By Rinki Pandey October 21, 2025

Same-Day ACH is a faster version of the Automated Clearing House (ACH) system that lets U.S. businesses and consumers move money within the same business day instead of waiting the traditional one to three days.

It uses the same nationwide ACH Network—governed by Nacha and operated by the Federal Reserve and The Clearing House—but adds multiple intra-day processing windows, later cut-offs, and specific funds-availability rules so eligible credits and debits can clear and settle the same day.

This guide explains, in plain English, what Same-Day ACH is, how the rails actually work behind the scenes, which transactions qualify, what limits and timelines apply today, and how to use it safely for payroll, B2B supplier payments, insurance disbursements, bill pay, and more.

We’ll also compare Same-Day ACH to Real-Time Payments (RTP) and the FedNow® Service so you can pick the right rail by speed, cost, risk, and use case.

The Basics: What Is Same-Day ACH?

Same-Day ACH is an enhancement to the U.S. ACH Network that enables eligible ACH credit and debit entries to be processed and settled on the same business day—rather than overnight or next-day.

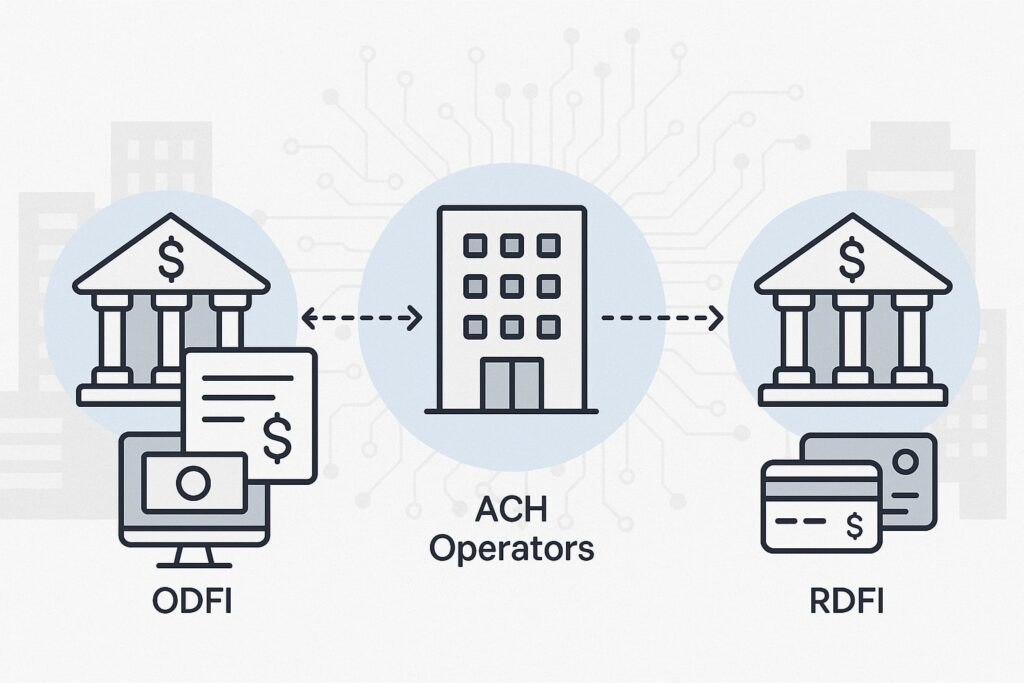

Technically, it’s still batch clearing: originators (businesses, billers, payroll providers, platforms) submit ACH files to their Originating Depository Financial Institution (ODFI). Those files go to an ACH Operator (the Federal Reserve or The Clearing House) for sorting and delivery to Receiving Depository Financial Institutions (RDFIs).

With Same-Day ACH, Nacha’s rules add multiple intra-day submission deadlines and settlement windows; RDFIs must make funds available according to accelerated timelines for qualifying entries.

This matters because it compresses cash-flow cycles, reduces late fees, and speeds up payouts—without changing account/routing numbers or onboarding new rails.

From a rules perspective, the Same-Day program launched in phases and has been expanded several times: in March 2021 Nacha added a later processing window (effectively extending same-day access for West-coast users), and in March 2022 Nacha raised the per-payment limit to $1,000,000 for eligible Same-Day ACH transactions.

Those updates significantly expanded the use cases—from payroll and bill pay to mid-market/enterprise B2B and treasury movements—because higher-value items could now ride the same-day rail.

How ACH Rails Work Under the Hood (ODFI, RDFI, and the Operators)

To understand “how Same-Day ACH works,” it helps to picture the standard ACH flow and then overlay the same-day elements. The originator (for example, a utility, marketplace, or employer) sends a formatted ACH batch to its ODFI.

The ODFI forwards that file to an ACH Operator—either the Federal Reserve’s FedACH or The Clearing House—where the entries are sorted and routed to each recipient’s RDFI. The RDFI posts incoming credits or debits to the receiver’s account.

Same-Day ACH keeps this choreography but uses earlier distribution and later intra-day distribution windows so that settlement and posting occur the same business day.

In every case, the ODFI warrants compliance with Nacha rules, and the RDFI honors the posting and funds-availability obligations for eligible entries.

Behind the scenes, the Operators handle timing, settlement, and reporting—distributing advice and settlement totals that banks reconcile against their books.

The Federal Reserve publishes practical guidance on the third processing window and related settlement codes so institutions can align core processing and treasury operations—useful context that explains why same-day items can appear in multiple intraday reports.

Today’s Cut-Offs, Windows, and Funds Availability

Same-Day ACH hinges on timing. Nacha defines multiple daily submission deadlines and corresponding settlement times. Importantly, Same-Day ACH now includes a later afternoon window (effective March 19, 2021), which extended access by roughly two hours—especially helpful for Pacific Time businesses.

In practice, ODFIs submit by specific cut-offs; Operators distribute entries; RDFIs must make same-day credits available by the mandated times on the same banking day. Because the ACH Network is a business-day rail, weekends and federal holidays still defer settlement to the next banking day.

While each bank’s front-end product may present different “send-by” times, Nacha’s official schedule and funds-availability chart is the authoritative source for operational timing.

If you’re designing flows or treasury ops around Same-Day ACH, always map your internal cut-offs to Nacha’s schedule—and remember that RDFIs have specific obligations for same-day credits, whereas debits follow separate authorization, return, and posting rules.

For current, bank-facing details on settlement and reporting for the late window, the Federal Reserve’s FedACH guidance remains a practical reference.

Dollar Limits, Eligibility, and What You Can (and Can’t) Send

As of today, the maximum per-payment amount for Same-Day ACH is $1,000,000—a limit that applies to both credits and debits for consumer and business entries, where otherwise permitted by the rules.

That higher cap, effective March 18, 2022, unlocked large disbursements (e.g., insurance claims, supplier payments, M&A escrow releases) and higher-value B2B settlements that previously needed wires or slower ACH.

However, not every ACH entry type is eligible for same-day processing, and some categories (for example, international IAT entries) follow different rules. Always confirm your bank’s risk policy, because ODFIs can add guardrails on top of Nacha’s baseline.

Separately, Nacha continues to update operating rules across the network—such as Micro-Entry formatting/monitoring and web-debit account validation requirements—to strengthen fraud controls and data quality.

Those enhancements apply to standard and Same-Day ACH alike, and they affect onboarding, authorization, and verification flows for consumer-initiated debits.

If you’re enabling Same-Day ACH for online checkout, subscription billing, or P2P-style business payments, align your implementation with the current Nacha Operating Rules and your ODFI’s underwriting.

Same-Day ACH vs. Standard ACH (Speed, Cost, Risk)

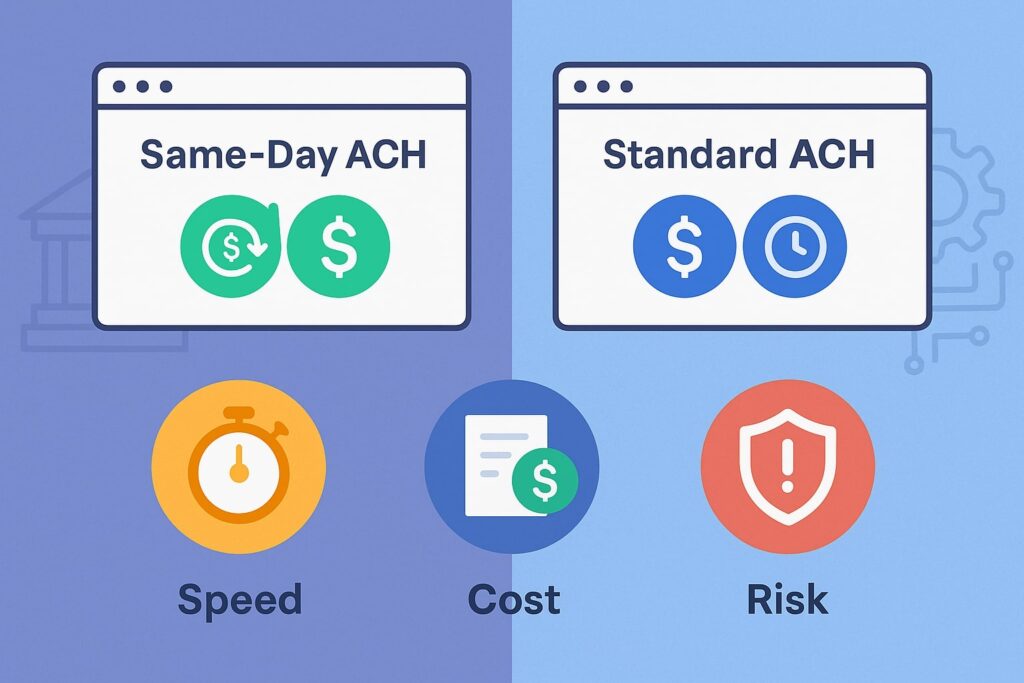

Standard ACH is typically next-day or two-day, depending on your ODFI’s product and the files’ submission times. Same-Day ACH compresses this to the same business day for eligible items, but both remain batch rails with settlement tied to defined distribution windows.

Costs are usually higher for Same-Day entries (your bank or processor may charge a premium per transaction) compared with standard ACH but remain well below typical wire fees.

Operationally, Same-Day is great for time-sensitive but not truly instant needs—think payroll corrections, vendor payments due today, or expedited refunds—especially when wire speed is overkill.

Risk management differs mainly in timing and returns. Returns (like NSF or unauthorized) still follow ACH return codes and windows (e.g., R01/R10), and RDFIs can post returns after settlement. That means Same-Day ACH accelerates funds availability but doesn’t eliminate return risk the way an irrevocable rail would.

Build your risk playbook accordingly: incorporate account validation, negative-file checks, thresholds, and velocity controls; reconcile intraday postings; and monitor late-window exposure as settlement approaches. Your ODFI’s Treasury team and Nacha guidance will be your best operational allies.

Same-Day ACH vs. RTP® and FedNow® (What to Use When)

Same-Day ACH is fast, but it’s not instant. The RTP network (from The Clearing House) and the FedNow Service (from the Federal Reserve) are real-time payment rails: they clear and settle individually, 24x7x365, with immediate funds availability and finality (subject to each rail’s risk controls).

By contrast, Same-Day ACH clears in batches and settles on business days. If you need irrevocable, around-the-clock payments—like just-in-time supplier funding, instant payroll earned wage access, or after-hours emergency disbursements—RTP or FedNow may be a better fit.

If you need broad reach, NACHA familiarity, remittance flexibility, and cost control for high-volume back-office flows, Same-Day ACH shines.

Two more nuances: (1) network reach and adoption, and (2) limits. FedNow launched in July 2023 and continues to add participating institutions—crossing 1,300+ banks and credit unions by Q1 2025—while RTP has deep penetration among larger banks and an expanding set of mid-market institutions.

RTP’s credit-push limit is around $1 million at network level, while FedNow’s default network limit has been published as lower (banks often set their own product limits below these). Both instant rails require bank enablement; Same-Day ACH benefits from ACH’s near-universal reach.

Where Same-Day ACH Excels: Practical Use Cases

- Payroll and off-cycle adjustments: Missed a pay run? Same-Day ACH lets you correct net pay the same business day without resorting to wires.

Just confirm your ODFI’s same-day cut-off and verify employee account details to avoid returns. For recurring payroll, many employers still prefer standard ACH for cost reasons and reserve same-day for exceptions. - B2B supplier payments and cash-flow timing: With the $1,000,000 cap, mid-market and enterprise accounts payable teams can settle invoices due today and capture early-pay discounts without wire fees.

Rich ACH addenda (CTX/CCD with addenda records) carry remittance data that helps straight-through reconciliation on the supplier side. - Insurance, lending, and marketplace payouts: Same-Day ACH is a strong fit for claim settlements, loan disbursements, and marketplace seller payouts when recipients expect money today but not necessarily this instant.

Combined with pre-funding and cutoff discipline, you can meet SLAs while managing cost and return risk. - Consumer refunds and bill-pay corrections: Utilities and billers use Same-Day ACH to reverse misapplied amounts or issue expedited refunds that land the same day, improving CX and reducing call center load. Pair with account validation and clear notifications to head off disputes.

Growth and Adoption: What the Latest Numbers Show

Same-Day ACH is no longer niche. In 2024, the ACH Network crossed a major milestone with more than 1.2 billion Same-Day ACH payments, totaling $3.2 trillion, and year-over-year volume growth above 45%—outpacing the rest of ACH.

Early 2025 data showed continued gains in both standard and same-day volumes and values, confirming that faster ACH has moved into mainstream treasury operations. For product managers, CFOs, and controllers, that translates to broader bank support, clearer pricing, and more robust operational tooling.

Those growth curves came after Nacha expanded the late-day window (2021) and raised the dollar cap (2022). Together, timing and limit improvements materially increased addressable use cases across payroll, AP/AR, and disbursements—evidenced by escalating adoption among corporates and fintech platforms.

Keep watching Nacha’s “New Rules” page for incremental risk and data-quality updates (e.g., micro-entries, validation) that improve network integrity without slowing down same-day speed.

Step-by-Step: How to Send a Same-Day ACH Payment

- Confirm eligibility and limits: Verify that your payment type (CCD/PPD/CTX/etc.) is eligible and within the current $1,000,000 per-payment cap. Check any lower limits your bank/processor imposes.

- Validate account and authorization: For credits, collect the correct routing and account number and ensure you have a valid authorization record. For debits (WEB, TEL, PPD), follow Nacha’s authorization and account-validation rules. This reduces returns and fraud exposure.

- Meet your bank’s cut-off: Align your internal “send-by” time with Nacha’s same-day windows and your ODFI’s earlier internal deadlines. Remember: no weekends/holidays. Late submissions fall to next-day.

- Use same-day indicators: Mark the entries for same-day processing in your file (your processor/bank will expose a flag or service code) so the Operator and RDFI treat them as Same-Day ACH. Reconcile the settlement reports and fees accordingly.

- Monitor returns and exceptions: Even with same-day credits, returns can arrive later. Keep an eye on R01 (NSF), R02 (account closed), R03/R04 (no account), and R10 (unauthorized) and adjust risk thresholds.

Same-Day ACH Security, Compliance, and Risk Controls

Same-Day ACH doesn’t change your compliance obligations—it compresses timelines. That means your risk stack has to keep pace:

(a) account validation (including micro-deposits, third-party verification, or bank-sponsored services), (b) velocity and amount thresholds, (c) manual review for anomalies near cutoff, (d) NOC handling (notifications of change), and (e) segregation of duties in treasury operations.

Apply principle-of-least-privilege access and require dual approval for high-value same-day files. Nacha’s ongoing rule enhancements reinforce these expectations across standard and same-day traffic.

Operationally, rehearse late-day incident playbooks. Because the late window settles the same afternoon, operational issues (e.g., wrong effective date or batch field) can cascade quickly.

The Federal Reserve’s settlement tips highlight the importance of accurate transaction coding and reconciliation for the third window, which your core and reporting tools must support.

Pricing and Treasury Strategy: When Same-Day ACH Is Worth the Premium

Most banks charge more for Same-Day ACH than for standard ACH—but still much less than a wire. For CFOs, the calculus is total cost of capital plus operational risk.

If Same-Day ACH helps you avoid late fees, capture early-pay discounts, accelerate collections, or improve seller/employee satisfaction, the premium often pays for itself. Consider a mixed strategy:

- Default to standard ACH for routine payroll and AP runs with predictable due dates.

- Upgrade to same-day for exceptions, escalations, refunds, and SLAs that require “funds today.”

- Use wires only when you need immediate finality across institutions and can justify the higher fee—or pivot to RTP/FedNow for always-on, irrevocable transfers where both parties are enabled.

Implementation Tips for U.S. Businesses and Platforms

- Map your cut-offs: Publish internal “send-by” times back-from your ODFI’s deadlines to avoid missing the late window. Include holiday calendars.

- Instrument your risk checks: Make account validation mandatory for first-time recipients and higher-value payments; step-up review on velocity spikes. Align with Nacha’s current rules to reduce returns and disputes.

- Design for reconciliation: Ensure your ERP or treasury system captures same-day fees, settlement postings, and return codes in near-real-time. Use CTX/CCD addenda for clean supplier reconciliation.

- Offer the right rail: In product UIs, give users a clear choice: Standard ACH (lower cost), Same-Day ACH (funds today, business hours), or Instant (RTP/FedNow, 24×7). Explain costs and delivery expectations plainly.

Common Myths and Realities About Same-Day ACH

“Same-Day ACH is 24/7” Not true. It runs on business days with defined intra-day windows. Nights, weekends, and federal holidays push settlement to the next banking day. Real-time rails handle 24×7.

“Same-Day ACH funds are final” Also not true. ACH entries—even same-day—are subject to returns within specified windows. Plan liquidity and risk accordingly.

“It’s only for small payments.” No longer. The per-payment cap is $1,000,000 as of March 18, 2022, which supports many enterprise use cases.

“Everyone’s cut-off is the same.” Your bank or processor may impose earlier internal cut-offs. Always check your service-level exhibit against Nacha’s timetable.

Same-Day ACH in 2025: The State of Play and What’s Next

The data tell a clear story: 2024 was a breakout year, with 1.2+ billion Same-Day ACH payments and $3.2T in value, and momentum continued into early 2025.

At the same time, real-time rails are expanding: FedNow reports 1,300+ participating institutions and growing quarter-over-quarter, while RTP continues to scale among larger banks and corporates.

For most U.S. businesses, the optimal approach is multi-rail: standard ACH for routine, Same-Day ACH for “funds today,” and instant rails for after-hours or irrevocable flows. Expect continued Nacha rule refinements around fraud mitigation, data quality, and potentially more operational guidance as adoption deepens.

FAQs

Q1) Are funds truly available the same day?

Answer: For qualifying credits, RDFIs must make funds available by the rule-specified time on the same banking day. Debits follow separate posting and return rules; availability depends on authorization, account status, and RDFI policy.

Q2) Do weekends and holidays count?

Answer: No. Same-Day ACH operates on business days. Entries submitted on weekends/holidays settle the next banking day. For 24×7 needs, consider RTP or FedNow.

Q3) Is Same-Day ACH instant or irrevocable?

Answer: No. It’s faster batch processing with same-day settlement windows. Returns are still possible within Nacha timeframes. For irrevocable, immediate settlement, use RTP or FedNow (if both banks are enabled).

Q4) Which entries are eligible?

Answer: Most domestic credit and debit entries are eligible, subject to Nacha rules and ODFI risk policy. International IATs and some other categories have different treatment. Confirm eligibility with your ODFI.

Q5) Why would I pick Same-Day ACH over a wire?

Answer: Cost and reach. Same-Day ACH is cheaper, widely supported, and adequate when “funds today” (business hours) is enough. Use wires or instant rails when you need finality or 24×7 availability.

Q6) How fast is Same-Day ACH growing?

Answer: In 2024, Same-Day ACH surpassed 1.2B payments totaling $3.2T, with volume up ~45% year over year. Early 2025 data show continued growth.

Conclusion

Same-Day ACH gives U.S. businesses a practical “funds today” option on the ubiquitous ACH Network. With later afternoon windows and a $1,000,000 per-payment limit, it’s ideal for payroll exceptions, urgent supplier invoices, and fast refunds—without the cost of wires or the enablement hurdles of instant rails.

But success is operational: align to Nacha’s schedule, respect bank cut-offs, validate accounts, monitor returns, and reconcile intraday. Pair Same-Day ACH with standard ACH and, where appropriate, RTP or FedNow to cover every timing scenario—routine, same-day, and 24×7 real-time.

If you anchor your treasury and product workflows to the current rules and windows, Same-Day ACH can materially improve cash flow and customer experience while keeping payment costs in check.

Leave a Reply