By Rinki Pandey October 21, 2025

Setting up ACH payments for your small business can dramatically reduce costs, speed up cash flow, and give customers a convenient, professional way to pay from any U.S. bank account.

This step-by-step guide explains what ACH is, how ACH debits and ACH credits actually move through the U.S. banking system, what you must do to stay compliant with Nacha rules, and the practical choices you’ll face when selecting an ACH payment processor or bank partner.

You’ll learn about pricing, risk controls, authorization requirements, account verification methods, return codes, and how to integrate ACH into invoicing, ecommerce, subscriptions, and B2B workflows.

Everything here is written for U.S. businesses and reflects current terminology used across banks, gateways, and processors so you can set up ACH payments confidently and correctly.

What Are ACH Payments and Why They Matter for Small Businesses

Automated Clearing House (ACH) is the U.S. network that moves money electronically between bank accounts—typically within one to three business days and often the same day using Same Day ACH.

ACH payments come in two main flavors: ACH debit, where you “pull” funds from a customer who has authorized you to do so, and ACH credit, where your customer “pushes” funds to you through their bank bill pay or your gateway.

Because ACH runs on a batch system rather than card networks, the per-payment cost is typically far lower than credit cards. That makes ACH payments ideal for higher-ticket invoices, monthly retainers, rent, tuition, B2B payables, and subscription renewals.

For small businesses, ACH payments reduce paper checks, eliminate trips to the bank, and align neatly with accounting tools, providing cleaner reconciliation and better cash forecasting.

Importantly, ACH is widely supported by U.S. banks and credit unions, so your customers don’t need a card—just a routing and account number—and you can accept payments from virtually any U.S. checking or savings account.

When implemented with proper authorization and verification, ACH payments can be highly reliable and secure, while still offering consumer protections for unauthorized transactions. In short, ACH payments give small businesses an affordable, professional, and scalable way to get paid on time.

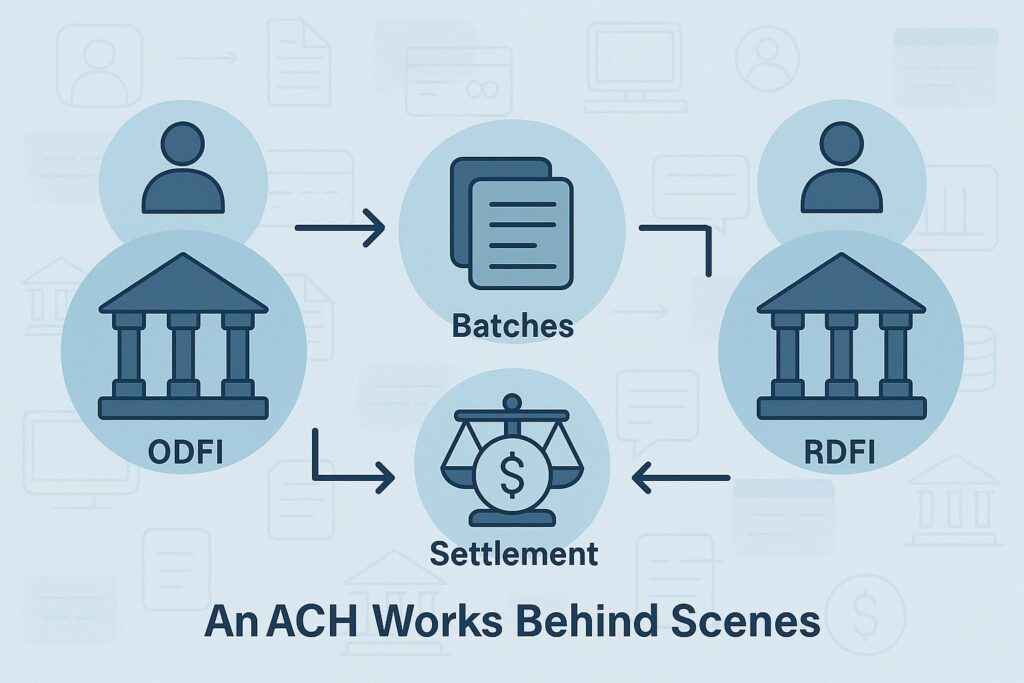

How ACH Works Behind the Scenes (ODFI, RDFI, Batches, and Settlement)

To set up ACH payments intelligently, it helps to understand the behind-the-scenes plumbing. When you initiate an ACH debit or credit, your payment processor (or your bank) acts as the Originating Depository Financial Institution (ODFI).

Your customer’s bank is the Receiving Depository Financial Institution (RDFI). You, the business, are the Originator. ACH entries are packaged into batches and transmitted through the ACH operator for clearing and settlement, typically the Federal Reserve’s FedACH or The Clearing House’s Electronic Payments Network.

Settlement windows occur multiple times during the business day. Standard ACH typically settles in one to three business days; Same Day ACH allows same-day settlement if you submit before published deadlines and pay a modest premium.

ACH entries are labeled by SEC codes that define the use case and authorization method—PPD for consumer debits, CCD for corporate debits/credits, WEB for ecommerce debits, TEL for phone-initiated transactions, and ARC/BOC/POP for check conversion, among others.

Understanding SEC codes matters because it affects how you collect authorization, how long you must retain it, and how returns are handled.

If an ACH is returned, a standardized return code—like R01 (insufficient funds), R03 (no account/unable to locate), R08 (stop payment), or R10 (unauthorized)—tells you what went wrong and what to do next.

Knowing these mechanics helps you configure the right risk thresholds, funding timelines, and customer communications to keep your ACH payments running smoothly and predictably.

Requirements to Accept ACH Payments (Bank Account, Processor, and Compliance)

Every small business that wants to accept ACH payments needs three essentials: a U.S. business bank account, an ACH-capable payment processor or bank treasury service, and a compliant process for collecting and storing payer authorization.

Your bank account receives settled ACH funds. Your processor or bank originates ACH entries on your behalf, manages batching and settlement, and provides tools like account verification, NACHA-compliant authorization templates, and a gateway or API.

During onboarding, expect “know your business” checks (KYB), including business legal name, EIN, ownership details, expected ACH volumes, average ticket, highest ticket, and industry. Processors evaluate risk because ACH debits can be returned or disputed.

You’ll be asked to follow Nacha rules for authorization, record retention, and transaction formatting. If you run ecommerce or phone payments, you must use the correct SEC code (WEB or TEL) and implement required controls like fraud screening, dynamic verification, and explicit authorization language.

For B2B payments, CCD entries usually require a straightforward written authorization from the other business. It’s best practice to store authorizations securely for at least two years after termination, and many processors recommend longer retention to cover audit needs.

Finally, if you plan to debit consumer accounts, build a clear process for handling notices of change (NOCs), returns, and reversals, so you can respond quickly and reduce repeat errors. With these requirements in place, your small business can implement ACH payments the right way from day one.

Step-by-Step: How to Set Up ACH Payments for Your Small Business

The practical setup process starts with selecting an ACH partner. Compare an ACH-focused payment gateway, a full-service processor, or your bank’s treasury platform.

Look for key features: online invoicing with ACH pay links, saved bank accounts with tokenization, instant bank verification (micro-deposits and instant account verification via secure bank login), Same Day ACH, robust reporting, return code handling, and developer-friendly APIs if you plan to integrate.

Next, complete underwriting. Provide your business documents, answer volume and ticket-size questions, and describe your billing model. After approval, configure your bank account for deposits and any reserve or funding delay your provider requires.

Then set up payer authorization flows. For WEB debits, build a checkout or payment page that captures routing and account numbers, owner name, account type, and an explicit authorization statement including timing, amount (or variable billing terms), frequency, cancellation method, and your contact details.

For recurring payments, disclose schedule, amount changes, and how the customer can revoke authorization. Add bank account verification: choose micro-deposits (two small credits with a verification step), instant account verification (IAV) through a secure link, or account-owner name matching to reduce returns.

Before going live, run test transactions in sandbox if available, then process a small live payment to confirm settlement, reporting, and webhooks.

Finally, train your team to read ACH reports, respond to return codes, and handle customer inquiries. With this step-by-step plan, your ACH payments program will be production-ready and aligned with U.S. best practices.

ACH Authorization Methods and SEC Codes You Should Know

Authorization is the backbone of compliant ACH payments. The SEC code defines how authorization must be captured and stored. For consumer ecommerce, WEB debits require a clearly displayed authorization with terms, payer identity, date/time, and a method for the consumer to obtain a copy.

You should also use commercially reasonable fraud screening such as velocity checks, IP/device risk signals, and account verification. TEL entries (telephone) require recorded verbal authorization or a written confirmation sent after the call, plus procedures to authenticate the caller.

PPD is used for recurring or single consumer payments authorized in writing—common for service contracts, memberships, and rent. CCD is designed for B2B payments and requires a written authorization from the corporate customer; because it’s business-to-business, the return windows differ.

For in-person check conversion flows like ARC/BOC/POP, the check image and notice language must be handled precisely; many small businesses have moved away from these in favor of pure ACH through online invoicing.

Whatever the code, store authorizations securely and make them retrievable for at least two years after the relationship ends. Include revocation instructions so customers can cancel future debits, and document how you handle amount changes in variable billing.

By aligning your ACH payments with the right SEC code and authorization method, you minimize unauthorized returns and create a smooth, compliant payment experience.

Bank Account Verification Options (Micro-Deposits, Instant Verification, and Name Match)

Before you debit a new customer through ACH payments, verify the account to reduce returns and fraud. Micro-deposits are the classic method: your system sends two small credits—often under $1—then the payer confirms the amounts.

It’s inexpensive and familiar, but it adds a day or two for verification. Instant account verification (IAV) lets customers authenticate directly with their bank through a secure connection and share account details safely, often in seconds.

IAV greatly reduces drop-off and speeds first-payment collection, especially for ecommerce and subscriptions. Some processors also offer account-owner name matching or negative database checks to catch typos and closed accounts.

For business customers, require a voided check or bank letter to confirm routing and account details, and ensure you’re collecting the correct account type (checking vs. savings).

Combine verification with velocity controls—for example, cap first-day amounts or require an initial small payment before higher-ticket debits. The right combination of micro-deposits, IAV, and name matching boosts acceptance, cuts R01/R03 returns, and keeps your ACH payments program stable as you scale.

Pricing for ACH Payments (Fees, Same Day ACH, Returns, and Funding Times)

One reason small businesses adopt ACH payments is cost. Instead of card interchange plus assessments, ACH pricing is usually a flat per-item fee—often well under a dollar per transaction—sometimes with a small percentage add-on for higher-risk categories.

Expect a monthly gateway or platform fee if you need invoicing, customer vaults, and reporting. Same Day ACH usually carries an additional per-item fee, but it can be worth it for faster cash flow and happier customers.

Ask about return fees for R01/R03 and chargeback-style fees for unauthorized consumer returns (R10/R11). Funding timelines vary by provider and risk profile: many processors offer T+2 for standard ACH and T+0/T+1 for Same Day ACH, while newer merchants or higher-risk models may see a rolling reserve or a longer delay.

Clarify whether fees are netted from deposits or billed monthly, and review monthly statements so you can reconcile fees against your accounting system.

Finally, negotiate volume tiers if you expect ACH payments to become your primary channel; processors often reduce per-item costs as your volumes grow, making ACH an even more attractive option compared to cards and wires.

Risk Management and Handling Returns (R-Codes, Disputes, and Best Practices)

Because ACH payments are pull-based for debits, returns can happen. Learn the top return codes and how to respond. R01 (insufficient funds) suggests retrying once or twice with customer consent or using a smart retry schedule aligned to payday cycles.

R03 (no account/unable to locate) usually indicates a routing or account number error—verify details before attempting again. R08 (stop payment) means the customer blocked that specific debit; reach out to resolve the dispute before any future billing.

R10/R11 (consumer claims unauthorized) are serious—refund promptly if appropriate, stop further debits, and review your authorization record. Keep your unauthorized return rate comfortably under Nacha thresholds by using solid authorization language, account verification, and clear cancellation and support channels.

Monitor your return ratio weekly, and implement velocity and amount caps for first-time payments. For subscriptions, send upcoming debit reminders with the amount and date; proactive communication reduces surprise disputes.

If you receive a Notice of Change (NOC), update routing or account data promptly to avoid future returns. With disciplined controls, your ACH payments will maintain low return rates, stable funding, and strong processor relationships.

Compliance and Security (Nacha Rules, Reg E, OFAC, and Data Protection)

ACH payments in the U.S. operate under Nacha Operating Rules and, for consumer accounts, intersect with Regulation E for electronic fund transfers. Your small business must collect and retain proper authorization, use the correct SEC code, and protect sensitive bank data.

Tokenize bank accounts in your gateway so your systems never store raw routing and account numbers. Use TLS for all payment pages, and restrict access to payment data internally on a need-to-know basis.

Screen payers against OFAC sanctions where appropriate, and avoid initiating entries that violate sanctions or prohibited transactions. If you handle recurring consumer debits, provide clear revocation instructions and honor cancellations quickly.

Keep audit trails of authorizations, verification steps, timestamps, IP addresses for WEB entries, and any changes to billing schedules. Publish a straightforward refund and dispute policy on your site and include it in authorization language.

For accessibility and fairness, ensure your payment pages are usable on mobile and include support contacts. A compliance-first approach protects your customers, keeps your return rates low, and ensures your ACH payments program can scale without regulatory headaches.

Same Day ACH, FedNow, and Wires: Choosing the Right Rail

ACH payments now include Same Day ACH windows that enable settlement on the same business day for eligible entries. Same Day ACH is ideal when you need faster confirmation than standard ACH, but at a lower cost than wires.

FedNow and RTP (Real-Time Payments) are instant payment rails that move funds within seconds, 24/7/365, but they require both banks to support the rail and may not yet be available to all small businesses or use cases.

Wires deliver guaranteed, immediate finality but are expensive and not reversible, making them best for very high-value, time-sensitive transactions. For most U.S. small businesses, ACH payments remain the everyday workhorse for invoices, subscriptions, and B2B payables, with Same Day ACH covering urgent scenarios.

Consider offering multiple rails: ACH for routine billing, Same Day ACH for expedited settlements, and wires or instant payments for large, time-critical transfers. By matching each payment to the appropriate rail, you optimize speed, cost, and customer experience.

Integrating ACH with Invoicing, Ecommerce, and Subscriptions

To get the most from ACH payments, embed them directly where your customers pay. For invoicing, add a “Pay by Bank (ACH)” button to emailed invoices and customer portals, enabling customers to enter their bank details or use IAV to connect securely.

Include the invoice number, memo fields, and customer reference so your accounting system can auto-match deposits. In ecommerce checkouts, list ACH alongside cards and wallets; highlight the lower fees or offer a small discount for ACH to encourage adoption.

For subscriptions and memberships, let customers save a bank account on file with clear recurring authorization terms, next-debit reminders, and self-service cancellation. Developers can use gateway APIs and webhooks to capture authorization artifacts, store tokens, and receive settlement and return notifications in real time.

Non-technical teams can use no-code invoice builders and payment links that your processor provides. In every flow, add account verification, IP/device risk checks, and clear consent language.

When ACH payments are built into your invoicing, checkout, and renewal journeys, your business reduces costs and your customers enjoy a familiar, bank-centric way to pay.

Reconciliation and Accounting (Cash Application and Reporting)

Accurate reconciliation makes ACH payments painless for your finance team. Enable rich remittance data in your payment links and invoices so the ACH entry includes references your accounting system can read—invoice number, customer ID, and memo fields when available.

Many gateways support automatic payment notifications and deposit summaries that break out fees, returns, and fund dates. Set a daily routine: post settled batches, match returns to original invoices, and process NOCs promptly.

If you use accounting software like QuickBooks or Xero, connect your payment processor’s integration to sync paid invoices and customer records automatically.

For B2B payments, consider CCD+ or addenda records that carry structured remittance data, enabling near-automatic cash application. Align your bank statement’s ACH deposits to processor funding reports so you can track net vs. gross and allocate fees accurately.

With clean reconciliation, you’ll spot anomalies fast, keep your books current, and trust your cash forecasts—turning ACH payments into a smooth back-office engine rather than an accounting chore.

Industry Use Cases and Practical Tips (B2B, Professional Services, Property, Healthcare, Education)

ACH payments shine in real-world U.S. scenarios. B2B wholesalers and SaaS vendors use ACH for invoices and seat-based subscriptions, bringing down acceptance costs while improving on-time payment with saved bank accounts.

Professional services—agencies, accountants, and consultants—set up recurring retainers via PPD/WEB authorizations and send automated debit reminders. Property managers and HOAs rely on ACH for rent and dues, using recurring schedules and grace-period rules.

Clinics and dental practices can accept ACH for higher-ticket bills, pairing IAV and clear consent language to limit disputes. Education and childcare providers use ACH for tuition and after-school programs, where predictable monthly debits are simpler than cards that expire.

Across all these industries, practical tips repeat: collect strong authorizations, verify new accounts, send reminders before debits, monitor return ratios weekly, and make cancellation easy. When you build consistent, transparent ACH payments processes, customers trust the method and your collections become timely and predictable.

Troubleshooting Common ACH Problems (Failures, Delays, and Customer Confusion)

Even a well-designed ACH program will occasionally hit snags. If a payment fails immediately, validate the routing number format (nine digits with a correct checksum) and account number length expected by the bank.

For recurring debits that return R01, implement a smart retry rule and notify the customer so they can plan funds. If you see a spike in R03 “unable to locate account,” tighten verification and consider switching from manual entry to IAV for new payers.

Delayed funding often ties back to processor risk holds or holidays; review submission cut-offs, Same Day windows, and bank holidays that pause settlement. If customers claim “I didn’t authorize this,” retrieve the exact authorization they agreed to, share it promptly, and pause future debits until resolved.

For businesses receiving NOCs, update account details quickly to prevent subsequent returns. Finally, educate frontline staff to recognize return codes and escalate disputes early; quick, informed responses turn potential churn into recovered payments and improved processes.

Checklist: Launching ACH Payments the Right Way

Create a short, repeatable launch checklist so your team sets up ACH payments consistently. First, select a processor offering ACH debits and credits, Same Day ACH, account verification, and robust reporting.

Second, finalize authorization language tailored to your SEC codes (WEB, PPD, CCD, or TEL) and add it to checkout, invoices, and subscription flows. Third, choose verification methods—micro-deposits for non-urgent cases and IAV for instant onboarding—to minimize R01/R03 returns.

Fourth, configure risk controls: velocity caps for new accounts, per-day and per-transaction limits, and manual review for unusually large debits. Fifth, test end-to-end with a real payment, confirm settlement timing, and practice handling an intentional return so staff can follow the playbook.

Sixth, publish your refund, cancellation, and support policies prominently. Seventh, connect reporting to your accounting system and schedule daily reconciliation. Eighth, train staff on return codes, notices of change, and dispute responses.

With this checklist, your ACH payments program will be compliant, efficient, and customer-friendly from day one.

FAQs About ACH Payments for Small Businesses (U.S.)

Q.1: What information do I need from a customer to accept ACH?

Answer: You need their bank routing number, account number, account type (checking or savings), account holder name, and a clear authorization. For ecommerce (WEB), capture date/time, IP, and a consent checkbox with compliant language. Pair this with micro-deposits or instant account verification.

Q.2: How long do ACH payments take to settle?

Answer: Standard ACH settles in one to three business days depending on submission times and bank holidays. Same Day ACH can settle the same business day if sent before cutoff windows, with a small extra fee.

Q.3: Are ACH payments reversible?

Answer: Consumer ACH debits can be returned as unauthorized within defined windows, so keep solid authorization records. Business-to-business CCD entries have different return rights; make sure you use the correct SEC code and written authorization.

Q.4: What do ACH return codes mean?

Answer: Return codes indicate why a transaction failed—R01 insufficient funds, R03 no account/unable to locate, R08 stop payment, R10 unauthorized, and others. Your processor’s portal will show the code, so you can choose to retry, correct data, or contact the customer.

Q.5: How do fees compare to cards and wires?

Answer: ACH usually costs far less per transaction than credit cards and is dramatically cheaper than wires. Expect a flat per-item fee, optional Same Day surcharge, and fees for returns or unauthorized disputes.

Q.6: Can I use ACH for recurring subscriptions?

Answer: Yes. ACH is excellent for fixed or variable recurring payments. Clearly disclose the schedule and amount changes, send reminders, and give customers an easy way to cancel authorization.

Q.7: Is accepting ACH safe?

Answer: Yes, if you follow Nacha rules, collect proper authorization, verify accounts, secure data via tokenization and TLS, and monitor returns. Many U.S. businesses rely on ACH for mission-critical receivables.

Q.8: What if a customer’s bank details change?

Answer: You may receive a Notice of Change (NOC). Update your records promptly and confirm with the customer. Using IAV for updates can prevent future errors.

Q.9: Can I offer discounts for ACH?

Answer: Many businesses encourage ACH by offering a small discount or waiving convenience fees because ACH fees are lower than card fees. Be transparent about pricing so customers understand their options.

Q.10: Do I need a special bank account?

Answer: A standard U.S. business checking account is usually sufficient. Your processor or bank will deposit ACH settlements there and may establish reserves depending on your risk profile and volume.

Conclusion

ACH payments give U.S. small businesses a powerful combination of low cost, broad bank coverage, and flexible billing flows—from one-off invoices to recurring subscriptions.

When you set up ACH correctly—selecting the right processor, collecting strong authorizations, verifying accounts, enabling Same Day when useful, and training staff on returns—you unlock reliable, scalable cash flow at a fraction of card costs.

Pair ACH with clear customer communication, sensible risk controls, and tight reconciliation, and your back office runs smoother while your customers enjoy a familiar, bank-centric way to pay.

Start with the checklist, implement verification and authorization best practices, and make ACH payments a first-class option across every invoice, checkout, and renewal. Your small business will reduce friction, lower fees, and get paid on time—month after month.

Leave a Reply