By Rinki Pandey October 21, 2025

An ACH payment gateway is the technology that lets businesses move money between U.S. bank accounts electronically using the Automated Clearing House network. If you sell online, invoice clients, run subscriptions, or collect rent, ACH payment gateways help you accept low-cost bank transfers, cut card fees, and streamline cash flow with fewer chargebacks.

Unlike wire transfers or paper checks, an ACH gateway automates routing numbers, account validation, authorization capture, file formatting, risk screening, and reconciliation—so you can focus on your business instead of manual bank tasks.

In the U.S., the ACH network is governed by Nacha and operated by the Federal Reserve and The Clearing House, which gives an ACH payment gateway a reliable backbone for moving funds nationwide.

Because bank-to-bank transfers travel in batches, an ACH gateway trades the instant authorization of cards for significantly lower costs, high scalability, and strong compliance guardrails.

You can configure an ACH payment gateway to power one-time payments, recurring billing, B2B invoices, payroll, refunds, and disbursements. With modern APIs and webhooks, an ACH gateway plugs into CRMs, accounting systems, ERPs, and shopping carts to create a single, auditable payment flow.

For U.S. companies that want predictable margins and durable payment acceptance, an ACH payment gateway is a practical and secure choice that’s easy to roll out and even easier to scale.

What Is an ACH Payment Gateway?

An ACH payment gateway is a software and compliance layer that allows a merchant or platform to originate ACH entries—credits and debits—through a financial institution to the ACH network.

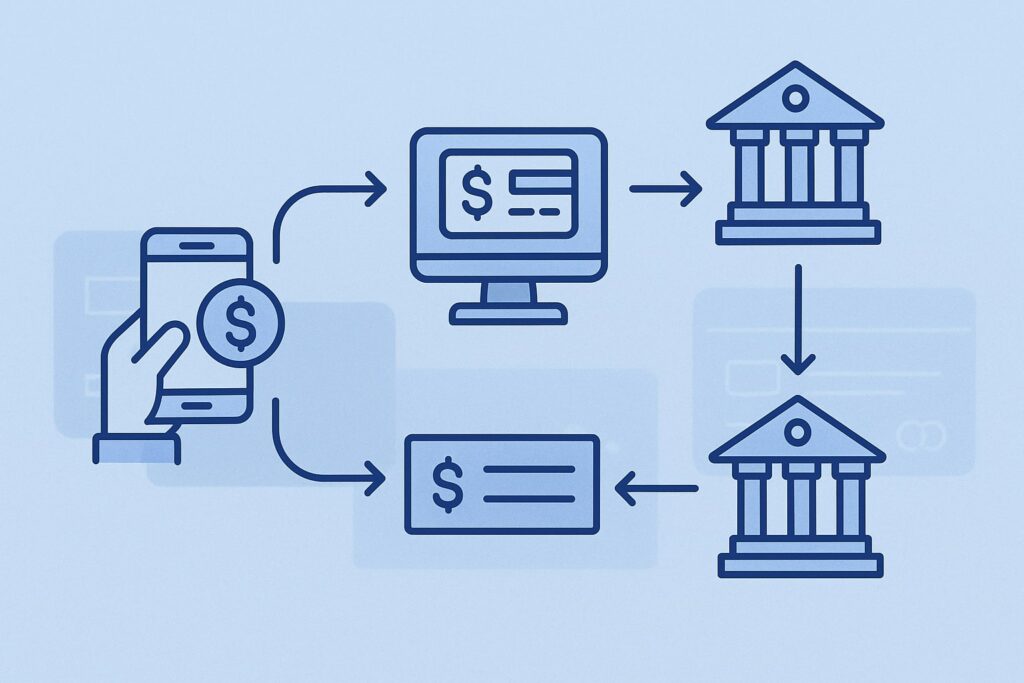

In simple terms, an ACH payment gateway takes your payer’s routing and account numbers, collects their authorization, formats the transaction into the ACH file standard, and submits it to the network through an Originating Depository Financial Institution (ODFI).

The ACH payment gateway also tracks returns, posts settlement details, manages cut-off times, and pushes updates back to your systems. Because bank account numbers are sensitive, an ACH gateway encrypts data in transit and at rest, tokenizes accounts for reuse, and can validate ownership with micro-deposits or instant account verification.

Compared with card gateways, an ACH payment gateway offers dramatically lower per-transaction costs, making it ideal for high-ticket invoices, recurring subscriptions, tuition, rent, and B2B remittances.

The trade-off is that an ACH payment gateway processes in batches, so final settlement takes longer than card authorizations. To mitigate timing and risk, the ACH gateway enforces Nacha rules, supports return code handling (like R01, R02, R07, R08), and can run risk checks before submission.

In the U.S. market, an ACH payment gateway is the backbone of affordable digital payments and provides a dependable path to scale without ballooning fees or operational complexity.

How an ACH Payment Gateways Work (Step by Step)

Every ACH payment gateway follows a life cycle designed around security, compliance, and predictability. First, you capture payer details—routing number, account number, account type, and account holder name—along with explicit authorization.

Your ACH payment gateway handles this capture using hosted fields, a secure payment page, or an embedded SDK.

Next, the ACH gateway validates the account. That can be done by instant account verification through open-banking connections, micro-deposits, or database checks to reduce typos and fraud.

The ACH payment gateway then assembles the payment entry—PPD for consumer, CCD for corporate, WEB for online, TEL for phone—using the correct SEC code for the authorization method.

At your configured cut-off, the ACH payment gateway batches your entries and sends them to your ODFI, which forwards them into the ACH network. The Receiving Depository Financial Institution (RDFI) posts funds to the receiver’s account on settlement, or issues a return with a specific code.

Throughout this cycle, your ACH payment gateway posts webhooks: file accepted, in-process, settled, or returned. You’ll see expected settlement dates, return notifications, and reconciliation files mapped to your invoice or subscription IDs.

Many ACH payment gateways also support Same Day ACH windows, allowing faster credits and debits at a slightly higher network fee. With thoughtful configuration, an ACH gateway delivers predictable timing, thorough reporting, and a smooth payer experience.

Key Participants in the ACH Payment Gateway Flow

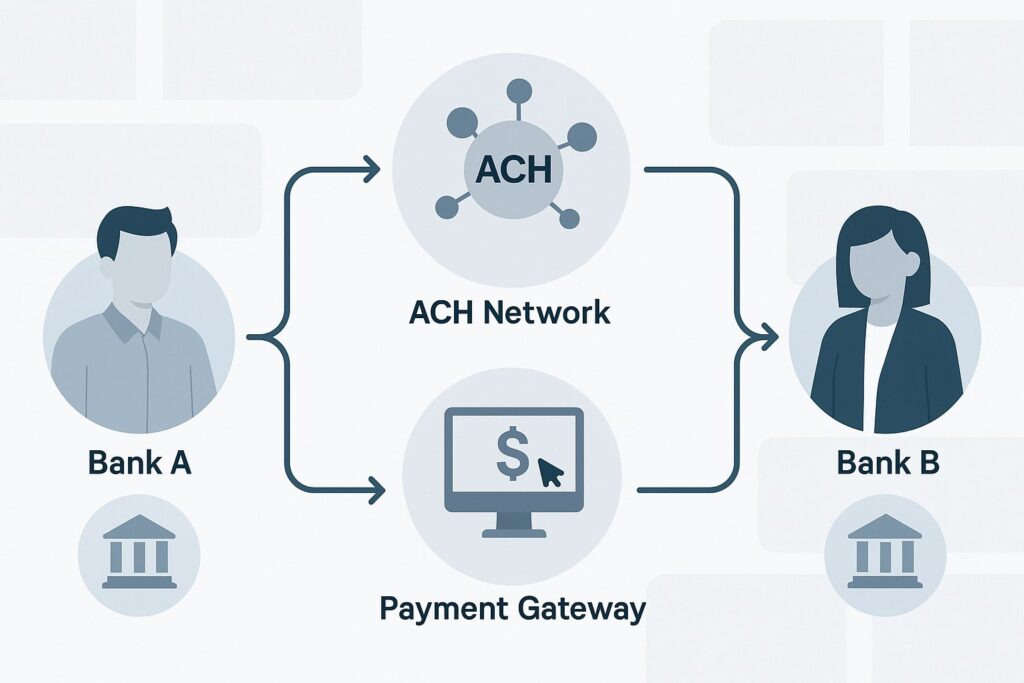

In a typical ACH payment gateway flow, several participants coordinate to move funds correctly. You—the Originator—create the transaction in your application. Your ACH gateway prepares and transmits entries via your ODFI, the bank that sponsors origination to the network.

The ACH Operators (the Federal Reserve and The Clearing House) route files to the appropriate RDFI. The receiver—the consumer or business that’s paying or getting paid—has funds posted by their bank.

Your ACH payment gateway sits between your software and the ODFI, translating business actions into compliant ACH entries and translating network responses into merchant-friendly status updates.

Risk and compliance also appear as participants: Nacha defines rules that your ACH payment gateway enforces automatically through file formatting, SEC code mapping, and return windows.

Depending on your arrangement, a Third-Party Sender (TPS) or Third-Party Service Provider (TPSP) may be the party actually originating on your behalf. In marketplace or platform models, the ACH payment gateway may also include sub-merchant onboarding, KYC, and split payouts.

Finally, auditors and finance teams rely on the ACH payment gateway’s logs, event history, and reconciliation files to match deposits, returns, and fees within your GL. By centralizing the technical and regulatory details, an ACH gateway keeps every participant aligned and accountable.

ACH Payment Gateway vs. Card Gateway: What’s the Difference?

A card gateway authorizes a transaction in seconds using card networks and issuing banks, while an ACH payment gateway submits bank-to-bank transfers in batches. The biggest difference for U.S. merchants is cost: card transactions stack interchange, assessments, and processor markups, which makes large tickets expensive.

An ACH payment gateway typically charges a small flat fee or percentage cap, keeping costs predictable for invoices, tuition, professional services, and rent. Another difference is dispute mechanics.

Cardholders can dispute card payments through chargebacks; ACH has returns governed by specific codes and windows, often leading to fewer losses and clearer root causes. Settlement timing also varies.

Card funds settle as your processor funds you; ACH settlement follows network windows and bank posting schedules. Security flows differ as well. Card gateways rely on tokenization, AVS/CVV, and 3-D Secure; an ACH payment gateway leans on account verification, SEC code compliance, and fraud screens tuned to bank transfers.

Operationally, card refunds reverse an authorization; ACH reversals may require separate credit entries or specific return handling. Integrations overlap—both support APIs, webhooks, and dashboards—but the ACH gateway provides features like micro-deposits, bank account tokens, and return code mapping.

For U.S. businesses that need to optimize unit economics or accept payments from customers who prefer bank transfers, an ACH payment gateway is the strategic complement to card rails.

Common Use Cases for ACH Payment Gateways in the U.S.

In the U.S., an ACH payment gateway shines wherever value and reliability matter more than instant card authorization. Professional services firms use it to collect retainers and monthly invoices without swallowing heavy card fees.

Landlords and property managers rely on an ACH gateway for rent, security deposits, and refunds. Schools and camps accept tuition and program fees with automatic installments. Healthcare clinics use an ACH payment gateway to set up payment plans after insurance adjustments, reducing mailing costs and check processing.

Nonprofits accept recurring donations with lower overhead, so more dollars reach the mission. In B2B, manufacturers, distributors, and agencies use an ACH payment gateway for recurring retainers, milestone billing, and vendor payments.

Marketplaces and platforms use it for payouts and split payments to sub-merchants, matching daily or weekly schedules. Subscription businesses combine an ACH payment gateway with card rails to offer customers a “pay by bank” option that reduces churn from expired cards.

Even payroll and expense reimbursements benefit when an ACH payment gateway powers same-day credits to employees and contractors. Wherever paper checks cause delays or card fees squeeze margins, an ACH gateway provides a modern, compliant, and affordable alternative that customers already trust.

Benefits of Using an ACH Payment Gateway

The primary benefit of an ACH payment gateway is cost efficiency. By moving payments over the ACH network, you’ll reduce per-transaction costs versus cards, protecting margins on high-ticket or recurring payments. Another benefit is improved cash application.

An ACH payment gateway lets you embed invoice numbers, customer IDs, and memo fields so finance teams can reconcile automatically in your ERP or accounting system. Reliability is a third advantage.

The ACH network’s batch model, combined with clear return codes, yields transparent outcomes that your team can monitor and automate. Security and compliance are built in: an ACH payment gateway encrypts data, tokenizes accounts, enforces SEC codes, and supports robust audit trails.

Customer experience improves too. With an ACH payment gateway, you can offer simple bank login, save bank details securely, and schedule recurring payments with predictable posting windows.

Many gateways also enable faster disbursements through Same Day ACH cut-offs, helping gig platforms and SaaS products deliver funds on tighter timelines.

Finally, an ACH payment gateway reduces operational drag. No more printing checks, making trips to the bank, or manually keying deposits. Everything is digital, searchable, and synced to your tools—so your team can scale revenue instead of paperwork.

Risks, Returns, and Compliance (What to Watch)

Every ACH payment gateway must manage risk, returns, and rules that differ from card networks. Returns are coded events—like R01 Insufficient Funds, R02 Account Closed, R03 No Account, R07 Authorization Revoked—that your ACH gateway must interpret and act on.

Consumers also have error resolution rights, and businesses must maintain authorization records that match the SEC code. Fraud risks include account takeover, typo-related misposts, and unauthorized debits.

To mitigate them, your ACH payment gateway should support instant account verification, micro-deposit checks, account name matching, and velocity limits. Compliance is essential. Nacha rules govern authorization language, data retention, and data security.

Your ACH payment gateway should offer tools for recurring payment consent, revocation handling, and notifications. Another risk is timing. Because ACH is batch-based, you might not learn about a return until after shipment or service.

To reduce exposure, tune your ACH payment gateway workflows: hold fulfillment until funds clear for high-risk scenarios, require prepayment on first orders, or use risk scores that factor in tenure, order value, and historical returns.

Keep your policies clear in customer communications, and use your ACH gateway’s webhooks to update orders when a return hits, preventing downstream fulfillment errors.

Pricing, Fees, and Total Cost of Ownership

An ACH payment gateway typically charges a simple fee structure that’s lower than card processing. You might see per-transaction flat fees, percentage fees with a cap, monthly SaaS fees, or a combination. Same Day ACH may carry an additional network cost.

Some providers charge for returns, reversals, or failed verification attempts. Beyond explicit fees, consider your total cost of ownership. An ACH payment gateway that automates reconciliation, posts webhooks reliably, and offers modern APIs reduces engineering and accounting time.

If you process large invoices or subscriptions, even small per-transaction savings add up to meaningful annual ROI. Also review your ODFI sponsorship model.

If your ACH gateway provides banking sponsorship, pricing may bundle network access and risk controls; if you bring your own bank, fees may sit with the ODFI while the gateway charges SaaS and support.

Ask for transparent reporting on fees by transaction type—credits vs. debits, returns, reversals—so you can align your pricing and policies. Most importantly, compare the landed cost of your ACH payment gateway to card processing on your actual ticket sizes.

For many U.S. businesses, the move to bank transfers generates immediate, measurable savings without sacrificing user experience.

Selecting an ACH Payment Gateway: A Practical Checklist

Choosing the right ACH payment gateway starts with your use case. Do you need one-time invoices, complex recurring billing, marketplace payouts, or all of the above?

Look for flexible APIs, hosted payment pages, and drop-in components that support your flows. Next, assess onboarding. Your ACH payment gateway should offer streamlined merchant underwriting, KYC, and risk configuration with clear SLAs.

Evaluate verification options: instant account verification, micro-deposits, account-owner confirmation, and name matching reduce returns and fraud. Compliance features matter too. Ensure your ACH payment gateway supports accurate SEC code mapping (WEB, PPD, CCD, CTX, TEL), clear authorization language, and durable audit logs.

On the ops side, demand robust webhooks, idempotent APIs, sandbox environments, and detailed error codes. Reporting is critical; your ACH payment gateway should export settlements, returns, and fees in formats your accounting tools can ingest automatically.

Consider support for Same Day ACH, cut-off times aligned to your business hours, and holiday calendars. Finally, examine security posture: encryption, tokenization, PCI scope reduction for card add-ons, and SOC 2 or similar attestations.

With a structured checklist, you’ll pick an ACH payment gateway that balances price, performance, and protection.

Integrating an ACH Payment Gateway with Your Stack

Successful integrations begin with a clear data model. Map customers, mandates/authorizations, payment methods, invoices, and payouts to your application’s entities, then connect them to your ACH payment gateway objects.

Use the gateway’s SDKs to collect bank details securely, and tokenize accounts for reuse without storing raw numbers. Implement webhooks to track lifecycle events—created, submitted, settled, returned—and update your orders and ledgers in real time.

For recurring billing, align your invoice cycles with ACH cut-offs and settlement windows. When using Same Day ACH, respect file deadlines so your payments reach the operator in time. Build retry logic for soft returns (like R01 Insufficient Funds) using the schedules your ACH gateway allows under Nacha rules.

In accounting, reconcile deposits by batch, not by individual payment, and store the gateway’s trace numbers to match bank statements. If you run a platform, leverage your ACH payment gateway’s sub-merchant onboarding and split payout APIs to simplify compliance while keeping payouts reliable.

With careful architecture and testing, an ACH payment gateway integrates cleanly into your CRM, ERP, or storefront and gives finance a dependable, auditable source of truth.

ACH Authorization and SEC Codes (WEB, PPD, CCD, CTX, TEL)

A cornerstone of any ACH payment gateway integration is correct use of Standard Entry Class (SEC) codes, because they describe how the payer authorized you.

WEB covers online consumer authorizations, requiring you to present clear terms and capture affirmative consent on your website or app. PPD applies to consumer entries authorized in writing (including electronic signatures) outside a web session.

CCD is for corporate entries—B2B payments—often used in invoicing or vendor remittance. CTX supports addenda for more detailed remittance information in B2B scenarios. TEL applies to consumer phone authorizations, which carry extra record-keeping rules.

Your ACH payment gateway should enforce appropriate SEC codes automatically based on the channel that collected the bank information. This matters because return timeframes and warranties differ across SEC codes, and your business assumes specific obligations for authorization storage.

In practice, the ACH payment gateway will store consent artifacts—timestamps, IP addresses, voice recordings for TEL, or mandate PDFs—and expose them if a dispute arises.

Mapping flows to SEC codes also improves analytics, letting you compare return rates by authorization channel. When implemented correctly, SEC code discipline turns your ACH gateway into a compliance ally instead of a risk surface.

Account Verification: Micro-Deposits vs. Instant Bank Login

Reducing returns begins with strong account verification. A modern ACH payment gateway supports both micro-deposits and instant bank login through secure open-banking connections.

Micro-deposits place two small credits in the payer’s account; the customer confirms the amounts, providing account access and reducing typos. This method is simple and broadly compatible but takes a day or two.

Instant bank login lets users authenticate directly with their bank and returns verified account and routing details immediately, often with account type and ownership signals. It shortens onboarding and increases conversion, especially for subscription sign-ups and marketplaces.

However, you should always offer a fallback, because not every customer is comfortable with bank login. Your ACH payment gateway can also add lightweight checks such as name matching, negative files, or account status indications to catch closed or invalid accounts early.

Pair verification with smart business rules: hold fulfillment until verification passes, apply higher velocity limits only to verified accounts, and prioritize Same Day ACH for verified payers.

By combining methods, your ACH payment gateway prevents the most common return codes and creates a smoother customer experience.

Returns, Reversals, and Disputes: Operational Playbook

Even with a strong ACH payment gateway, returns happen. Build a playbook that treats each return code as a specific workflow. For R01 Insufficient Funds, your policy might trigger two automated retries spaced by settlement windows.

For R02 Account Closed or R03 No Account, stop retries and prompt the customer to update details through your secure ACH gateway portal. For R07 Authorization Revoked, cease debits immediately, notify the customer, and document the revocation to satisfy compliance.

Some scenarios allow reversals (for example, duplicate entry or wrong amount) if you act within the permitted window; your ACH payment gateway should expose a simple reversal workflow and validate eligibility.

Use webhooks to notify support and finance in real time so orders don’t ship when funds won’t arrive. In reporting, trend returns by SEC code, product line, and customer segment to identify training or UX fixes—often, a clearer authorization checkbox or better micro-deposit guidance cuts return rates dramatically.

Finally, close the loop with customers using empathetic messaging and clear next steps. Your ACH payment gateway provides the data; your operations define the experience that keeps trust intact.

Onboarding, KYC, and Underwriting Considerations

An ACH payment gateway often includes merchant onboarding, KYC, and underwriting, especially in platform models or when the gateway sponsors access to an ODFI. Expect to provide business legal names, EINs, ownership details, control persons, and bank statements.

Underwriting evaluates industry risk, average and maximum tickets, monthly volume, and historical return rates. If you’re a software platform onboarding sub-merchants, choose an ACH gateway that provides a hosted onboarding flow with document capture and watchlist screening.

Clear onboarding reduces delays and ensures you’re configured for the right limits and cut-offs. Post-onboarding, the ACH payment gateway monitors processing behavior for anomalies, such as sudden spikes in WEB debits or unusual return patterns.

Transparent risk policies and adjustable limits let you scale without friction. Make sure roles and responsibilities are documented: who stores authorizations, who responds to returns, and how revocations are handled. With a thoughtful approach, underwriting becomes a launchpad for safe growth, not a hurdle.

Security and Data Protection for ACH Payments

Security is non-negotiable. An ACH payment gateway should encrypt data in transit and at rest, use HSM-backed tokenization for bank accounts, and provide scoped API keys with role-based access control.

While PCI DSS primarily governs card data, many ACH gateways align to similar controls and maintain SOC 2 Type II reports to validate their security posture. Your application should never log raw routing or account numbers; use tokens exposed by the ACH payment gateway and rotate credentials frequently.

IP allow-listing, mTLS, and signed webhooks reduce spoofing risks. For consumer flows, present clear disclosures and store consent artifacts tied to each token. Implement least-privilege in your own systems—separate duties between developers, finance, and support—and require MFA for dashboard access.

Finally, conduct tabletop exercises for data incidents and return spikes. A secure ACH payment gateway plus disciplined operational hygiene keeps customer trust and regulatory expectations aligned.

Same Day ACH and Timing Strategy

Same Day ACH can shrink your collection and payout cycles when your ACH payment gateway supports the relevant submission windows. You’ll pay a slightly higher network fee, but the ability to process credits and debits for same-day posting can be valuable for payroll, urgent refunds, marketplace payouts, or time-sensitive B2B settlements.

Work backward from your ACH gateway’s cut-off times to design your product experience: display clear deadlines to customers, queue payments properly, and prioritize higher-value transactions for earlier windows.

Not every payment needs speed; often, standard settlement suffices and saves costs. Use your ACH payment gateway reporting to segment by urgency and customer tier.

Also remember bank holidays and weekends—postings may shift, so your notifications should set realistic expectations. With a smart timing strategy, Same Day ACH becomes a targeted tool rather than a blanket expense.

Reporting, Reconciliation, and Accounting Practices

Clean books require clean data. Your ACH payment gateway should export settlement reports that group transactions by batch and deposit event, not just by individual payment.

Tie each gateway event to your internal invoice or order ID, and store the ACH trace number for bank statement matching. Build automated reconciliations that compare gateway deposits to bank statements and GL entries daily.

Track fees at a granular level—returns, reversals, Same Day ACH—so finance can model profitability by product and channel. For refunds or credits, align your accounting treatment with how your ACH payment gateway posts the entries, and ensure your ERP can map addenda records for B2B remittances.

If you run a platform, demand sub-merchant-level reporting with roll-ups so you can fund payouts accurately and close the month without manual spreadsheets. The right ACH payment gateway turns reconciliation from a weekly slog into a daily routine that safeguards cash.

Implementation Timeline and Best Practices

A smooth rollout follows a tested path. Start in a sandbox with your ACH payment gateway, implement secure collection, tokenization, and verification flows, and wire up webhooks with retries and signature validation.

Run end-to-end tests covering success, returns, reversals, and Same Day ACH scenarios. Have support macros ready for common return codes. In pilot, limit exposure by capping tickets and holding fulfillment until settlement clears.

Monitor return rates, SEC code distribution, and processing volume to validate assumptions. Once stable, expand eligibility and enable recurring billing.

Keep documentation current, and schedule quarterly reviews with your ACH payment gateway to adjust cut-offs, limits, and risk controls. Continuous improvement—small changes to copy, authorization flows, or verification logic—often yields meaningful drops in returns and measurable boosts in conversion.

Legal, Tax, and Record-Keeping Considerations in the U.S.

In the U.S., your ACH payment gateway helps with compliance, but you’re responsible for your policies and records. Maintain clear consumer consent language, present terms at checkout, and store authorizations for the required period.

For B2B, keep invoices, addenda, and correspondence that support your right to debit or credit a business account. Coordinate with counsel on state-level disclosures for recurring debits and cancellation mechanisms.

Taxes don’t change because you use an ACH payment gateway, but bank transfers can simplify remittance reporting by providing cleaner data sets. For data privacy, align with your privacy policy and limit data access internally.

If you service regulated industries, confirm your ACH payment gateway is comfortable with your merchant category and has the right banking partners. With strong documentation, you’ll reduce dispute risk and sail through audits.

Frequently Asked Questions (FAQ)

Q.1: How long do ACH payments take to settle?

Answer: Standard ACH via your ACH payment gateway typically settles in one to three business days depending on cut-off times and bank posting practices. Same Day ACH can speed that up for eligible credits and debits if you submit before the gateway’s deadlines. Your dashboard will show the expected settlement date.

Q.2: Are ACH payments reversible if there’s a mistake?

Answer: Sometimes. Your ACH payment gateway can request a reversal for reasons like duplicate entry or wrong amount within defined timeframes. Returns also occur when a bank rejects an entry—like R01 Insufficient Funds or R02 Account Closed. Consumers can revoke authorization for future debits, and you must honor it.

Q.3: Is ACH safer than mailing checks?

Answer: Generally yes. An ACH payment gateway encrypts and tokenizes bank details, enforces authorization rules, and provides auditable logs. Checks expose account numbers on paper and can be lost or stolen. With proper controls and verification, ACH reduces both operational and security risks.

Q.4: What fees should I expect?

Answer: Costs vary, but an ACH payment gateway is usually far cheaper than card processing. Expect a small per-transaction fee, possible monthly platform fees, and charges for returns or Same Day ACH. The overall landed cost is typically a fraction of card interchange on comparable ticket sizes.

Q.5: Can I use ACH for subscriptions?

Answer: Absolutely. An ACH payment gateway excels at recurring billing because bank accounts don’t expire like cards. With clear consent and smart retries for soft returns, subscription churn often drops and margins improve due to lower processing costs.

Q.6: What information do I need from customers?

Answer: To debit via an ACH payment gateway, you need the customer’s routing number, account number, account type, name, and explicit authorization. Many merchants also use instant bank login to verify the account quickly and reduce returns from typos or closed accounts.

Q.7: Do I still need PCI compliance?

Answer: PCI DSS applies to card data. While PCI doesn’t govern bank accounts, a strong ACH payment gateway will follow comparable security best practices and often undergo SOC 2 audits. You should still protect bank data, limit access, and use tokens instead of raw numbers.

Conclusion

For U.S. businesses that care about cost, control, and compliance, an ACH payment gateway is a practical engine for growth. It replaces checks with secure, automated bank transfers and complements card acceptance with a lower-cost option customers trust.

By selecting the right ACH payment gateway, configuring account verification, respecting SEC codes, and building disciplined return workflows, you’ll reduce fees, simplify reconciliation, and deliver a smoother payment experience.

Focus on clear authorizations, verified accounts, and clean reporting. Pair your ACH payment gateway with thoughtful policies—when to ship, when to retry, when to refund—and you’ll turn a technical integration into a strategic advantage.

Whether you run a SaaS product, a marketplace, a property portfolio, or a professional services firm, the path is the same: design with compliance in mind, automate with your ACH payment gateway, and keep iterating.

The result is faster collections, stronger cash flow, and a payment operation that scales as confidently as your business.

Leave a Reply