By Rinki Pandey January 13, 2026

An ACH transaction (Automated Clearing House payment) typically takes 1–3 business days to complete from the moment you authorize it to the moment funds are available to the receiver. Many ACH (Automated Clearing House) transactions arrive the next business day when they’re submitted early enough and pass bank validation.

If speed matters, Same Day ACH can deliver an ACH transaction the same business day—but only if it’s submitted before the right cutoff window and meets eligibility requirements.

That said, the real answer to “how long does an ACH (Automated Clearing House) transaction take?” depends on what you mean by “take.” Some people mean settlement between banks. Others mean posting to the recipient account.

And many businesses mean “when is the money safe and final?”—which can be different because ACH returns and exceptions can happen after the first posting.

This guide breaks down ACH (Automated Clearing House) transaction timing in a practical way: how the ACH network moves files in batches, what “standard” vs “same-day” truly looks like, what slows an ACH transaction down, and how to consistently get faster outcomes without raising return rates or compliance risk.

Understanding ACH transaction timing (what “takes” time, exactly)

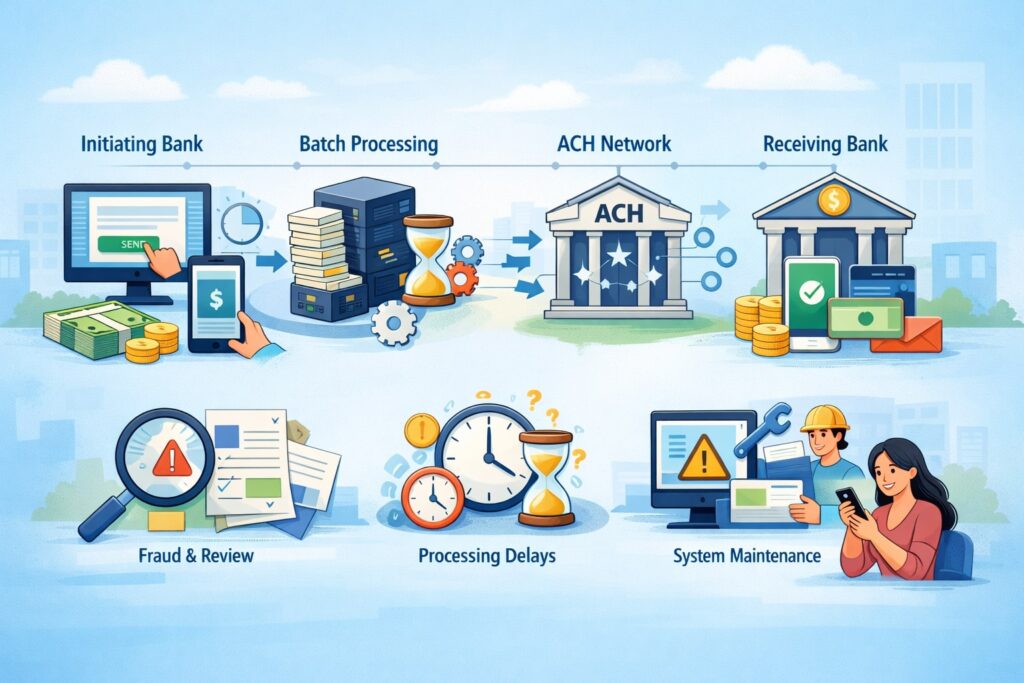

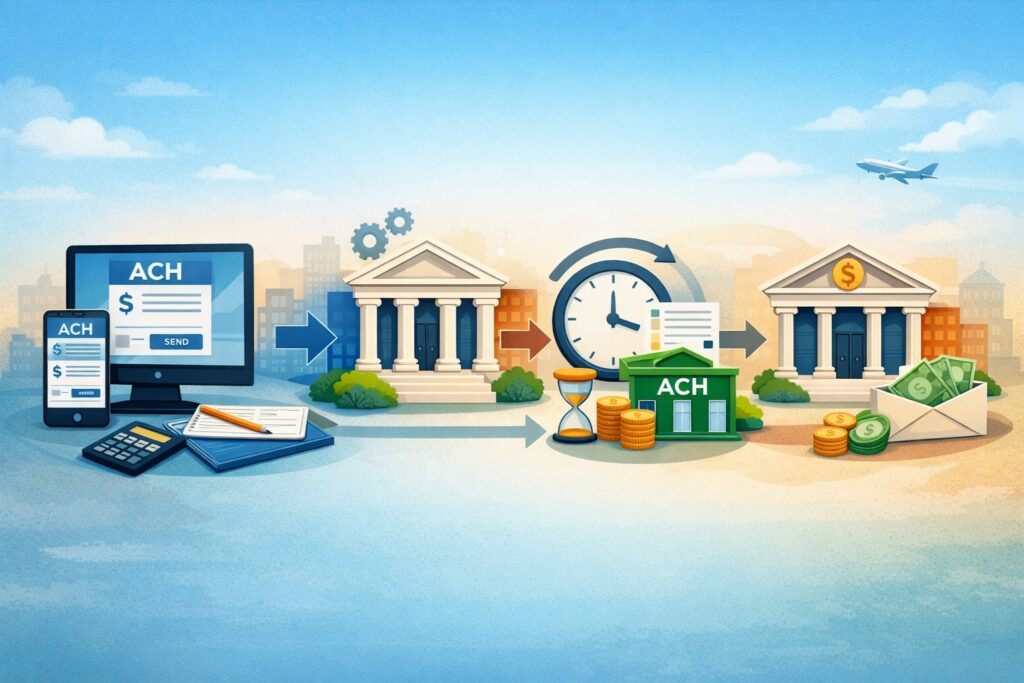

An ACH (Automated Clearing House) transaction moves through a chain: your payment platform or bank, the originating bank (ODFI), the ACH operator, the receiving bank (RDFI), and finally the receiver’s account. Unlike real-time payments, the ACH network is built around batch processing.

That batch design is why an ACH transaction often takes one or more business days, even if you hit “send” in seconds.

Here’s the key: most delays in an ACH (Automated Clearing House) transaction aren’t caused by the network being “slow.” They happen because the ACH ecosystem has decision points—cutoff times, file windows, validation checks, risk holds, posting schedules, and return rights.

A bank may receive an ACH transaction file but post it later based on internal processing rules. Or your payment may miss today’s cutoff and move to tomorrow’s processing cycle.

Also, not all ACH (Automated Clearing House) transactions are the same. ACH credit (push) and ACH debit (pull) can behave differently, especially for consumer accounts and first-time authorizations.

The SEC code (like PPD, CCD, WEB, TEL) and the way authorization is captured can influence risk review and return exposure, which indirectly affects how long an ACH transaction takes in real life.

Bottom line: if you want predictable timing, you need to manage the entire ACH transaction lifecycle—initiation timing, submission windows, clean data, verification, and return management—rather than focusing only on “1–3 business days.”

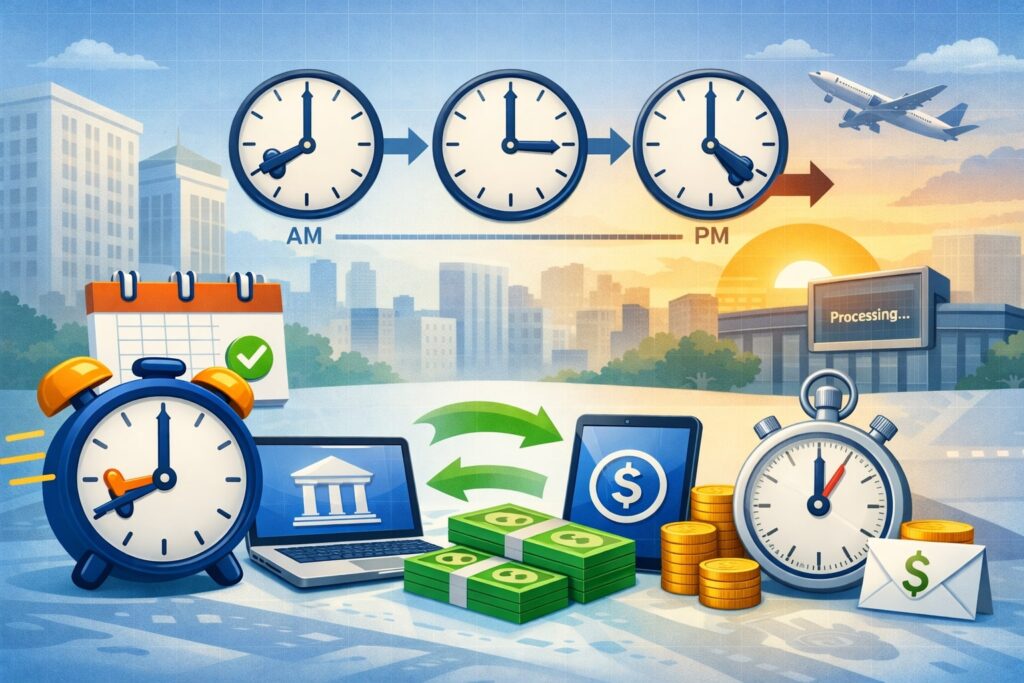

The three clocks that control ACH transaction time

Every ACH transaction is controlled by three “clocks” that can add or remove business days:

- The submission clock (your platform/bank cutoff): Even if Same Day ACH exists, your provider may stop accepting files earlier than the network deadline.

Many platforms run internal risk checks, batching, and funding validation before they release an ACH transaction into the network. If you initiate after that internal cutoff, your ACH (Automated Clearing House) transaction effectively starts tomorrow. - The network clock (ACH operator windows): The ACH operator runs timed processing windows. For Same Day ACH, there are defined windows with deadlines and settlement times.

For example, a Same Day ACH file has specific deadlines (e.g., 10:30 a.m. ET, 2:45 p.m. ET, 4:45 p.m. ET) tied to when the receiving bank gets it and when settlement occurs.

And for FedACH specifically, settlement timing for items not eligible for same-day occurs at 8:30 a.m. ET on the next banking day (per the FedACH processing schedule documentation). - The posting clock (receiving bank posting and funds availability): A receiving bank can receive the ACH transaction but post it later—sometimes at set times like morning, midday, or end-of-day.

Same Day ACH also comes with funds availability expectations tied to local time (for eligible entries) which affects when the receiver can actually use the funds.

When people ask “how long does an ACH transaction take,” they usually don’t realize they’re asking about all three clocks at once. The fastest outcomes happen when you align submission timing, the correct processing window, and predictable posting behavior.

Standard ACH transaction timeline (what to expect on typical processing)

A standard ACH transaction commonly takes 1–3 business days, with many completing in one business day when submitted early and formatted correctly. Standard ACH (Automated Clearing House) transaction timing is mostly about when the ODFI releases the transaction into the next operator cycle and when the RDFI posts it.

A practical way to think about standard ACH transaction timing is in “business-day hops”:

- Day 0 (initiation day): You authorize or send the ACH transaction. If you initiate before the provider’s cutoff, it may be included in that day’s file. If you initiate after the cutoff, your ACH transaction moves to Day 1 automatically.

- Day 1 (processing/settlement day): The ACH operator processes and forwards the entry. Settlement between banks often occurs on the scheduled settlement time for that processing day or the next banking day depending on eligibility and operator schedule.

- Day 1 or Day 2 (posting day): The receiving bank posts the ACH transaction and makes funds available based on its posting schedule and the type of transaction (credit vs debit).

- Day 2 or Day 3 (exceptions/returns surface): If something is wrong—invalid account, closed account, no account, etc.—the ACH transaction may be returned within standard return time frames, creating the “it looked done, then it reversed” experience.

This is why businesses that rely on standard ACH (Automated Clearing House) transactions for cash flow (rent collection, invoices, subscriptions) should plan for both processing time and return exposure. “Completed” on your dashboard may mean “sent,” not “final.”

What “next-day” means in practice for an ACH transaction

“Next-day ACH” is often used informally to describe an ACH transaction that arrives the next business day. In practice, “next-day” usually happens when:

- You initiate the ACH transaction early enough to hit the provider’s cutoff.

- The file is released to an operator window that settles for the next banking day.

- The receiving bank posts credits quickly the next morning.

FedACH documentation notes that settlement for ACH items not eligible for same-day occurs at 8:30 a.m. ET on the later of the next banking day or the resulting settlement date under the operating circular schedule logic.

That’s one reason many “next-day” ACH (Automated Clearing House) transactions show up early in the morning for receivers—especially for credits like payroll.

But “next-day” is never a guarantee across all banks and all payment types. The receiving bank’s posting schedule can shift the visible result from morning to afternoon. And if the ACH transaction is flagged for review (new payee, unusual amount, mismatched name/ID signals, or elevated return risk), it may be delayed even if the network could have handled it quickly.

If you sell “next-day ACH transaction” capability to your customers, position it as a strong typical outcome with clear cutoff rules—rather than a promise—unless your bank/provider contractually supports it.

Same Day ACH transaction timing and cutoff windows (how it can be same-day)

A Same Day ACH transaction can complete within the same business day, but only if it meets eligibility rules and is submitted before the appropriate deadline. Same Day ACH is not “instant”—it’s still batch-based—yet it compresses the cycle so that initiation, processing, settlement, and posting happen within a tighter window.

Nacha publishes a schedule showing three Same Day ACH processing windows with deadlines and settlement times. The schedule lists ODFI deadlines of 10:30 a.m. ET, 2:45 p.m. ET, and 4:45 p.m. ET, with corresponding settlement timing tied to those windows.

The Federal Reserve also describes Same Day service as enabling processing and settlement of eligible ACH payments during the current processing day, with exclusions and constraints (for example, certain transaction types and eligibility limits).

There’s also a practical limit: Same Day ACH eligibility includes an amount cap (commonly referenced as up to $1,000,000 for eligible transactions through FedACH SameDay service descriptions). (Your provider may set a lower limit for risk reasons.)

So, how long does an ACH transaction take with Same Day ACH? Often hours, not days—assuming you start early and everything is clean. If you initiate late afternoon, the “same-day” option might be gone, and your ACH transaction falls back to next-day.

Same Day ACH funds availability expectations (what receivers actually experience)

Even with Same Day ACH, what the receiver experiences depends on the receiving bank’s posting and funds availability.

Nacha’s published resource on schedules and funds availability ties Same Day windows to expected availability in the receiving bank’s local time (e.g., availability by early afternoon or end-of-processing-day depending on the window and whether the entry is received before certain local cutoffs).

Here’s what that means in plain terms:

- A Same Day ACH transaction submitted in the morning window is more likely to show up and be usable earlier in the day.

- A Same Day ACH transaction submitted in the late window can settle same-day but might only be available near end-of-day, especially if the receiving bank posts once in the late afternoon.

- Some banks post multiple times daily; some post in one big batch. So “same-day” can still feel different from bank to bank.

For businesses, the operational takeaway is simple: if Same Day ACH is part of your promise (for payroll corrections, emergency vendor payments, customer payouts), set customer-facing cutoff times that are earlier than the network deadlines. That buffer reduces failed expectations when internal risk checks, file building, or funding steps take longer than planned.

Why your ACH transaction may take longer than expected

If an ACH transaction takes longer than 1–3 business days, the cause is usually one of these: missed cutoff times, weekends/holidays, incorrect account data, elevated risk review, or an exception/return event.

Cutoff misses are the most common. An ACH transaction initiated after your provider’s cutoff might not enter the network until the next business day. If that happens on a Friday evening, your ACH transaction might not move until Monday (or later if there’s a holiday).

Weekend and holiday effects matter because ACH is built around banking days. Even if your app accepts the request, the actual movement and settlement of the ACH transaction typically follows operator schedules and banking-day rules.

Data errors (routing number issues, account number errors, name mismatches, wrong account type) can lead to returns or manual intervention. A single digit error can turn a “next-day” ACH transaction into a 3–5 business day problem once you include investigation and re-initiation.

Risk checks are increasingly relevant. Many banks and payment platforms perform automated screening for suspicious patterns: first-time payees, unusual dollar sizes, velocity spikes, mismatched identifiers, or return-rate risk.

These checks are not “ACH delays” in the network—they’re pre-network controls meant to prevent fraud, unauthorized debits, and avoidable returns.

Risk reviews, verification, and exceptions (the hidden delay layer)

Modern ACH programs often add a verification layer before releasing an ACH transaction:

- Account validation (confirming the account is open and can accept debits/credits)

- Customer identity and underwriting checks

- Velocity controls (how many ACH transactions per hour/day)

- Return-rate protection (preventing excessive unauthorized or administrative returns)

Even Nacha’s risk framework and industry guidance emphasize return-rate monitoring and network quality expectations, which pushes many providers to tighten controls. If your business has had elevated returns, your provider may slow down ACH transaction releases until performance stabilizes.

Exceptions also include operational problems: funding failures, malformed files, duplicate detection, or compliance flags. When that happens, your ACH transaction might appear “pending” for longer because it’s waiting for a manual review queue, not for ACH processing.

If you’re a business sending ACH transactions at scale, the best way to reduce these delays is to treat verification and authorization quality as part of ACH speed. Cleaner onboarding and validation = fewer holds and faster releases.

ACH transaction time for credits vs debits (push vs pull timing)

An ACH credit transaction (push) is initiated by the payer to send funds out—think payroll, vendor payments, or customer payouts. An ACH debit transaction (pull) is initiated to collect funds—think subscription billing, loan payments, or utility drafts.

This difference changes how long an ACH transaction takes, mainly because debits carry higher dispute and return sensitivity.

Credits often post faster and more predictably. Payroll ACH transactions, for example, are usually scheduled with a clear effective date, and receiving banks commonly prioritize posting credits on the settlement day.

Debits can be trickier. A debit ACH transaction depends on authorization quality, account status, and the receiver’s bank handling of debits. If the receiver’s bank identifies a potential unauthorized pattern, it may scrutinize or return the debit. And from a business perspective, a debit that “posted” might still be at risk of return within allowable return time frames.

So if you’re estimating “how long does an ACH transaction take” for your customers, it’s smart to give different expectations:

- ACH credit transaction: often next-day, sometimes same-day if Same Day ACH is used and cutoffs are met.

- ACH debit transaction: often 1–3 business days, with a stronger emphasis on return monitoring and customer communication.

Payroll, bill pay, and merchant debits (timing differences that matter)

Use case changes timing expectations for an ACH transaction:

- Payroll (ACH credits): Payroll files are typically submitted in advance with a target effective date. When done correctly, employees see funds on the scheduled payday morning because banks post these credits early.

- B2B bill pay (ACH credits, CCD): Business payments may run through approvals and batching, which can delay initiation. But once submitted, they often follow predictable next-day settlement patterns.

- Merchant and subscription debits (WEB/PPD debits): These can take 1–3 business days to settle and post, and they carry higher return exposure if customers dispute authorization or if account details are wrong.

- Customer payouts (credits): These often benefit from Same Day ACH when you need faster delivery without wire fees, but you must manage cutoffs and eligibility limits. FedACH SameDay service descriptions highlight eligibility exclusions and a transaction amount limit framework for same-day processing.

When you align use cases with the right ACH transaction type (credit vs debit) and the right processing option (standard vs same-day), ACH timing becomes far more predictable.

Returns, reversals, and disputes: how they affect when an ACH transaction is “final”

Many people treat an ACH transaction as final once it posts. But “posted” isn’t always “final,” because ACH returns can reverse the transaction after settlement if the receiving bank returns it within allowed time frames.

Returns happen for many reasons: insufficient funds, account closed, no account, invalid transaction, unauthorized debit claims, and more. A return can arrive after a day or two (common for administrative returns) or later for certain consumer unauthorized scenarios (depending on the specific rules and situation).

Financial institutions and industry guides commonly reference short standard return deadlines like two banking days for many return types, with extended time frames for certain consumer unauthorized claims.

This is a big reason businesses ask “how long does an ACH transaction take to clear?” In business terms, “clear” often means: when can I trust the funds and ship the product, release the service, or recognize revenue? The answer depends on your risk tolerance and your return history.

If you run a high-trust relationship (payroll, known vendors), you may treat an ACH transaction as good once posted. If you run high-risk collections (first-time customers, digital goods, subscription signups), you may wait longer or use verification controls to reduce returns.

Common return time frames and what to do when an ACH transaction comes back

A practical return-management approach for an ACH transaction looks like this:

- Plan for quick returns: Many routine return reasons follow a short banking-day window (often referenced as two banking days in bank reference guides).

Action: Monitor returns daily and notify customers immediately with a clear “fix and reattempt” workflow. - Expect unauthorized claims to be different: Consumer unauthorized debit situations can have extended dispute handling compared with simple “invalid account” returns.

Action: Store authorization evidence, use clear descriptors, and offer easy cancellation/refund paths to reduce disputes. - Use same-day returns where possible: Industry bulletins note that not all receiving banks use Same Day windows for returns consistently, even though it can speed resolution.

Action: Build your cash forecasting assuming many returns still arrive next-day, but optimize your own outbound timing and customer comms to reduce rework.

For forecasting, don’t just ask “how long does an ACH transaction take to arrive?” Also ask: “How long until ACH transaction risk is low enough for my business model?” That’s where returns and disputes matter.

How to speed up an ACH transaction (without creating return problems)

If you want a faster ACH transaction, you have four levers: start earlier, choose Same Day when appropriate, reduce errors, and reduce risk flags.

- Start earlier: Submitting before internal cutoffs is the simplest win. If you consistently initiate ACH transactions in the morning, you maximize next-day outcomes and open the door for Same Day options when needed.

- Use Same Day ACH strategically: Same Day can turn an ACH transaction from days to hours, but it’s not free and not always available. You’ll need to meet the required submission deadlines (the same-day windows are tied to specific ET cutoffs).

- Improve data quality: Most avoidable ACH transaction delays come from bad account details. Use routing validation, account-type checks, and confirmation flows. If you can, add account validation tools so fewer entries come back as “no account” or “invalid.”

- Reduce risk flags: If your provider delays releases due to risk scoring, the fastest path is improving your profile: lower return rates, clear authorization capture, consistent volumes, and strong customer support resolution.

Operational checklist for faster ACH settlement and better timing

To make your ACH transaction timing more consistent:

- Set customer-facing cutoffs earlier than the network deadlines: This creates a buffer for approvals, risk review, and funding steps.

- Use ACH credits for payouts when speed matters: Credits tend to be cleaner operationally than debits for urgent delivery.

- Pre-verify bank details for first-time payees: This reduces returns and speeds up release decisions.

- Keep descriptors and customer support paths clear: Confusing statements can drive disputes and “unauthorized” returns, which slows future ACH transactions.

- Monitor return codes and fix root causes fast: A few recurring return reasons can snowball into risk holds and longer ACH transaction times.

- Use Same Day ACH for exceptions, not every payment: Reserve same-day fees and processes for payroll corrections, urgent vendor issues, or customer experience saves.

When you combine these steps, you don’t just speed up a single ACH transaction—you improve the reliability of your whole ACH program.

Future outlook: how ACH transaction timing is likely to evolve

ACH is getting faster around the edges, even while the core remains batch-based. Same Day ACH already compresses how long an ACH transaction takes, and industry conversation continues around further enhancements.

Nacha has publicly explored ideas and gathered feedback on Same Day ACH evolution, including considerations like adding or adjusting processing windows (for example, discussion of a potential additional daily window and spacing windows more evenly).

Separately, operational guidance and industry bulletins show that adoption of same-day windows for returns varies, which suggests there’s still room for speed gains simply through broader usage of existing windows.

At the same time, faster payment rails are expanding (instant and near-instant alternatives). That doesn’t mean ACH goes away. Instead, many businesses will adopt a routing strategy:

- Use ACH transaction flows for low-cost, predictable payments (payroll, vendor payments, recurring billing).

- Use instant rails for urgent, high-value customer experience moments.

- Use wires for very high-value or specialized scenarios.

What faster payments means for the ACH transaction experience

Over the next few years, the biggest improvements in “how long does an ACH transaction take” will likely come from:

- Better pre-validation: fewer bad entries means fewer delays and returns.

- Smarter cutoffs and automation: platforms will optimize batching and release decisions to hit same-day windows more often.

- Greater return-speed best practices: more receiving banks may use same-day windows for returns, improving resolution time even when payments fail.

- Clearer customer expectations: businesses will present ACH transaction timing as a range with cutoffs, instead of a vague “1–3 days,” reducing support load.

The “future” of ACH transaction speed isn’t necessarily making every ACH transaction instant. It’s making ACH more predictable, with more same-day options when needed—and pairing ACH with faster rails for the moments that truly require immediacy.

FAQs

Q.1: How long does an ACH transaction take to show up in the recipient’s account?

Answer: Most ACH transactions show up in 1–3 business days, often next business day if sent early. Same Day ACH can make an ACH transaction available the same business day if cutoffs are met.

Q.2: Can an ACH transaction be pending for several days?

Answer: Yes. A pending ACH transaction may be waiting for a cutoff, weekend/holiday, risk review, funding validation, or correction of bank details.

Q.3: Do ACH transactions process on weekends?

Answer: Typically, ACH processing follows banking days. An ACH transaction initiated on a weekend often starts moving on the next business day.

Q.4: What’s the fastest ACH transaction option?

Answer: Same Day ACH is typically the fastest ACH transaction option within the ACH network, using defined processing windows and deadlines.

Q.5: Why did my ACH transaction complete and then reverse?

Answer: That’s usually an ACH return. Returns can occur after posting if the receiving bank returns the entry within allowed time frames for the return reason.

Conclusion

For most people and most businesses, an ACH transaction takes 1–3 business days, with next-business-day outcomes common when you submit early and avoid errors. Same Day ACH can shorten how long an ACH transaction takes to the same business day, but only when you meet the right window and eligibility rules.

The most important takeaway is that ACH timing isn’t just about the network. The real drivers of “how long does an ACH transaction take” are cutoffs, batching, posting schedules, data quality, and risk/return management.

When you treat ACH as an end-to-end workflow—initiation discipline, verification, clean authorizations, and proactive return monitoring—you get faster delivery, fewer reversals, better cash forecasting, and fewer customer support tickets.

Leave a Reply