By achforbusiness August 3, 2025

Accepting ACH payments (Automated Clearing House payments) from your customers can save your business money and streamline your billing. ACH is an electronic network for bank-to-bank payments in the United States, and it’s widely used for things like direct deposit of paychecks and automatic bill pay. In fact, the ACH network handled over 33 billion transactions in 2024 (worth more than $86 trillion) – a clear sign of its broad adoption.

This guide will walk you through everything you need to know to start accepting ACH payments, with an instructional, step-by-step approach applicable to businesses across all industries.

We’ll cover what ACH payments are, why they’re beneficial, how they compare to other payment methods, and exactly how to set up and process ACH transactions. We’ll also highlight U.S.-based solutions and answer frequently asked questions. By the end, you’ll have a comprehensive understanding of ACH payment processing and how to implement it for your business.

Understanding ACH Payments

ACH payments are electronic transfers of money from one bank account to another through the Automated Clearing House network. Instead of using paper checks or card networks, funds move directly between bank accounts in batches. The network is governed by the National Automated Clearing House Association (NACHA), which sets rules and security guidelines for ACH transactions.

Essentially, ACH is the backbone for many everyday financial transactions – from employees getting paid via direct deposit to customers paying utility bills by authorizing bank drafts.

When a customer pays you via ACH, the transaction can be either an ACH debit or an ACH credit. An ACH debit means you (the business) pull funds from the customer’s account (with their permission), whereas an ACH credit means the customer pushes funds from their bank to yours. In both cases, the money flows through the ACH network, which clears and settles payments in batches a few times a day rather than in real time.

Typically, ACH payments take 1-3 business days to settle, though Same-Day ACH options can speed this up to same-day processing for an extra fee. NACHA reports that about 80% of ACH payments settle in one business day or less thanks to improvements in the network.

Key characteristics of ACH payments:

- Domestic U.S. system: ACH transfers are used for transactions within the United States (international ACH is limited). If your client doesn’t have a U.S. bank account, ACH isn’t an option; you’d need to use wire transfers or other international payment methods.

- Batch processing: ACH transactions are processed in batches (usually three scheduled times per weekday), not instantly at the moment of payment. This makes ACH efficient for large volumes of payments, but it means timing can affect how soon funds clear.

- Security and regulation: ACH is a secure network regulated by federal authorities and managed by NACHA. Transactions go through clearing houses (the Federal Reserve or The Clearing House) with encryption and fraud prevention measures in place. ACH payments also require customer authorization, adding an extra layer of security and compliance (more on that later).

- Common uses: Payroll direct deposits, vendor payments, mortgage and rent payments, subscription or membership dues, B2B invoice payments, charitable donations, and many other recurring or one-time transactions can be handled via ACH. In fact, about 95% of U.S. employees are paid via ACH direct deposit, and ACH payment volume is growing every year across various sectors.

Benefits of Accepting ACH Payments

Why should your business consider accepting ACH payments? Here are some of the major benefits, which apply across industries from e-commerce and software services to healthcare, professional services, nonprofits, and beyond:

- Lower Processing Fees: ACH payments are significantly cheaper for merchants than credit card payments. Credit card processing typically costs around 1.5% – 3.5% of the transaction amount in fees, plus additional charges, which can really add up. By contrast, ACH transactions often cost only pennies or a small flat fee.

For example, a $5,000 customer payment via ACH might cost the business around $0.25 to $5.00 in fees, whereas that same transaction on a credit card could cost $65 to $175 in fees. Many providers charge either a flat fee (e.g. $0.20–$1.50 per transaction) or a percentage (around 0.5%–1% typically) capped at a few dollars. Overall, businesses can save hundreds or thousands of dollars per year by shifting large or recurring payments to ACH. - Improved Cash Flow for Recurring Billing: ACH is excellent for recurring payments such as subscriptions, memberships, or installment plans. Once customers authorize an ACH debit, you can automatically collect payments on a schedule. Unlike credit cards, which can expire or be canceled (leading to payment failures), bank account numbers rarely change – the average U.S. bank account is kept for 14 years.

This means less churn or interruption in payments. By using ACH autopay (sometimes called ACH direct debit or eChecks), you can count on more consistent on-time payments and a steadier cash flow. - Convenience for Customers: Many customers find ACH convenient, especially for bills or large payments. They don’t need to write checks or deal with cash, and there’s no credit card debt involved. Once set up, an ACH payment can be processed with minimal effort from the customer’s side – often they just provide their bank routing and account number once.

Consumers are also quite familiar with ACH in daily life (for example, most people have used it for direct deposit or online bill pay). If you offer a user-friendly ACH payment option (like a secure online form or portal), customers may appreciate the ability to pay directly from their bank account. - Security and Reduced Fraud Risk: ACH payments are highly secure and tightly regulated. Transactions go through certified ACH operators and must comply with NACHA’s rules for fraud prevention and data security. Fraud rates for ACH are very low compared to other payment methods – one Federal Reserve study found ACH had one of the lowest fraud incident rates among payment types.

Unlike paper checks that can be lost or stolen, ACH is fully electronic. Additionally, customers have certain protections: unauthorized ACH debits can be disputed and reversed if reported (typically within 60 days for consumer accounts), which gives payers confidence. For businesses, the requirement to obtain customer authorization adds a layer of trust and clarity to the transaction. - Efficiency and Automation: Handling payments via ACH can streamline your operations. You can integrate ACH payments with accounting or invoicing software to automatically send bills and collect payments, reducing manual work. Many payment platforms offer tools like recurring billing, subscription management, or automatic payment reminders that work with ACH.

This automation is especially beneficial for industries that send a high volume of invoices or that collect regular payments (e.g., service providers, contractors, property management companies for rent, etc.). Moving from paper checks to ACH can also save time on trips to the bank and on waiting for checks to clear. - Better for Large Transactions: ACH can handle large payment amounts at lower cost. For instance, wire transfers can also move large sums but come with high fees; credit cards often have transaction limits or hefty percentage fees.

ACH is well-suited for big B2B transactions, supplier payments, or expensive purchases, because the fee does not scale dramatically with the amount. In fact, some banks or providers cap ACH fees, so sending $50,000 might cost the same as $5,000. This makes ACH a smart choice for businesses that deal with high-value orders or invoices.

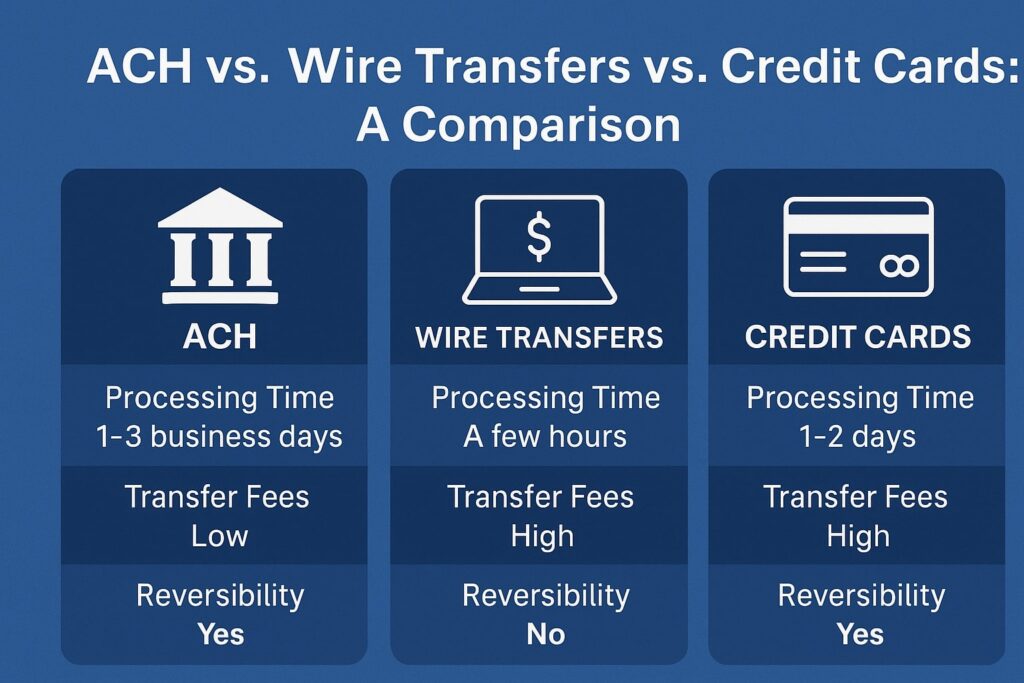

ACH vs. Wire Transfers vs. Credit Cards: A Comparison

It’s useful to understand how ACH payments stack up against other common payment methods like wire transfers and credit card payments. Each has its place in business, and many companies use a combination of all three. The table below summarizes key differences:

| Aspect | ACH (Bank Transfer) | Wire Transfer | Credit Card Payment |

|---|---|---|---|

| Speed (Settlement) | 1–3 business days (standard). Same-day ACH available for a fee; ~80% of ACH payments now settle within one day. | Typically same-day (domestic wires clear within minutes to hours). International wires may take 1–2 days. | Instant authorization; settlement to merchant in ~1–2 days. Funds appear on customer’s card account immediately as a charge. |

| Cost (Fees) | Very low cost. Often $0 to $1 per transaction or ~0.5%–1% (usually capped at a few dollars). Often free for customers; fees are paid by the business or split. | High cost. Domestic wires often ~$20–$30 for sender (and sometimes $15+ for receiver). International wires cost more (additional $15–$30 + exchange fees). | High cost for merchants. Processing fees average ~1.5%–3.5% of the amount (plus fixed gateway fees). Customers usually pay no fee (except interest if using credit). |

| Transaction Size | Suitable for small and large transactions. Often used for routine payments (average ACH payment ~$2,600). Some providers or banks set daily/transaction limits, but limits can often be raised for business needs. | Commonly used for large, high-value transactions (average Fedwire transaction is in the millions). No percentage fee makes it economical for very large sums despite flat fees. | Good for small to medium consumer payments (there may be card limits per transaction or credit limits). Large transactions are possible but incur high fees to the merchant. |

| Geography | Domestic U.S. only (must involve U.S. bank accounts). Not used for international payments except through special arrangements. | Worldwide (via SWIFT and correspondent banks). You can send/receive internationally in various currencies (with currency exchange fees). | Worldwide acceptance through card networks (Visa, MasterCard, etc.). Currency conversion fees apply for cross-border transactions. |

| Reversibility | ACH debits can be disputed/reversed if unauthorized or error (consumers have ~60 days to dispute an unauthorized debit). ACH credits (push payments) generally cannot be recalled once sent, except for errors. Overall, ACH offers some recourse for mistakes or fraud, but not instant cancellation. | Wires are generally irreversible once completed. They can only be canceled if the bank is notified before completion or in cases of clear error/fraud (and even then, recovery isn’t guaranteed). Wires are considered final and cleared almost immediately. | Credit card payments can be disputed via chargebacks, often up to 60–120 days after the sale. This protects consumers but creates risk for merchants, who may lose funds if a chargeback is decided against them. Merchants can also void or refund transactions, but once settled, the onus is on the merchant in case of disputes. |

| Recurring Payments | Yes, ACH is ideal for recurring payments (e.g. subscriptions, memberships, installment billing) once an authorization is in place. Funds can be pulled automatically on a schedule. | Generally used for one-time payments. Each wire is a separate instruction; not practical for automated recurring charges. | Yes, credit cards can be billed on a recurring basis. However, card numbers can expire or get canceled, potentially interrupting recurring billing, whereas bank accounts change rarely. |

| Customer Convenience | Moderate. Requires customer to provide bank routing and account number (and trust the process). Modern solutions let customers link their bank online securely (using an app or online banking login) to make it easier. No need for the customer to manage cash or check writing. | Moderate/Low. The customer (sender) must initiate the wire through their bank, which can be inconvenient (often requires going online to their bank or even visiting a branch for large amounts). Useful for large, planned payments, but not for spontaneous purchases. | High. Credit cards are very convenient for customers – just enter card details or tap/swipe. They also earn rewards points in many cases and provide purchase protections. This convenience often makes credit cards the preferred method for consumer purchases despite the cost to merchants. |

| Use Case Fit | All industries: Great for B2B invoices, service fees, big tickets, recurring bills, nonprofit donations, etc. Especially useful when transaction amounts are large or frequent and cost sensitivity is high. Not for instant needs. | High-value or urgent transfers: Common for real estate transactions, large corporate payments, or sending money internationally. Used when speed or cross-border capability justifies the cost. Not typically used for day-to-day consumer payments. | Retail and consumer payments: Ideal for point-of-sale, e-commerce, and any situation where customers want quick, on-the-spot payment. Necessary if you want to accept credit (or debit) card payments from customers, but costs need to be priced in. |

As you can see, ACH offers a low-cost, reliable way to move money, especially well-suited for domestic payments and recurring transactions. It is slower than a wire transfer, but you can opt for same-day ACH for faster settlement when needed (with some limitations, such as a $1 million per-payment cap for same-day service as of 2023). Meanwhile, wire transfers shine for speed and international reach, albeit at a steep price, and credit cards maximize convenience and ubiquity but come with high fees and risk of chargebacks.

Prerequisites for Accepting ACH Payments

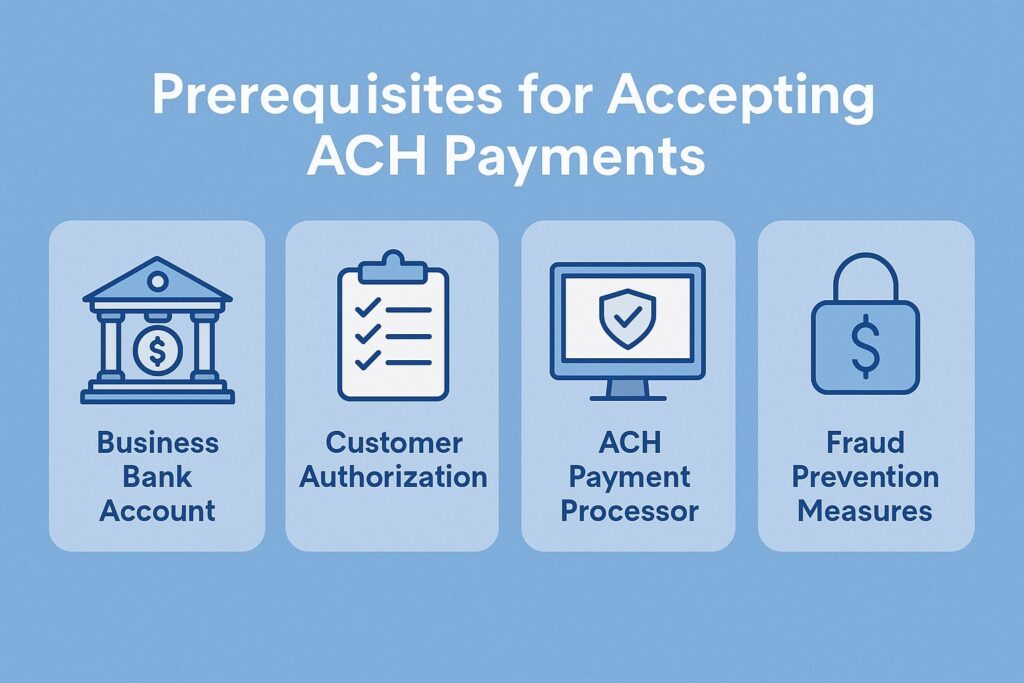

Before you can start accepting ACH payments from customers, there are a few prerequisites to take care of. Ensuring these are in place will make the setup and processing go much smoother:

- Business Bank Account: You must have a U.S. business bank account to receive ACH payments. ACH transfers move funds between bank accounts, so your company needs its own checking (or savings) account to serve as the destination (for incoming payments) and/or the source (for outgoing payments).

If you don’t already have a business bank account, open one with a bank or credit union that suits your needs. Most banks support ACH transactions by default, but if you plan to originate ACH debits (pulling money from customers), ensure your account is set up for that or that you’ll use a processor who can handle the origination on your behalf. - ACH Processing Partner (Bank or Payment Processor): Decide how you will process ACH payments. There are two main routes:

- Through your bank: Some businesses initiate ACH transfers directly via their bank’s online banking or cash management system. This is more common for occasional transfers or internal use (like payroll).

For accepting customer payments, it can be cumbersome to manage manually, but it might work if you only do a few ACH transactions and don’t need an online checkout integration. Essentially, the customer would send you an ACH credit (push payment) if you give them your routing/account info, or you would manually initiate a debit via your bank’s system with the customer’s authorization. - Through a third-party payment processor or gateway: Most businesses find it easier to use a payment service provider (PSP) or payment gateway that supports ACH. If you already accept credit cards with a provider, check if they offer ACH/eCheck processing – many do. Examples of U.S.-based payment processors that support ACH include Stripe, Square, PayPal (via eCheck or bank transfer options), Authorize.Net, Dwolla, and others.

These processors handle the heavy lifting: they connect to the ACH network, debit the customer’s account, and deposit into your account. Often, they also provide a user interface or API to integrate ACH payments into your website, app, or billing software. We’ll discuss specific solutions later, but you should research and pick a provider that fits your business model and volume.

- Through your bank: Some businesses initiate ACH transfers directly via their bank’s online banking or cash management system. This is more common for occasional transfers or internal use (like payroll).

- Verification and Compliance Checks: When you set up any payment processing service (ACH included), be prepared to verify your business information. Payment processors and banks will typically require your EIN (Employer ID Number) or Social Security number (for sole proprietors), business address, contact information, and perhaps documents proving your business legitimacy. This is standard KYC (Know Your Customer) procedure to prevent fraud.

Additionally, understand NACHA’s basic rules: for example, you are required to obtain proper authorization from customers for ACH debits, and you need to maintain records of those authorizations. While the processor’s platform will handle the actual transaction, compliance is ultimately your responsibility, so it’s good to familiarize yourself with any guidelines your provider or NACHA provides. - Customer Payment Information: To accept ACH payments, you’ll need certain information from your customer. At minimum, this includes:

- Bank Routing Number (a 9-digit number identifying their bank) and

- Bank Account Number (the customer’s personal or business account number at that bank).

- Bank Routing Number (a 9-digit number identifying their bank) and

- You’ll also want the account holder’s name, and whether it’s a checking or savings account in some cases. If you use paper authorization forms, the customer will fill these in. If using an online method, the customer may enter these details into a secure form.

Some modern solutions can let customers authenticate their bank account instantly via online banking login (using tools like Plaid) so you never see the actual account numbers and the process is faster – this is a nice-to-have but not required. The key is that you or your system must collect the banking details accurately and securely before you can initiate an ACH charge.

Once these prerequisites are sorted – you have a bank account ready, a chosen ACH processing method, and a way to collect customer bank info with authorization – you’re ready to proceed with the actual steps of accepting ACH payments.

Step-by-Step: How to Accept ACH Payments

Now let’s walk through the process of accepting ACH payments from customers, step by step. This assumes you (the business) want to pull payments from the customer’s account (ACH debit), which is the most common scenario for businesses billing customers. We’ll also note what to do if you want customers to push payments to you (ACH credit).

Step 1: Set Up a Business Bank Account (if not already done)

The first step is to ensure you have a dedicated business bank account for transactions. As mentioned, ACH moves money between bank accounts, so your business needs an account to receive funds. Using a business account (instead of a personal account) is important for legal and accounting reasons, and many payment processors require it.

If you have one already, great – confirm with your bank that it can accept ACH deposits (virtually all can) and ask about any ACH origination services if you plan to use the bank’s own system. If you don’t have an account, open one as soon as possible. Compare banks on their fees, online banking capabilities, and any specific ACH services (some banks have online portals for initiating ACH transfers, often found under “Bill Pay” or “Payments” in business online banking).

Tip: When setting up your ACH processing later, you’ll likely need your bank’s routing number and your account number, so keep those handy (these can be found on a check or in your online banking details). Also, ensure your account is enabled to both receive and send ACH, especially if you plan to do debit pulls – some small banks might need you to opt into an ACH origination service.

Step 2: Choose an ACH Payment Processing Solution

Next, decide on the payment processing solution you’ll use to actually handle the ACH transactions. There are a few paths:

- Use your existing payment processor or POS system: If you already accept credit card payments (online or in-person), check if your processor can add ACH as a payment method. Many providers offer ACH as an add-on. For example, popular U.S. payment providers like Stripe allow ACH direct debit transactions (useful for online businesses or software subscriptions), and providers like Square support ACH payments for invoices or e-commerce.

Even some merchant account providers oriented to small businesses (Helcim, Stax, etc.) have ACH options. Using one provider for both cards and ACH can simplify your financial systems. - Use an ACH-specialized processor or gateway: There are services that focus on ACH (sometimes called eCheck processors). For instance, Dwolla is a platform specifically for ACH payments and bank transfers. Traditional payment gateways like Authorize.Net also support eCheck/ACH transactions, which can be integrated into websites or virtual terminals.

If your business model is B2B or high-value transactions, you might go with a specialist known for low ACH fees or specific features like customer account verification. Ensure any provider you choose is reputable and provides the features you need (such as recurring billing support, a customer payment portal, or integration with your systems). - Via accounting or invoicing software: Some businesses can accept ACH payments through their accounting software or billing system. For example, QuickBooks Online allows you to include a bank payment option on invoices to clients – the customer can pay the invoice by entering their bank info, and QuickBooks processes the ACH (often through a partner bank or processor behind the scenes).

Bill.com is another platform that lets businesses send invoices and receive ACH payments from clients (useful for service businesses). If you use industry-specific software (like software for law firms, medical offices, etc.), check if they have a built-in ACH payment capability.

When choosing a solution, compare factors like fees (transaction fee and any monthly fee), setup effort, integration options, and how quickly funds are deposited. Most processors will deposit ACH payments to your bank within 1-3 business days of the transaction. Also consider customer experience: do you get a nice payment link or portal for customers? Can you handle both one-time and recurring payments easily? These practical aspects will affect how smoothly you can roll out ACH payments.

After selecting a provider, you’ll go through their application/setup process. This often involves providing your business details, linking your bank account for deposits (sometimes via a micro-deposit verification or Plaid integration), and getting approved. Processors might run a quick credit or risk check on your business because ACH debits carry some risk to them (if customers dispute or have insufficient funds). Once approved, you should have access to their platform to configure ACH payments.

Step 3: Enable ACH Payments in Your System

Once you have a processor or method in place, you need to enable ACH payments on your sales channels or invoicing system. This step will vary depending on your chosen solution:

- For online businesses or e-commerce: If you run an online store or SaaS business, integrate the ACH option at checkout or payment pages. For instance, in Stripe or similar gateways, you would turn on “Bank Transfer” or “ACH Direct Debit” as a payment method and possibly build a form for customers to enter their routing/account numbers (or use an embedded Plaid form for bank login).

Many gateways provide ready-made components to collect bank information securely, so you don’t have to handle raw account numbers. Test the checkout process in a sandbox mode if possible to ensure it’s working properly. Make sure to clearly label it as a bank payment or ACH option so customers recognize it. - For invoicing or billing: If you send digital invoices (via QuickBooks, FreshBooks, Zoho, etc.), enable the online payment link and include ACH as a payment option. This usually means the invoice email or link will have a “Pay Now” button, and the customer can choose “Pay by bank account” in addition to or instead of “Pay by credit card”. Configure any necessary settings, such as whether you want to allow customers to cover the fee (some platforms let customers opt to pay the processing fee, though this might discourage use – many businesses just absorb the small ACH fee).

- For in-person or over-the-phone payments: You might occasionally want to accept an ACH payment in person (or via phone) rather than taking a paper check. Some virtual terminal systems allow you to key in a customer’s bank details (just as you would key in a credit card number) to process an ACH debit.

For example, virtual terminals offered by merchant providers often support ACH if enabled. If a client is with you in person, you could also have them fill out a quick authorization form and provide a voided check or their account info, then later enter it into your system.

Over the phone, ACH is trickier – if you take their account info verbally, you can create an ACH debit, but you need either a recorded verbal authorization or a written follow-up authorization for compliance. In many cases, it might be easier to email the customer a payment link to an online ACH payment page rather than collecting bank info by phone. - Set up recurring payments if needed: If part of your goal is to charge customers on a recurring schedule (membership dues, subscriptions, retainers, etc.), use your platform’s recurring billing feature. For instance, Stripe and others let you create a subscription plan using ACH as the payment method on file.

Or if using an accounting system, set the invoice to recur and auto-pay via ACH. Have customers sign up for auto-pay by providing their bank info once, and then you can bill them automatically under the terms they agree to. Just ensure you have clear authorization (in writing or via electronic agreement) for recurring charges.

In this step, you’re essentially integrating ACH into your workflows. After configuration, do a test if possible: perhaps have a team member or a friendly client do a small payment via ACH to make sure transactions go through and you know how to track them.

Step 4: Obtain Customer Authorization for ACH Debits

One crucial step specific to ACH (especially ACH debits where you pull money) is getting the customer’s authorization. Under NACHA rules, you must have proper authorization from the payer before debiting their bank account. This authorization can take a few forms:

- Written authorization (paper or electronic): The customer signs an ACH authorization form. This could be a physical document or a digital form they fill out (e.g., through an online signup or electronic signature). The form should clearly state that the customer allows your business to debit their account, the details of the payment or schedule, and how they can revoke authorization.

For recurring payments, it should outline the timing (e.g., “$100 on the 5th of each month until canceled”). Many businesses include an ACH authorization as part of a contract or service agreement. If you need a template, many banks and processors provide sample ACH authorization forms. - Online checkout or form consent: If the customer is entering their bank details on a website, you can obtain authorization by having them check a box or click “I Agree” to terms that include the ACH authorization language. For instance, right before finalizing payment, present a statement like: “I authorize [Your Business] to debit the bank account provided for the amount above.

I understand this authorization will remain in effect until … etc.” The customer’s action of submitting the payment serves as an electronic signature. Be sure to record or save this consent (your payment system may do this automatically in logs). - Verbal authorization (by phone): It is possible to get authorization by phone for ACH, but there are stricter rules. For a one-time phone payment, you should tape-record the customer’s verbal consent or read a script and get their affirmative response, and then provide a written receipt or confirmation.

For recurring payments set up by phone, NACHA actually requires you to also obtain a written authorization (or send them a letter or email confirmation that they sign/acknowledge) to supplement the call. In practice, phone authorizations are mostly used in call center scenarios for one-off debits.

No matter how you get the authorization, keep a record of it. Save the signed form or the electronic acceptance record. NACHA rules say you should retain authorizations for at least two years after they end, and you must be able to produce it if a payment is disputed. This protects you in case a customer later claims, “I didn’t authorize that.” You can show that they did.

If the customer instead will be sending you an ACH credit (they initiate payment on their side, like using their bank’s bill to pay you), then the authorization is not your responsibility – the customer is initiating it through their bank. In that case, your step is simply to provide them with your routing and account number and any needed details (sometimes they might need your business name as it appears on your bank account).

Many businesses include bank payment instructions on invoices for clients who prefer to initiate an ACH or bank wire. Just make sure to label it clearly as an option (“Pay via ACH transfer to [bank info]”). You might also include a reference code or invoice number for them to add when they send the payment so you can match it.

Step 5: Initiate the ACH Transaction

With authorization in place and your system set up, you can now initiate ACH payments when needed:

- If the customer provided bank info for you to debit: You will create an ACH transaction through your payment processor or bank interface. This usually means entering the payment amount and scheduling the date of debit (often ASAP, i.e. the next available processing window, unless you want to set it for a future date). If it’s a one-time payment, you process it once. If it’s recurring, you either set up the recurring schedule in the system or remember to repeat the charge at the agreed intervals.

Modern systems make this easy – for example, you might just click “Charge customer” in your invoice or subscription software, and it will handle sending the ACH request to the network. The funds will be pulled from the customer’s account and queued to deposit into your account. Make sure to enter the exact amount authorized and on or after the date authorized (don’t charge earlier than a customer expects). - If the customer is initiating payment (ACH credit): In this scenario, you’re essentially waiting to receive the payment. The customer will use your bank details to send the money. The ball is in their court, but you should assist by providing clear instructions.

For example, you might say in an invoice: “Please pay via ACH transfer to [Bank Name], Routing # 123456789, Account # 000123456789, Account Name: XYZ LLC.” Once the customer initiates it (through their online banking or by instructing their bank), the ACH system will transfer the funds to your account. You might receive an email notification or see the deposit when it arrives. This method is common in B2B settings where the payer has an accounts payable system to send ACH payments in response to invoices.

In either case, timing is important to note. If you submit an ACH debit, it will typically be processed in the next batch of the ACH network. The U.S. The Federal Reserve has multiple batch windows throughout the day (morning, afternoon, and now later in the day for same-day ACH). If you submit after the last cutoff of the day, your transaction will queue for the next business day’s batch.

Also remember weekends and bank holidays do not process ACH. So, if you initiate a payment on Friday evening, it likely won’t start moving until Monday. Managing customer expectations about this timeline is wise (e.g., let them know “once you pay, it takes about 1-2 days to clear your bank”).

If you need faster confirmation or funds, consider using Same-Day ACH for eligible transactions. Many processors allow you to choose same-day processing for an extra fee (and as long as you initiate before the daily deadline, often around mid-morning). Same-Day ACH can settle by the end of the business day, which is helpful for time-sensitive payments. However, same-day is optional – you can stick with standard ACH which is usually next-day or two-day for most payments, and it’s cheaper.

After initiation, the ACH transaction goes through the network. If you’re using a payment platform, you should see the transaction status (e.g., “Pending”, then “Completed”).

Step 6: Confirm Settlement and Reconcile the Payment

The final step is to ensure the payment clears and settles, and then record it in your books like any other payment.

When an ACH payment is successful, you will receive the funds in your bank account. Typically:

- For ACH debits you initiated, your bank balance will increase by the payment amount (minus any processor fee) once it settles. The processor might show the payment as “completed” in their dashboard. Settlement times vary, but often it’s T+1 or T+2 (T being transaction day) for many providers. Check your bank on the expected date to see the deposit.

- For ACH credits sent by the customer, the deposit will appear in your bank when it arrives, often labeled with the payer’s name or some reference. You might also get an email confirmation if using an invoicing system that tracks it.

Reconciliation: Match the ACH payment to the corresponding invoice or customer account in your records. Because ACH might take a day or two, there’s a gap between when the customer initiates and when you get paid. It’s good practice to mark an invoice as “Paid” only after you’ve confirmed the funds. Many accounting systems will do this automatically if they are connected to your bank or if the payment was through an integrated platform.

Watch for any failures: One important aspect of ACH is that payments can fail or bounce after initiation. The common reasons are:

- Insufficient funds (NSF) in the customer’s account.

- Invalid account details (for example, a typo in the number or a closed account).

- Authorization revoked (customer tells their bank to block the debit).

- Other bank account issues (like account frozen, etc.).

If an ACH debit bounces due to NSF or invalid info, you usually get a return code notification within 1-2 business days of submission. Your payment processor will alert you (and often charge a small returned item fee). It’s comparable to a bounced check. If this happens, reach out to the customer to arrange another attempt or an alternative payment method. Some processors will even retry the debit once automatically (ACH rules allow a retry for NSF).

Assuming the payment clears successfully, you’re all set – the money is yours. Keep your authorization record on file in case of any disputes. In rare cases, a customer might dispute an ACH debit as unauthorized. If that occurs, the bank might claw back the funds (similar to a chargeback) and you’ll need that proof of authorization to challenge it. But with proper authorization and customer communication, disputes are uncommon.

By following these steps, you have now effectively accepted an ACH payment! Once you have the system down, accepting ACH becomes a routine part of doing business. Many companies even encourage more customers to switch to ACH (from credit cards or checks) to reap the cost savings and reliability; next, we’ll look at some ways to implement ACH in different contexts and tools available.

ACH Payment Solutions and Providers (U.S.-Based)

To successfully implement ACH payments, it helps to know some of the popular solutions and providers that can facilitate these transactions. Here’s an overview of options (focused on U.S. providers):

- Banks and Credit Unions: Almost every bank can receive ACH payments, and many also allow businesses to originate ACH debits. Larger banks offer online portals or cash management systems where you can upload ACH files or enter transfers. For instance, Wells Fargo, Bank of America, Chase, etc., have business banking tools to send ACH payments (often used for payroll or vendor payables).

Using a bank directly might be cost-effective for high volumes (some charge low per-transaction fees), but the integration and user experience may be basic. It often doesn’t easily integrate with your website for customer self-service. Banks are ideal if you want to handle ACH in-house or for internal payments. For customer-facing payments, you might pair your bank account with a more user-friendly front-end (like an invoicing software). - Payment Processors and Merchant Service Providers: These are companies that typically handle credit card processing and also offer ACH as part of their service. Working with them often gives you an all-in-one dashboard to manage payments. Notable examples:

- Stripe – A developer-friendly online payments platform; supports ACH debits (with features like instant bank account verification via Plaid) and has an API as well as a dashboard for manual entries. Commonly used by tech startups, SaaS, and e-commerce sites.

- Square – Known for point-of-sale card payments, Square also offers ACH for its invoices and online checkout. It’s easy to use for small businesses who already use Square for POS or billing.

- PayPal and Braintree – PayPal can process ACH in certain contexts (PayPal calls it “eCheck” when a customer pays by linking their bank). Braintree (a PayPal company) also supports ACH direct debit for online businesses.

- Helcim – A small-business-focused processor with transparent pricing that includes ACH options. For example, Helcim supports ACH in its virtual terminal, online invoices, and payment requests.

- Stax (Fattmerchant) – Offers subscription-based pricing for payments and supports ACH transactions (one-time or recurring) through a virtual terminal.

- Merchant account providers like Merchant One, Payment Depot, ProMerchant, etc. – Many traditional merchant services now have eCheck/ACH features. For instance, Merchant One has a customer vault that stores account info and can process recurring ACH payments. Authorize.Net (a gateway commonly provided by such companies) allows ACH transactions in addition to card.

- Stripe – A developer-friendly online payments platform; supports ACH debits (with features like instant bank account verification via Plaid) and has an API as well as a dashboard for manual entries. Commonly used by tech startups, SaaS, and e-commerce sites.

- The advantage of these providers is they often integrate with multiple platforms (shopping carts, billing software) and provide extra features like fraud screening or secure data storage. Pricing can vary – some charge around 0.5–1% per ACH or a flat $0.30-$1 per transaction, sometimes with monthly fees. Always check their pricing pages.

- ACH Specialists and FinTechs: There are newer fintech companies that specialize in ACH or bank-to-bank transfers:

- Dwolla – A platform specifically for bank transfers, ACH, and RTP (Real-Time Payments). Dwolla provides API tools to embed bank payments into your app or website. It’s geared towards tech-savvy businesses that want a customizable solution.

- Plaid (Transfer) – Plaid is known for connecting to bank accounts for verification. They also introduced Plaid Transfer, which is an all-in-one solution for account authentication and ACH payment initiation. This can simplify onboarding customers to ACH, since Plaid can verify and move money with one integration.

- GoCardless – A company focused on recurring bank debit payments (popular in Europe and also operates in the U.S.), offering an easy way to set up customers on ACH autopay with a good user experience.

- Zelle for businesses – Zelle is a bank-based P2P service for instant bank transfers. A few banks offer Zelle for small businesses to accept payments (usually person-to-business, like a customer could send to your registered email/number). While not exactly traditional ACH, it uses similar networks and is instant. Zelle could be an option for service professionals taking payments on the spot, but it’s not built for large or recurring transactions generally.

- Dwolla – A platform specifically for bank transfers, ACH, and RTP (Real-Time Payments). Dwolla provides API tools to embed bank payments into your app or website. It’s geared towards tech-savvy businesses that want a customizable solution.

- Industry-specific solutions: Depending on your industry, there might be platforms that handle payments including ACH. For example, a gym management software might have ACH integrated for membership dues, or a property management system might allow tenants to pay rent by ACH. These often piggyback on one of the processors above but present it in a tailored way for that business type.

When prioritizing the U.S.-based solutions, ensure that any provider you use is compatible with U.S. banking (ACH network) and ideally has a presence in the U.S. market for support. All the ones listed above are U.S. focused or have U.S. operations.

Ask about fees and limits: When speaking with a vendor or researching, inquire about ACH processing times (standard vs same-day), fees per transaction, monthly fees, setup fees, and any limits. Some processors have an initial cap on ACH transaction size or monthly volume for new accounts (for risk reasons), which they can increase as you build history. Also confirm how the processor handles failures or disputes (e.g., do they charge an NSF fee to you if a payment bounces, do they auto-retry, etc.).

Finally, integrations are key. If you want your payments to sync with your accounting software or CRM, choose a solution that offers those integrations (many modern payment providers connect with QuickBooks, Xero, Salesforce, etc., or have Zapier support at least).

By selecting the right partner, you make the ACH acceptance process much easier on yourself and your customers. The good news is that you have many options, and the trend in the U.S. is that more and more payment platforms are embracing ACH because of its growing popularity (the ACH Network saw about a 5% growth in volume year-over-year recently).

ACH Payments Across Industries (Use Cases)

ACH payments can benefit virtually any industry where payments are part of doing business. Here are some examples of how different types of businesses use ACH:

- E-commerce and Online Services: While credit cards and digital wallets are common for online shopping, some e-commerce merchants offer ACH at checkout for customers who prefer a direct bank transfer (often labeled as “Pay by Bank” or “Electronic Check”). This can reduce cart abandonment for customers who don’t have credit cards or who want to pay directly from a bank account.

Subscription-based online services (like software subscriptions, membership sites) heavily use ACH for recurring billing to avoid interruptions when cards expire. For high-ticket online sales, offering ACH can also save the merchant significant fees. - Professional Services and B2B Businesses: Companies that invoice other businesses or clients (e.g., marketing agencies, consultants, law firms, accounting firms) often get paid by check or wire. Switching to ACH for those invoices can speed up collection and eliminate paper handling.

For instance, a law firm might use an online payment link where clients can pay large invoices via ACH instead of mailing a check. B2B transactions are a huge area of ACH growth – billions of B2B ACH payments occur annually and it’s increasing by around 10% year-over-year, as businesses move away from paper checks. - Contractors and Construction: Industries like construction or home services (plumbers, electricians) frequently deal with large payments for projects. Accepting ACH (maybe via an emailed invoice or a tool like QuickBooks payments) can be easier and cheaper than handling credit card fees or waiting for a check. It’s also safer than carrying large checks around.

- Healthcare and Wellness: Medical and dental offices, or even gyms and wellness centers, use ACH for recurring payments or large bills. A doctor’s office might set up a payment plan for a patient’s bill via ACH auto-debit each month. Gyms and fitness clubs often get members to sign an ACH authorization for monthly dues (avoiding credit card declines and updates). ACH is compliant for healthcare payments (there are even specialized healthcare EFT standards under ACH).

- Property Management and Rentals: Landlords and property management companies widely accept ACH for rent payments. Instead of chasing paper rent checks, they have tenants fill out an ACH form or use an online portal to pay rent via bank draft each month. This reduces late payments and the hassle of physical checks. The scale of rent and mortgage collection via ACH is massive.

- Nonprofits and Charities: Nonprofits often encourage donors to contribute via ACH, especially for recurring donations. Credit card donations incur processing fees that cut into the donation amount, whereas ACH fees are minimal – meaning more of the donor’s dollar goes to the cause. Donors can set up an automatic monthly gift via ACH, which is great for predictable fundraising. Churches, alumni organizations, and charities provide ACH as an option for those who are comfortable entering bank info for a good cause.

- Education and Subscription Services: Schools or childcare providers might use ACH for tuition or fees (sometimes through a service like FACTS or other tuition management systems). Similarly, subscription services such as utility companies (electric, water) or insurance companies offer ACH auto-pay so that customers can pay their recurring bills from a bank account (often incentivizing it by waiving convenience fees). If your business has any subscription or installment element, ACH is a natural fit.

In all these examples, the common thread is efficiency and cost savings. Industries that handle a lot of payments, especially large or repeated ones, stand to gain the most from ACH. Even retail or restaurants, which mostly rely on cards, might use ACH on the back-end for transferring funds or paying out suppliers or gig workers. So, regardless of your industry, think about where a direct bank payment could improve your operations – you might find multiple applications.

Frequently Asked Questions (FAQs)

Q: What information do I need from a customer to accept an ACH payment?

A: To process an ACH debit from a customer’s bank account, you will need their bank routing number, account number, the account type (checking or savings), and the account holder’s name as it appears on the account. You also need their authorization (consent) to pull the funds. If you’re using an online system, the customer typically enters these details into a secure form.

Some systems may require additional info like the customer’s billing address or driver’s license number for verification, but generally routing and account numbers are the key pieces. For ACH credit payments (customer pushes money to you), you need to give them your routing number, account number, account name, and possibly your bank name – essentially the details they’d need to set up a transfer on their side.

Q: How long does it take for an ACH payment to clear?

A: Standard ACH payments typically take 1 to 3 business days to fully clear and settle in your bank account. In many cases, you’ll see the funds the next business day or within two days, but ACH timing can depend on when the transaction was initiated and the policies of the banks involved. NACHA has reported that the majority of ACH payments settle within one day now.

However, there are scenarios where it could take a bit longer (for example, if a payment is initiated on a Friday, you might not have funds until Monday or Tuesday). Same-Day ACH is available for faster settlement – if you and your processor submit the payment within the daily cutoff window, the transaction can settle by the end of the same business day.

Keep in mind that weekends and federal holidays do not count as business days for ACH processing. Always plan for at least a day’s delay compared to instant payment methods. If timing is critical, use same-day processing or notify the customer of the expected clearing date.

Q: Are ACH payments safe and secure?

A: Yes. ACH payments are considered very secure. They are overseen by NACHA and regulated by federal law, and they use the banking system’s established security infrastructure. When you process an ACH, the data is encrypted, and modern processors often tokenize sensitive information (meaning your business might not even store the actual bank numbers).

Additionally, banks employ fraud detection on ACH transactions, and there are clear rules for handling unauthorized transactions. Statistically, ACH has a low fraud rate compared to credit cards and checks. One reason is that to debit someone’s account, you need explicit authorization, and customers have the right to dispute unauthorized debits, which acts as a deterrent to fraud.

Of course, as a business, you should use secure systems and follow best practices (like not emailing bank account numbers in plain text, etc.). If you implement ACH via a reputable payment processor, they will handle most security requirements (for example, ACH is not subject to PCI-DSS like credit cards are, but processors will still secure the data). In short, ACH is a trusted network with robust safeguards, making it a safe choice for transferring funds.

Q: What fees will I pay for accepting ACH payments?

A: Typically, you will pay either a flat fee per transaction, a small percentage, or a combination of both. For example, a common pricing is $0.25 to $1.50 per ACH payment, or around 0.5% to 1% of the transaction amount, often with a cap (e.g., “1% capped at $5”). NACHA data indicated third-party processors charge in the range of 0.5%–1.5% plus $0.20 to $1.50 per transaction.

Some providers charge just a flat fee (e.g., $0.30 each) no matter the size of the payment, which is great for large payments. Others might have a monthly fee but lower per-item cost. Importantly, ACH fees are always much lower than credit card fees for the same transaction.

Additionally, if you use your bank’s direct ACH service, the bank might charge something like $10-$20 per month for the service and maybe $0.10 per transaction (banks often price ACH for volume). There can also be fees for ACH failures (e.g., a $2–$5 fee if a payment is returned NSF) or for optional services like same-day processing. Be sure to review your provider’s pricing schedule so you aren’t caught off guard. In many cases, the savings on credit card fees by using ACH will outweigh these costs significantly, especially on larger payments.

Q: What’s the difference between an ACH direct debit and a wire transfer?

A: Both are electronic bank payments, but there are key differences. An ACH direct debit (or credit) goes through the Automated Clearing House network in batches, usually taking a day or two, and costs very little per transaction. A wire transfer is processed in real-time by banks (through networks like Fedwire or SWIFT for international) and is delivered the same day, often within minutes if domestic.

Wires are typically used for urgent or high-value transfers and come with high fees (for example, $25 to send a domestic wire). Also, wire transfers are generally final – once sent, the money is gone and can’t be easily recalled – whereas ACH debits have mechanisms for returns or disputes in certain cases. Another difference: wires can easily go overseas; ACH is mainly U.S. only. Think of ACH as a low-cost workhorse for everyday payments and recurring billing, and wires as a premium service for special cases when speed is critical or international reach is needed.

Q: How do I handle a customer who wants to pay by ACH?

A: Make it as easy as possible for them. Provide a secure way for them to give you their banking info – this could be an online payment link/form or a physical form. Explain that their payments will come out of their bank account directly. Ensure them that it’s secure and that they’ll get a receipt or confirmation. If they’re used to writing checks, you can mention that ACH is effectively an “electronic check” (sometimes it’s even called eCheck) and they can void a check and attach it to a form for you to get the needed info.

If a customer prefers to push the payment (they initiate it), give them clear instructions with your account details. Once they have paid, promptly provide a receipt or at least confirm you received the payment, as ACH isn’t as instantly obvious to them as a card charge. Good communication will build trust in this method.

Also, if you want to encourage customers to switch to ACH, you might highlight that it helps you keep costs down (some businesses even offer a small discount for ACH payments, since saving ~3% on a big invoice might be worth giving the customer 1% off, for instance). Given that ACH is widely used, many customers (especially other businesses) will be perfectly comfortable with it when you present it professionally.

Q: Can customers dispute or refund an ACH payment like they do with credit cards?

A: Customers can’t “chargeback” an ACH in the same way as a credit card, but they do have dispute rights for certain cases. If a customer believes an ACH debit was unauthorized, they can contact their bank and file a claim. For consumer accounts, they typically have 60 days from the date of their bank statement to report an unauthorized ACH and get it reversed. The bank will automatically pull the money back from your account if that happens, and then it’s on you to prove it was authorized (hence why keeping authorization records is important).

There’s no arbitration network like credit card chargebacks; it’s handled through the ACH return process. The valid reasons for an ACH return include unauthorized debits, incorrect amount, payment on a date earlier than authorized, or if the customer revoked authorization. Other types of returns happen too (NSF, account closed, etc., which aren’t disputes per se). As a business, if a customer legitimately needs a refund (say they overpaid or you need to return their money), you usually should not “ACH debit/credit back” to refund through the network (there is a way to do ACH credits out, but many businesses simply issue refunds via check or ask the processor if they support ACH refunds).

Some payment processors do allow you to issue an ACH credit to the customer’s account as a refund if needed. Always communicate with customers if there’s an issue to prevent them from feeling the need to dispute through the bank. In summary: yes, ACH debits can be disputed and reversed, but the process and timelines differ from credit card chargebacks, and there’s generally less fraud-motivated dispute activity on ACH.

Q: Is ACH only for U.S. transactions? What if I have international clients?

A: ACH is fundamentally a U.S. network (managed by NACHA for U.S. banks). It can also reach certain U.S. territories. If you have international clients or need to accept payments from non-U.S. accounts, ACH won’t work for that. Instead, you’d likely use a wire transfer or an international payment system.

There is something called International ACH Transaction (IAT) which is a standard for cross-border payments that get converted to ACH, but those are usually handled by banks and are more complex. In practice, for international customers, you may have them pay by wire transfer (SWIFT), or by credit card, or use other services like TransferWise/Wise, etc., which convert and route through local networks.

Keep in mind also that same-day ACH does not apply to international (IAT) payments – same-day is only for domestic U.S. payments. If you operate globally, it might be worth setting up multiple options: ACH for U.S. folks, and something else for international. But for U.S.-based transactions and accounts, ACH is an excellent solution.

Conclusion

Accepting ACH payments from customers is a smart move for businesses of all sizes and industries. By following this step-by-step guide, you can implement a secure and efficient ACH payment process that complements your other payment methods. To recap:

- ACH is an electronic bank-to-bank transfer system that offers low fees and reliable recurring payment capabilities. It’s widely used and governed by strict rules to protect all parties.

- By setting up the right accounts and choosing a capable ACH processor, you can quickly enable ACH payments for your invoices, online checkout, or point-of-sale systems. Remember to obtain proper authorization from customers, as this is key to compliance and trust.

- When compared to credit cards and wire transfers, ACH stands out for its cost-effectiveness and ease of use for domestic payments. Many businesses find that adding ACH reduces payment processing costs and improves cash flow, especially for large or repeat transactions.

- U.S.-based solutions are plentiful – from banks to fintech platforms – so you can find one that fits your technical needs and budget. Integrating ACH might be as simple as toggling an option in your invoicing software or as involved as using an API for a custom application.

- Across industries, ACH payments help streamline operations: less time chasing checks, fewer fees eating into margins, and more predictable revenue through recurring billing.

- Be sure to educate your customers about this option, addressing any concerns and highlighting the convenience. Over time, you may see more customers opting for ACH once they realize it’s just as easy as writing a check or entering a card (and often more secure).

In conclusion, implementing ACH payments is an investment in your business’s efficiency and customer experience. With the knowledge from this guide, you can confidently offer ACH as a payment option, knowing you’re using a modern payment method that keeps costs low and payments flowing smoothly. Embrace the change – both your bottom line and your customers may thank you for it, as ACH continues to grow as a backbone of electronic payments in the U.S.

Leave a Reply