By Rinki Pandey October 21, 2025

ACH payment batching is the practice of grouping multiple ACH transactions—like payroll credits, vendor payments, refunds, or recurring debits—into a single electronic file that moves through the Automated Clearing House (ACH) Network.

Instead of sending dozens, hundreds, or even thousands of individual payments one by one, a business creates an ACH “batch” that includes standardized records for each transaction.

That batch is transmitted to the bank (the ODFI—Originating Depository Financial Institution), which forwards it to an ACH Operator (FedACH® or The Clearing House), and finally to the receiving banks (RDFIs—Receiving Depository Financial Institutions).

The result is lower cost per transaction, predictable timing, and streamlined reconciliation across your accounting stack.

In plain terms, ACH payment batching converts your payment run—payroll, payables, subscriptions, or collections—into a repeatable file-based workflow. Batching works for both ACH credits (you push money out, e.g., payroll) and ACH debits (you pull money in, e.g., monthly invoicing under a proper authorization).

It also supports multiple Standard Entry Class (SEC) codes, such as CCD (corporate-to-corporate), PPD (consumer direct deposit or bill pay), CTX (corporate with large addenda), and others.

Because the ACH Network is rule-governed by Nacha, batching gives your finance team the predictability to schedule payments around cutoffs, holidays, and return windows—key to safeguarding cash flow and maintaining compliance in the U.S. banking system.

For context, Same Day ACH now allows up to $1,000,000 per eligible payment, which has expanded mission-critical use cases for batched disbursements and collections.

How ACH Payment Batching Works End-to-End

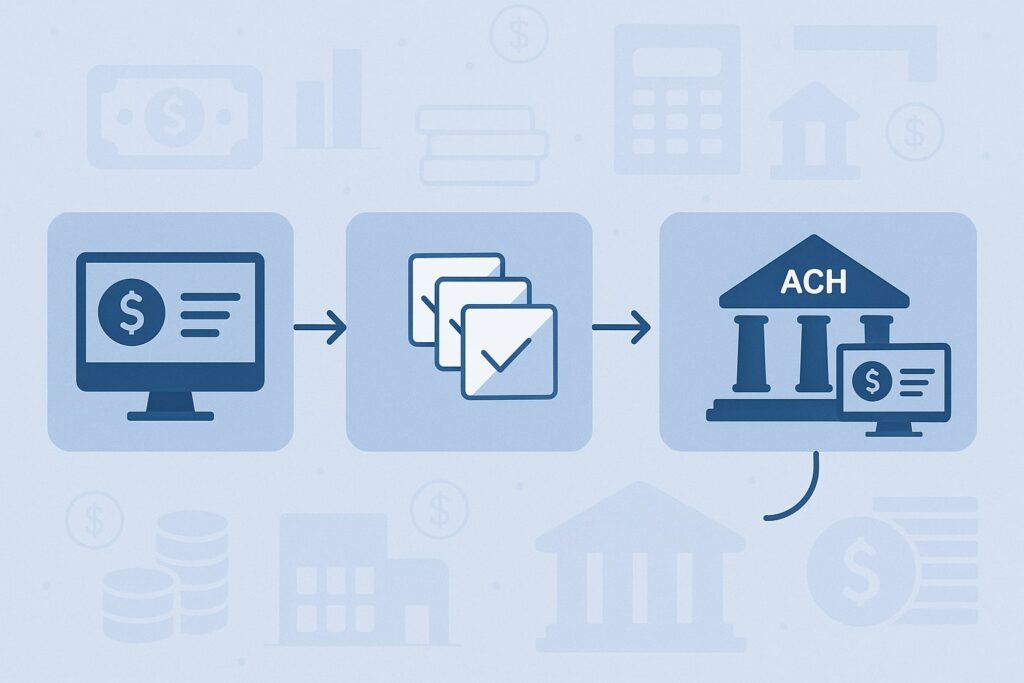

An ACH batch starts life inside your payroll, ERP, AP automation, or payments platform. Those systems export a NACHA-formatted file (fixed-width, 94-character records) that includes the file header, batch headers, entry detail records for each transaction, optional addenda for remittance, and control totals.

Your ODFI validates the file, enforces per-transaction limits and SEC-code suitability, and transmits it to an ACH Operator for distribution to RDFIs.

The ACH Operator processes ACH in defined cycles with multiple intraday windows, including Same Day ACH, meaning batched files submitted before specific deadlines can settle the same business day.

After distribution, RDFIs post entries to receivers’ accounts. If a transaction cannot be posted—wrong account/routing, closed account, insufficient authorization—the RDFI returns it using an ACH return code (e.g., R01 for insufficient funds, R03 for no account, R10 for consumer “Not Authorized”).

Consumer unauthorized debit returns generally have a 60-day window under Regulation E and Nacha Rules (your procedures must respect both), while corporate returns have much shorter timeframes.

Settlement occurs based on the processing window you hit—standard (next-day or two-day) or Same Day ACH. Businesses then use acknowledgments, reports, and their own control totals to reconcile what was sent, posted, and returned, and to trigger any exception handling or re-presentments.

File Creation & Validation (Inside the NACHA File)

A NACHA file is a structured text file with multiple record types in a required order: File Header (1), Batch Header (5), Entry Detail (6), optional Addenda (7), Batch Control (8), and File Control (9). Each line is exactly 94 characters.

Entry Detail records contain routing number, account number, amount, SEC code, and indicators that flag whether addenda follows. Control records include entry counts, hash totals (a checksum across receiving DFI IDs), and total debit/credit dollar amounts to ensure data integrity end to end.

Your AP/payroll system or gateway should automatically calculate these fields; your bank may also provide a validation spec to catch formatting, SEC-code, or balancing errors before submission. Using addenda is critical when you must pass remittance data (e.g., CTX for EDI-rich B2B payments).

Best practice: build a pre-file checklist—confirm daily limits, verify totals, validate routing/account formats, confirm effective dates, and sanitize addenda (no PII that violates data handling policies).

If you originate across multiple batches (e.g., payroll credits in one, vendor credits in another), ensure each batch balances and that the file control shows the correct grand totals. Doing this well avoids rejections at your ODFI or the Operator, and reduces downstream return risk.

Submission Windows: Standard vs. Same Day ACH

Your cutoffs dictate when a batched file will settle. Standard ACH settles next business day (or the following), depending on your bank’s deadlines and effective dates. Same Day ACH enables settlement the same business day for eligible entries that meet dollar, timing, and SEC-code requirements.

Since March 19, 2021, Nacha added an additional late-day Same Day ACH window, extending ODFI submission options; the network’s current windows are reflected in Nacha and Federal Reserve materials. In practice, financial institutions align to three submission cutoffs that target midday and late-day settlement times.

Your exact cutoffs and funds-availability times are set by your bank, but they map to the FedACH processing schedule and Nacha’s same-day charts. Understanding those windows is essential to decide whether a given batch must go same-day (e.g., emergency payroll or urgent supplier payouts) or can ride standard processing to save fees.

Critically, Same Day ACH per-payment limit is $1,000,000, expanding batching use cases like high-value B2B disbursements that previously required wires. Still, some entries are ineligible (e.g., IAT in many setups), and your ODFI can apply stricter limits based on your risk profile.

Build an internal “cutoff calendar” that lists your bank’s standard and same-day submission/approval deadlines, the effective-entry-date rules your platform uses, and the expected posting windows by the receiving bank.

Settlement, Returns & Reversals

After an ACH batch settles, exceptions flow back as returns or NOCs (Notifications of Change). Returns carry specific codes and strict timeframes. For consumer unauthorized debits, Regulation E and Nacha Rules reference 60 days, but those “60 days” are defined differently; your procedures must align with both standards.

Corporate unauthorized debits generally must be returned by midnight of the business day following posting (“midnight deadline”), which is far shorter—so train AR teams accordingly.

You can also issue reversals in limited scenarios (e.g., duplicate file, wrong amount), following Nacha’s reversal rules and timelines, and ideally paired with customer notices.

RDFIs increasingly use same-day windows to send returns, which accelerates exception resolution for originators who also leverage same-day processing.

That means you may see bad items boomerang back faster—good for risk control, but it tightens your operational response times. Embed return-reason analytics and automatic workflows: instant re-debit rules when allowed, card-on-file fallbacks, or prompts for updated banking details.

Why Businesses Batch ACH: the Core Benefits

ACH payment batching remains the finance team’s workhorse for U.S. disbursements and collections because it blends cost efficiency, scale, and compliance.

Cost is the headline: ACH per-item fees are typically a fraction of card interchange or wire fees, and batching keeps your operational overhead low by processing in large groups rather than individual pushes or pulls.

Predictability is the second advantage: when you lock into known cutoffs and holidays, you can plan working capital—running payroll, paying suppliers, and collecting receivables with expected settlement and exception patterns.

Third, data and reconciliation: batched files carry control totals, entry hashes, and addenda, which let you reconcile at both file and transaction levels. This dramatically reduces month-end close friction.

Fourth, risk management: batching lets you approve once, quarantine riskier entries (new counterparties, high amounts, sensitive SEC codes), and stage reviews before submission. You can also choose standard vs. same-day windows to balance urgency against fraud/return exposure and cost.

Finally, compliance: the ACH Network’s standardization (SEC codes, authorizations, return codes, NOCs) gives controllers and auditors a clear, auditable trail—essential when you scale.

Cost Savings vs. Cards and Wires

Compared to card payments, ACH batches avoid interchange and assessment fees that can stack up on large B2B invoices. For suppliers who offer “card on file” convenience, you can negotiate ACH terms and use CTX or CCD with addenda to include detailed remittance, keeping your vendors happy while reducing acceptance costs.

Against wires, ACH batches trade real-time finality for major fee savings and broad reach. With the $1,000,000 Same Day ACH limit, many transactions that once required wires (and wire fees) can ride ACH the same day—especially vendor payments and urgent reimbursements—so long as counterparties and entries are eligible.

Your treasury policy can route payments by value and urgency: wires for true real-time, ACH Same Day for same-day urgency under $1M per item, and standard ACH for everything else.

Cash-flow Visibility & Reconciliation

Batching concentrates your outbound and inbound flows into predictable windows. You can model cash position by scheduled files, expected settlements, and historical return rates.

At ingestion, your ERP/AP tools can post batched credits and debits, tie them to invoices or payroll runs, and auto-match bank data using addenda and control totals.

CTX supports rich EDI remittance—huge for enterprises handling many invoices per payee—while CCD/PPD cover most day-to-day B2B and consumer scenarios.

When returns arrive, your system maps return codes to next actions: reattempts (when allowed), manual outreach, or alternative rails. This data discipline shortens DSO and makes month-end close far more predictable.

Risk Controls & Compliance Hygiene

ACH is low-cost but not risk-free. For debits, maintain strong authorizations (SEC-appropriate), store them securely, and log any revocations immediately.

For credits, implement sanctions screening and name matching for beneficiaries, even though domestic ACH is not cross-border IAT. Enforce per-transaction and daily limits by SEC code and counterparty risk tiers.

Monitor returns by code and rate; high return rates—especially unauthorized codes—can trigger ODFI scrutiny. Update procedures to reflect evolving Nacha guidance, including increased use of same-day return windows by RDFIs, and ensure your team understands the 60-day consumer unauthorized dispute standards under both Regulation E and Nacha Rules.

When to Use Batching vs. Real-time or Single-entry Flows

Choose ACH batching when you have many scheduled payments, predictable timing, and a need to minimize cost: payroll, supplier runs, insurance claims, refunds, tuition plans, HOA dues, and subscription sweeps.

Choose Same Day ACH batching when you need faster settlement for high-priority runs under $1M per item—emergency payroll corrections, end-of-quarter payouts, or supplier accelerations to unlock discounts.

Use wires when you need irrevocable, immediate finality, cross-border wires, or amounts above $1M that must settle now. Consider RTP® or FedNow® for 24/7/365 instant payments when counterparties and use cases fit (e.g., just-in-time payouts, small urgent refunds).

For one-off, high-risk or high-touch payments, a single ACH via your bank portal may suffice, but remember that batching preserves auditability and lowers per-item effort.

Your payment policy should route by value, urgency, risk, and counterparty preference, with ACH batching as the default for routine U.S. disbursements and collections.

How to implement ACH payment batching in your company

Start by mapping your use cases (payroll, AP, AR, refunds), volumes, and required remittance data. Decide which SEC codes you’ll need: PPD for consumer payroll/bill pay, CCD for standard B2B, CTX when you must include extensive EDI addenda.

Select your ODFI and platform (bank treasury portal, payments gateway, or an API provider) and confirm support for Same Day ACH, file uploads/approvals, and robust reporting. Build internal controls: dual approval, segregation of duties, and automated validations for routing numbers and account formats.

Define cutoffs and effective dates: who prepares files, who approves, and by what time for standard vs. same-day. Create a return-handling playbook with SLAs.

Establish onboarding flows for payees/payers, including micro-deposits or instant bank account validation to reduce returns. Finally, test end-to-end in a bank sandbox: send sample files, verify posting and returns, practice reversals, and validate reconciliation.

Your goal is a push-button payment run: the system produces a conforming NACHA file, your approvers sign off, and the treasury submits it confident that settlement and exceptions will behave as expected.

Choosing a provider & setting up with your ODFI

Your ODFI relationship governs limits, pricing, risk controls, and your access to Same Day ACH. Evaluate banks and providers on:

(1) Cutoff breadth (do they support all same-day windows?); (2) File acceptance (NACHA upload, APIs, SFTP); (3) Reporting & webhooks for returns/NOCs; (4) Risk tooling (account validation, sanctions screening, velocity rules); and (5) Support for complex SEC codes and addenda (CTX/EDI).

Clarify per-item and daily caps for standard and same-day, and whether your ODFI will allow high-value entries near the $1M limit. Ask for a spec that lists validations and any bank-specific quirks (padding, blocking, effective-date rules).

File formats, SEC codes & addenda essentials

A conforming NACHA file is fixed-width (94 characters each line) with strict record sequencing. The Entry Detail (6) record houses the transaction; the Addenda (7) record carries remittance, mandated for some SEC codes and optional for others.

CCD fits most B2B with modest addenda; CTX supports extensive EDI segments for complex invoices; PPD applies to consumer transactions such as payroll and bill payments.

The Entry Hash and control totals in Batch/File Control records safeguard integrity across the entire set. Get comfortable with your platform’s addenda editor so remittance is machine-readable for your trading partners.

Testing, prenotes & handling returns

Run prenotes (zero-dollar test entries) for new payees/payers where appropriate to verify account numbers before you send live funds. Many teams now prefer micro-deposits or instant account verification to accelerate onboarding and reduce returns.

In U.S. consumer debits, be ready to honor 60-day unauthorized claims; train customer support to route disputes correctly and document authorizations. For corporate debits, teach AR to act immediately—the midnight-deadline return window is tight.

Codify automatic rules for R01/R09 (NSF/Uncollected funds) reattempts when allowed, and never reattempt unauthorized debits. Close the loop by updating bank master data when you receive NOCs so future batches post cleanly.

Operational best practices for ACH payment batching

Establish daily rituals around cutoffs: a morning file prep window, midday approvals, and a final checkpoint before your last same-day cutoff. Use maker-checker workflows and restrict who can create, approve, and release files.

Maintain a runbook for each payment type with SEC codes, dollar caps, and documentation templates for authorizations. Automate account/routing validation and watchlists. Monitor return rates by SEC code, keeping unauthorized returns low to avoid program risk. Keep an audit trail: log file versions, approvers, timestamps, and hash/control totals.

Synchronize with holidays and early-close days. On U.S. Federal Reserve holidays, ACH does not settle; plan payroll and AP runs around those dates and communicate with stakeholders. Build buffers around month-end, quarter-end, and known blackout periods.

If you operate across time zones, standardize in Eastern Time for cutoffs. Finally, review Nacha Rules updates at least quarterly; changes to same-day windows, return practices, and authorization standards can affect your SLAs and templates.

Cutoff calendars, holidays & early closes

Post a 2025 FedACH holiday calendar where finance and HR can see it—New Year’s Day, MLK Day, Presidents’ Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus/Indigenous Peoples’ Day, Veterans Day, Thanksgiving, and Christmas are all non-settlement days.

Some banks also announce early cutoffs on Christmas Eve and New Year’s Eve; if you do payroll or vendor runs then, you likely must submit earlier or settle the next business day.

Confirm your bank’s same-day windows and any early-close policies and mirror them in your payroll/AP schedules so batches never miss a window due to internal delays.

SEC codes & authorization storage

Match the SEC code to your use case and authorization method. For example, PPD requires signed or similarly authenticated consumer authorization for recurring debits; WEB covers online consumer authorizations; TEL covers telephone-initiated entries with recorded or written authorization; CCD/CTX serve corporate payments with different addenda capacities.

Store authorizations securely, with revocation tracking and retention policies that satisfy both Nacha and Regulation E expectations. Use clear scripts and confirmation language to mitigate disputes, and require re-authorizations on material changes (amount, timing, payee).

When in doubt, over-document—ACH batching scales best when every entry’s authorization can be produced quickly during a return investigation.

ACH batching costs & pricing models

ACH pricing typically includes: (1) Per-item fees (standard vs. same-day often priced differently), (2) File or monthly fees for origination services, (3) Return/NOC fees, and (4) Add-ons like account validation or sanctions screening.

Same-day items also carry an Operator fee that ODFIs pass through. Because Same Day ACH reduces time-in-flight, many treasurers pay the modest premium for high-priority runs while keeping routine flows on standard ACH.

Negotiate tiers tied to volume, return rates, and risk profile. Also quantify soft costs: fewer card/wire fees, less reconciliation labor, and improved DSO/working capital can outweigh nominal per-item fees.

Use your batch analytics to right-size the mix between standard and same-day entries for each payment type.

Legal & compliance updates you should know (2025)

Several developments matter for batching in 2025. First, the $1,000,000 Same Day ACH limit remains in effect, widening the aperture for batched same-day B2B payouts.

Second, Nacha continues to encourage same-day processing of returns by RDFIs—an emerging operational reality that tightens your response timelines on exceptions.

Third, the additional late-day same-day window (effective 2021) remains a cornerstone for late approvals, but you should confirm the exact cutoffs with your ODFI because banks map internal deadlines to Federal Reserve schedules.

Finally, holiday calendars and early-close days materially affect your batch timing, so keep your 2025 FedACH schedule handy and communicate upstream to HR/AP teams.

Review your procedures against these items twice a year, and train staff on the differences between Regulation E and Nacha’s 60-day standards for consumer unauthorized disputes.

FAQs

Q.1: Is ACH payment batching the same as ACH debits/credits?

Answer: No. Debits and credits are the transaction directions; batching is how you submit many entries in one file. A batch can contain credits (e.g., payroll), debits (e.g., utility bill pulls), or both—organized by SEC code and business purpose.

The batching method reduces per-item overhead and improves reconciliation thanks to control totals and addenda.

Q.2: What’s the biggest amount I can send in Same Day ACH?

Answer: As of 2025, the per-payment cap for Same Day ACH is $1,000,000. Your bank may set lower limits based on your program’s risk profile, and some entry types may be ineligible—confirm with your ODFI before relying on same-day for large disbursements. Nacha

Q.3: How do submission windows affect my batch?

Answer: If you submit before your bank’s standard cutoffs, your batch settles on the next business day. Submit before a Same Day ACH cutoff and eligible entries can settle the same business day. Nacha and the Federal Reserve publish schedules; your bank translates those into internal deadlines you must meet.

Q.4: Can RDFIs return entries the same day now?

Answer: Yes. Nacha’s 2025 operations bulletin notes RDFIs increasingly use same-day windows to send returns. That means exceptions can come back faster—great for risk, but your teams must respond more quickly.

Q.5: What is the “60-day rule” for unauthorized consumer debits?

Answer: Both Regulation E and Nacha Rules include 60-day periods, but they aren’t identical. Your procedures must satisfy both frameworks—coordinate with your bank and counsel to ensure your dispute handling, notices, and documentation align with each.

Q.6: Do U.S. federal holidays affect ACH batches?

Answer: Yes. ACH doesn’t settle on Federal Reserve holidays. You must plan payroll and AP around dates like Thanksgiving and Christmas; many banks also observe early cutoffs on Christmas Eve and New Year’s Eve.

Q.7: Which SEC code should I use?

Answer: Use PPD for most consumer items (e.g., payroll), CCD for routine B2B, and CTX when you need heavy remittance via EDI. Match the code to the authorization method and keep records per Nacha requirements.

Q.8: Do I need addenda records?

Answer: Addenda are optional for some SEC codes but required for others and often recommended for B2B to carry remittance details that help suppliers auto-reconcile. CTX in particular is designed for rich EDI remittance.

Conclusion

For U.S. businesses, ACH payment batching turns payments into a disciplined, low-cost, and auditable process. By grouping entries into a single NACHA-formatted file, you lower fees, simplify reconciliation, and control risk through standardized authorizations, return codes, and NOCs.

With the $1,000,000 Same Day ACH limit and expanded late-day submission windows, batching also delivers speed when you need it—without paying wire prices.

The playbook is straightforward: pick the right SEC codes, automate file validations, align to your ODFI’s cutoffs, post a 2025 FedACH holiday calendar, and drill your team on return timeframes—especially the consumer 60-day standards and corporate midnight deadlines.

Do that, and ACH payment batching becomes more than a back-office task; it becomes a strategic lever for predictable cash flow, happy suppliers and employees, and airtight compliance.

Leave a Reply