates low-return ACH programs from high-return ACH programs.

Common ACH Authorization Form mistakes that cause returns and compliance issues

Even good businesses make preventable mistakes with an ACH Authorization Form. Here are the issues that most often lead to unauthorized return claims, customer complaints, or bank scrutiny:

Mistake 1: Vague authorization language

If your ACH Authorization Form doesn’t clearly state the amount, schedule, and cancellation method, customers may claim they didn’t understand what they agreed to.

Mistake 2: Channel mismatch

Collecting “online” consent but treating it like a written signature, or collecting phone consent without a usable record, can undermine Proof of Authorization expectations for that channel.

Mistake 3: Not addressing variable amounts

If amounts can change, your ACH Authorization Form should explain how notice works and how customers can opt out. This is a major driver of disputes in subscription + usage hybrids.

Mistake 4: Weak identity checks for online signups

Online ACH can be a fraud target. Without layered checks, you may see higher returns and account validation failures.

Mistake 5: Poor storage and retrieval

If you can’t quickly produce the ACH Authorization Form and supporting evidence, internal teams waste time and disputes escalate unnecessarily.

Mistake 6: Overcomplicating the customer experience

A 3-page ACH Authorization Form written like a legal contract can backfire. Customers abandon checkout, and the ones who complete it often don’t understand it—raising complaint risk later.

Fixing these mistakes is less about “more compliance text” and more about clarity, matching your process to the transaction type, and building durable documentation.

ACH Authorization Form template guidance (fields and sample wording)

Below is guidance you can adapt into your own ACH Authorization Form. (This is not legal advice; it’s a practical structure that aligns with common expectations.)

Recommended form fields

- Customer name + contact info

- Account holder name (if different)

- Routing number + account number + account type

- Payment type: one-time / recurring / variable

- Amount: fixed / maximum cap / variable per invoice

- Frequency and start date

- Authorization statement + cancellation method

- Signature + date (or e-sign acceptance + timestamp)

Sample authorization statement (plain-language)

“I authorize [Business Name] to initiate ACH debit entries to my bank account indicated above for [purpose] under the following terms: [schedule/amount]. I understand I may cancel this authorization by contacting [cancellation method] at least [X] business days before the next scheduled debit.”

Sample variable-amount add-on

“If the amount of a scheduled debit will differ from the prior debit, I will receive notice of the amount and date by [email/SMS/other method] before the debit occurs, unless I have chosen another option described in this agreement.” (Align your notice practice to the requirements that apply to your use case.)

A good ACH Authorization Form template is short, readable, and specific. If customers can read it in under two minutes and still understand exactly what will happen, you’re doing it right.

SEO and customer-experience tips to improve ACH authorization completion rates

If your goal is to rank and convert, treat the ACH Authorization Form as both a compliance artifact and a customer experience moment.

Use customer-friendly labeling

Instead of “Receiver” and “Originator,” say “you” and “we.” Keep the technical terms in the background.

Place reassurance next to bank fields

A short note like “We use bank-grade security and only debit according to the ACH Authorization Form terms you approve” reduces drop-off.

Add “why we ask” microcopy

Explain routing/account numbers with a link or tooltip. Confusion here is a major abandonment point.

Offer bank-account validation that feels simple

Micro-deposits can work, but they add steps. Where possible, consider validation methods that reduce friction while still meeting risk expectations. Micro-entry standards and risk controls have been emphasized in ACH rule guidance.

Show the key terms at the moment of consent

Right above the submit button, restate:

- Amount or max amount

- Frequency

- Cancellation method

- Next debit date (if available)

This reduces “surprise” and cuts disputes. It also increases trust—ironically making customers more likely to choose ACH.

Future predictions: where ACH Authorization Forms are heading next

The ACH Authorization Form will remain essential, but how it’s collected and defended is changing fast. Here are realistic trends to expect:

1) Stronger authorization + authentication expectations for online ACH

As online fraud evolves, businesses will increasingly pair the ACH Authorization Form with layered identity and account validation. Industry guidance already emphasizes authorization and authentication concepts for online debits. Expect more providers to require step-up verification for certain risk signals (new device, mismatched identity, high ticket size).

2) More structured definitions for e-commerce-like ACH purchases

Some bank educational materials highlight evolving definitions for e-commerce purchases and the use of specific entry classifications and standardized descriptions. This points toward clearer categorization and reporting, which will push businesses to align ACH Authorization Form language with the customer’s purchase context (one-time checkout vs recurring).

3) Smarter, automated dispute response

Rather than manually assembling Proof of Authorization, platforms will auto-package the ACH Authorization Form, logs, notices, and customer communications into a dispute-ready packet.

4) Better consumer-facing controls

Customers will increasingly expect self-serve cancellation, pause, and plan management. ACH Authorization Forms will evolve to explicitly support these controls—reducing stop payments and unauthorized returns.

5) Convergence with “bank payment” UX patterns

As bank payments become more user-friendly, the ACH Authorization Form will become shorter and more standardized—while the “proof layer” becomes richer behind the scenes.

Bottom line: the future of the ACH Authorization Form is simpler language up front, stronger evidence behind the scenes, and more real-time validation to reduce risk.

FAQs

Q.1: What is an ACH Authorization Form used for?

Answer: An ACH Authorization Form is used to obtain permission to debit or credit a bank account through the ACH Network. Businesses use an ACH Authorization Form for recurring billing, one-time payments, payroll direct deposit, reimbursements, and subscription-based services.

Q.2: Is an ACH Authorization Form required for one-time payments?

Answer: For ACH debits, you should have clear authorization even for one-time payments. A one-time ACH Authorization Form can be a signed document, an e-sign agreement, or an online acceptance record—so long as it clearly captures the payer’s permission and terms.

Q.3: Can an ACH Authorization Form be electronic?

Answer: Yes. An ACH Authorization Form can be electronic, including e-signature flows and online checkouts, as long as the authorization record is retained and can be reproduced when needed. WEB-focused guidance emphasizes understanding authorization responsibilities for online debits.

Q.4: How long should I keep an ACH Authorization Form?

Answer: Common guidance is to retain Proof of Authorization for two years after the last transaction under that authorization, though your bank/provider or risk program may require longer. When in doubt, store longer.

Q.5: What if a customer wants to cancel an ACH authorization?

Answer: Your ACH Authorization Form should explain how the customer can revoke authorization and how much notice is needed. Consumers may also have stop-payment options through their financial institution for preauthorized transfers under applicable rules.

Q.6: What happens if the debit amount changes from month to month?

Answer: If amounts can vary, your ACH Authorization Form should clearly describe how you will notify the customer about changes and how they can cancel. Regulation text discusses advance notice requirements for certain varying preauthorized transfers.

Q.7: What are micro-deposits (micro-entries), and do they replace an ACH Authorization Form?

Answer: Micro-entries help validate account access, but they do not replace the ACH Authorization Form. You still need authorization terms for the actual debits. Nacha’s micro-entry standards define formatting and practices (including standardized descriptions like “ACCTVERIFY”).

Conclusion

An ACH Authorization Form is more than a form—it’s the documented permission that powers reliable, low-cost bank payments while protecting customers and businesses.

When your ACH Authorization Form clearly states the account details, payment timing, amount rules, and cancellation process, it reduces disputes, lowers return rates, and improves customer trust. It also becomes your Proof of Authorization—a record you can produce quickly if a debit is challenged.

The most effective ACH Authorization Form is aligned with how you collect permission (online, phone, or written), supported by strong recordkeeping, and designed with change-management in mind (variable amounts, plan upgrades, and cancellations).

Consumer preauthorized transfer rules and ACH operating rules both influence how you should handle notice, stopping payments, and recurring schedules.

Looking ahead, the ACH Authorization Form will likely become easier for customers to understand while businesses strengthen the behind-the-scenes evidence layer through better authentication, account validation, and automated documentation packaging.

If you build your ACH Authorization Form process now with clarity, verification, and retrieval speed, you’ll be set up to scale ACH confidently—today and as the rules and risk landscape continue to evolve.

Leave a Reply